Ripple Price Forecast: XRP eyes $2.65 as Ripple seeks US national banking license

- XRP continues its recovery after breaking the 100-day EMA hurdle amid market-wide bullish sentiment.

- Ripple applies for a national banking charter with the US OCC to advance compliant stablecoin and cross-border payments.

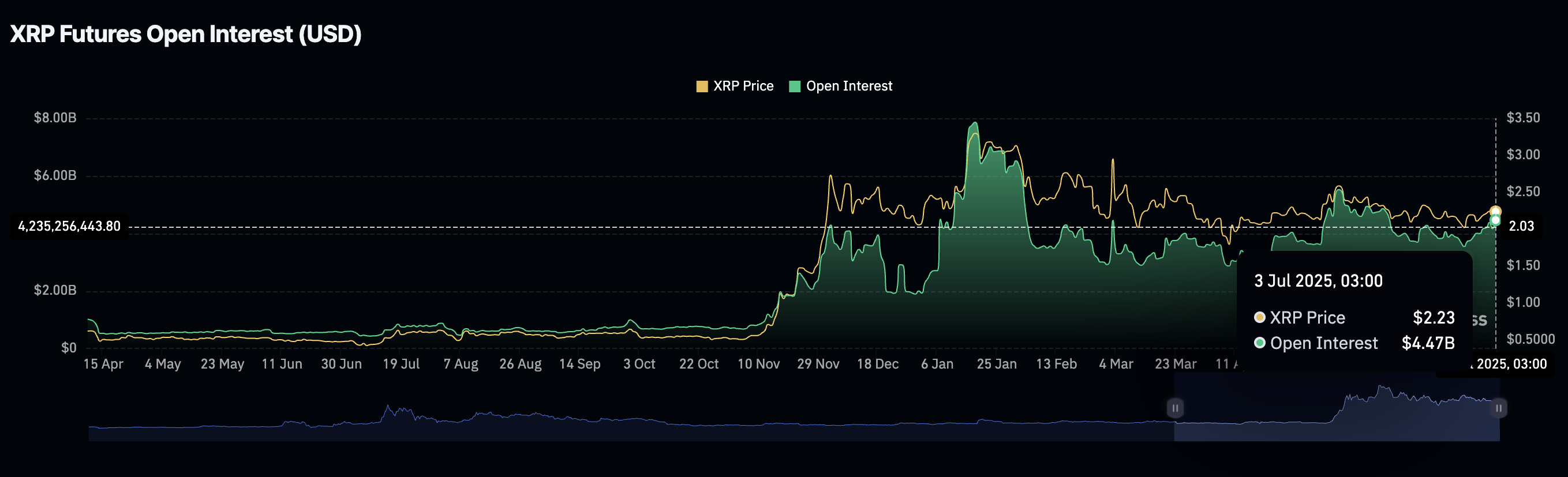

- Interest in XRP surges as Open Interest increases to $4.47 billion, alongside a rise in volume to $7.31 billion.

Ripple's (XRP) price regains momentum on Thursday, breaking above a key resistance hurdle to exchange hands at $2.29 at the time of writing. The cross-border money remittance token adopted for the Ripple Payments network is up over 2.5% on the day, reflecting positive sentiment in the broader cryptocurrency market.

Interest in XRP surged following the recovery from Wednesday's levels, which had largely been capped below resistance at $2.22. CoinGlass data highlights a significant jump in the cumulative Open Interest (OI), now standing at $4.47 billion, accompanied by a substantial increase in trading volume, up 93% to $7.31 billion.

XRP futures Open Interest data | Source: CoinGlass

Ripple applies for US national banking license

Ripple's CEO, Brad Garlinghouse, announced on Wednesday via X that the blockchain payments company had applied for a national bank charter from the United States (US) Office of the Comptroller of the Currency (OCC).

If approved, Ripple would be regulated both at the state level under the New York Department of Financial Services (NYDFS) and by federal oversight, setting a new and unique benchmark for trust in the market that is advancing quickly toward mass stablecoin adoption.

According to the Wall Street Journal (WSJ), Ripple joins other institutions seeking to bridge the gap between cryptocurrencies and mainstream finance. Ripple is the issuer of RLUSD, a US Dollar (USD) backed stablecoin valued at $469 million.

Ripple's interest in obtaining a national banking license comes a few days after the company applied for a Federal Reserve (Fed) Master account, which would allow it to hold RLUSD reserves directly with the Fed. Garlinghouse stated that this would mark a significant milestone in ensuring an additional layer of security and fostering trust in RLUSD.

"Ripple always has and will continue to build trusted, battle-tested and secure infrastructure. In a $250B+ market, RLUSD stands out for putting regulation first, setting the standard that institutions expect," Garlinghouse said in an X post.

Ripple's partnership with OpenPayd, announced on Monday, aims to expand cross-border transfers by integrating fiat currencies such as the Euro (EUR) and the Pound Sterling (GBP) with the support of Ripple Payments.

The collaboration underscores Ripple's intentional efforts to provide regulated, institutional-grade infrastructure with unique functionalities, including cross-border transfers, treasury management, and access to USD liquidity.

Technical Outlook: XRP uptrend anchored

XRP's price remains slightly above previous technical hurdles, as highlighted by the 50-day Exponential Moving Average (EMA) at $2.21 and the 100-day EMA at $2.22. The cross-border money transfer token appears technically predisposed to extend the uptrend above the descending trendline resistance, as shown on the daily chart below.

A buy signal from the Moving Average Convergence Divergence (MACD) indicator, maintained since Saturday, upholds the bullish outlook, encouraging traders to elevate their risk appetite.

XRP/USDT daily chart

The Relative Strength Index (RSI), which has advanced to 57 from lows around 35, suggests that buyers have the upper hand. XRP's uptrend could steady as the RSI moves toward overbought territory.

Still, traders should tread with caution, considering the trendline resistance and the RSI position as it approaches overbought territory, as this could be a precursor to a trend reversal.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.