Why the US should care about GENIUS Act as stablecoin market hits new record in 2025

- Stablecoin market capitalization crossed $263 billion last week, hitting a two-year peak and setting a new 2025 record.

- Circle’s IPO is one of the key market movers, alongside the GENIUS Act, lined up for a hearing at the Senate this week.

- USDT leads the market with a 62% share, followed by USDC at 24%.

- Bitcoin market cap historically rises in the weeks following new peaks in stablecoin market capitalization.

GENIUS Act, a bill that sets the rules for stablecoin issuers, is likely to get a Senate hearing this week. With stablecoins hitting a new yearly high last week, market participants await the GENIUS Act hearing with increased interest.

Bitcoin price has a positive correlation with stablecoins' market capitalization, based on data from previous bull runs. This likely sets the stage for a new Bitcoin all-time high fueled by higher liquidity and market participation.

Americans should care for the GENIUS Act, here’s why

The GENIUS Act is a stablecoin legislation that is hailed as a means to protect consumer interests and establish industry standards to allow these assets to become mainstream. A smooth passage of the GENIUS Act could turn stablecoins into a means for digital payments, requiring issuers to maintain reserves, regulating this class of digital assets.

Stablecoins are considered the gateway to crypto, and the stablecoin market cap is an indication of liquidity in the crypto ecosystem. Americans should care for the GENIUS Act, and according to US Vice President JD Vance, the legislation should pass as a clean bill with no amendments that are unrelated to the goal of the stablecoin bill.

America’s credit unions have raised their voices collectively against proposed amendments to the GENIUS Act. In their press release, America’s Credit Unions have opposed Senator Roger Marshall’s initiative to add the Big Box Bailout, or Marshall's Credit Card Competition Act ‘language’ to the bill.

The Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act is being considered a representation of innovation and a regulatory framework for crypto adoption in America. If unrelated amendments are made to the legislation, it could negatively impact the credit card payments system and make access to credit more expensive and difficult for consumers.

Stablecoin hits new milestone in 2025, hit highest market cap in two years

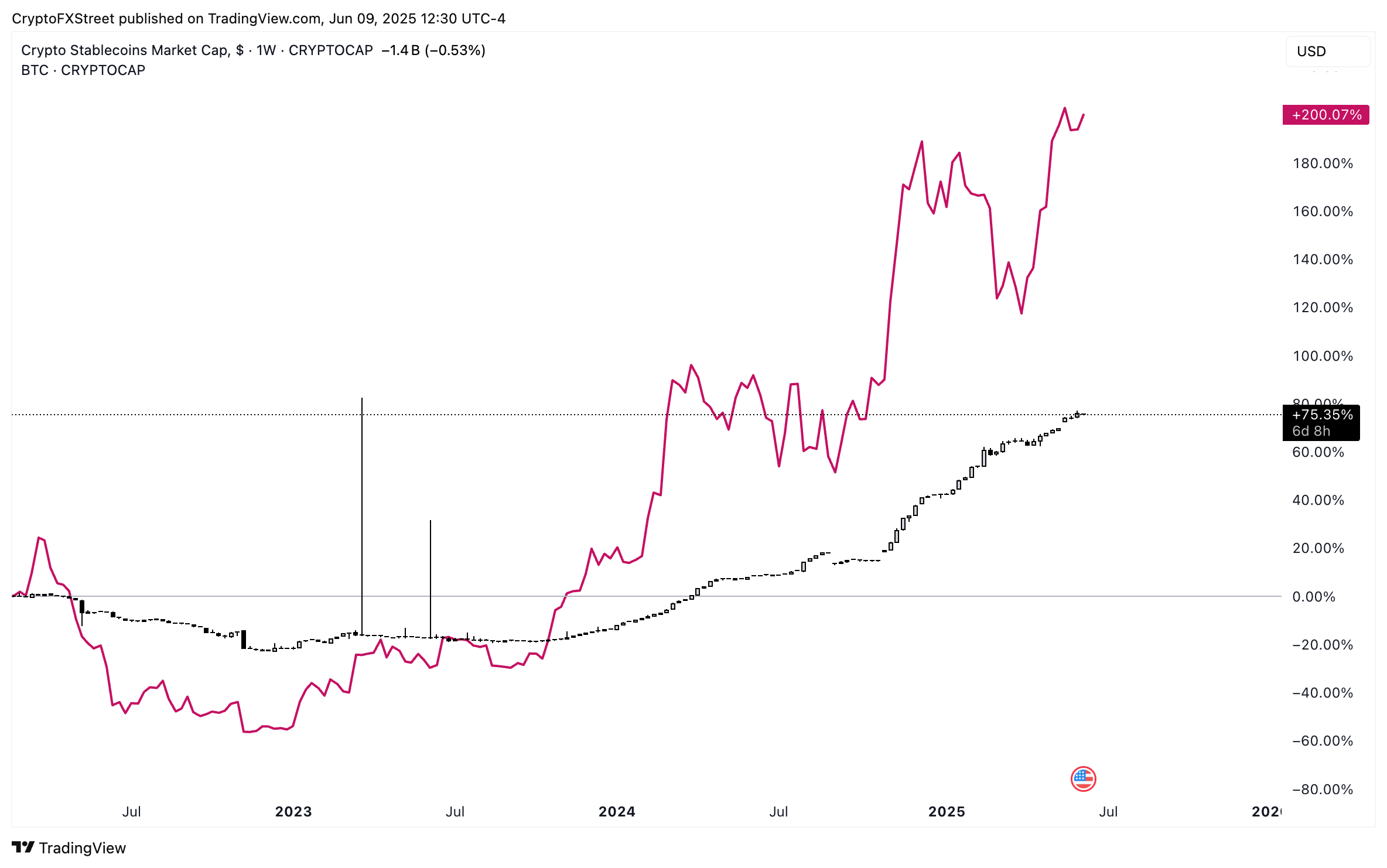

Data from TradingView shows stablecoin market capitalization has climbed to a peak of $263.71 billion last week, the highest level in 2025 and nearly two years. A rise in the stablecoin market cap is considered an indicator of an impending rally in Bitcoin price.

When Bitcoin's market capitalization is compared with the stablecoin on the same percentage scale, it is clear that there is a correlation between the two. Typically, in previous market cycles, Bitcoin price has rallied in the weeks following peaks in stablecoin market capitalization.

The recent two-year peak in stablecoin market capitalization is therefore considered key to Bitcoin’s bull run in 2025.

Crypto market cap and Bitcoin market cap | Source: TradingView

Where is Bitcoin headed next?

Bitcoin is back above $108,500, close to its all-time high of $111,980. Bitcoin has bounced back from its low at $100,372 on June 5, as Tesla Chief Elon Musk and US President Donald Trump’s spat became a public spectacle, across X and TruthSocial.

The BTC/USDT price chart shows a likelihood of further gains in Bitcoin price. BTC is climbing steadily towards a re-test of its all-time high. The Relative Strength Index (RSI) reads 60 and is sloping upwards. Moving Average Convergence Divergence (MACD) flashes consecutively shorter red histogram bars, meaning that the underlying negative momentum in Bitcoin price trend is slowly waning.

BTC could rally nearly 4% and re-test its all-time high. A daily candlestick close above this level could push Bitcoin into price discovery.

BTC/USDT daily price chart | Source: TradingView

Conversely, a decline in Bitcoin could see the king crypto collect liquidity in the Fair Value Gap (FVG) between $97,732 and $102,315. This is marked as a bullish FVG on the daily timeframe, meaning once Bitcoin collects liquidity in this zone, is likely to test the closest resistance at the $108,000 support level.

Utkarsh Ahuja, Founder and Managing Partner at Moon Pursuit Capital, told FXStreet in an exclusive interview that his base case for Bitcoin is $160,000, likely by November 2025, as the cycle top for the king crypto. The bullish case is $240,000, and Ahuja believes the potential is strong for this target.

“Bitcoin capital flows are bolstered by institutional adoption metrics and the growing demand driven by ETFs. Aligned with projections derived from mean regression channels, the rally to $240K may require greater-than-expected monetary expansion, a Trump presidency focused on tech acceleration (e.g., Musk’s influence), and even stronger institutional adoption and ETF inflows.”