US-China Talks End with Dollar and Gold Slightly Up

- International Oil Prices Retreat Rapidly; G-7 to Discuss Emergency Oil Reserve Release

- Goldman Sachs Raises Oil Price Forecasts and Warns Oil May Break All-Time Highs if Strait of Hormuz Disruption Persists

- Gold slumps below $5,100 as US Dollar gains

- Crypto’s Great Recovery: Is the Post-Conflict Surge a Sustainable Rally or a Sophisticated Bull Trap?

- WTI recovers to near $86.50 as Strait of Hormuz remains closed

- Gold slumps to near $5,050 on oil-driven inflation fears, stronger US Dollar

There is positive news in the negotiations between China and the United States in London.

Representatives of the two countries said in London that the two sides reached a framework agreement on how to implement the consensus reached by the two sides in the previous round of Geneva talks.

Li Chenggang, vice minister of China's Ministry of Commerce, said in the early hours of Wednesday that the communication between China and the United States was professional, rational, in-depth, and frank. U.S. Commerce Secretary Howard Lutnick said that the framework combines the Geneva Consensus with the results of the call between the leaders of the two countries on June 5.

Next, the U.S. and Chinese delegations will submit the proposal to their respective leaders and then wait for the approval of the leaders of both sides.

Dollar and gold saw small gains

The market initially reacted calmly to the news.

The dollar remained stable against major currencies in early trading on Wednesday. The dollar index, which measures the greenback against six other currencies, rose slightly by 0.15% to 99.204. The euro was flat at 1.1410 against the dollar, and the offshore yuan was flat at 7.1881 against the dollar.

S&P 500 futures and Nasdaq futures both fell slightly by 0.1%.

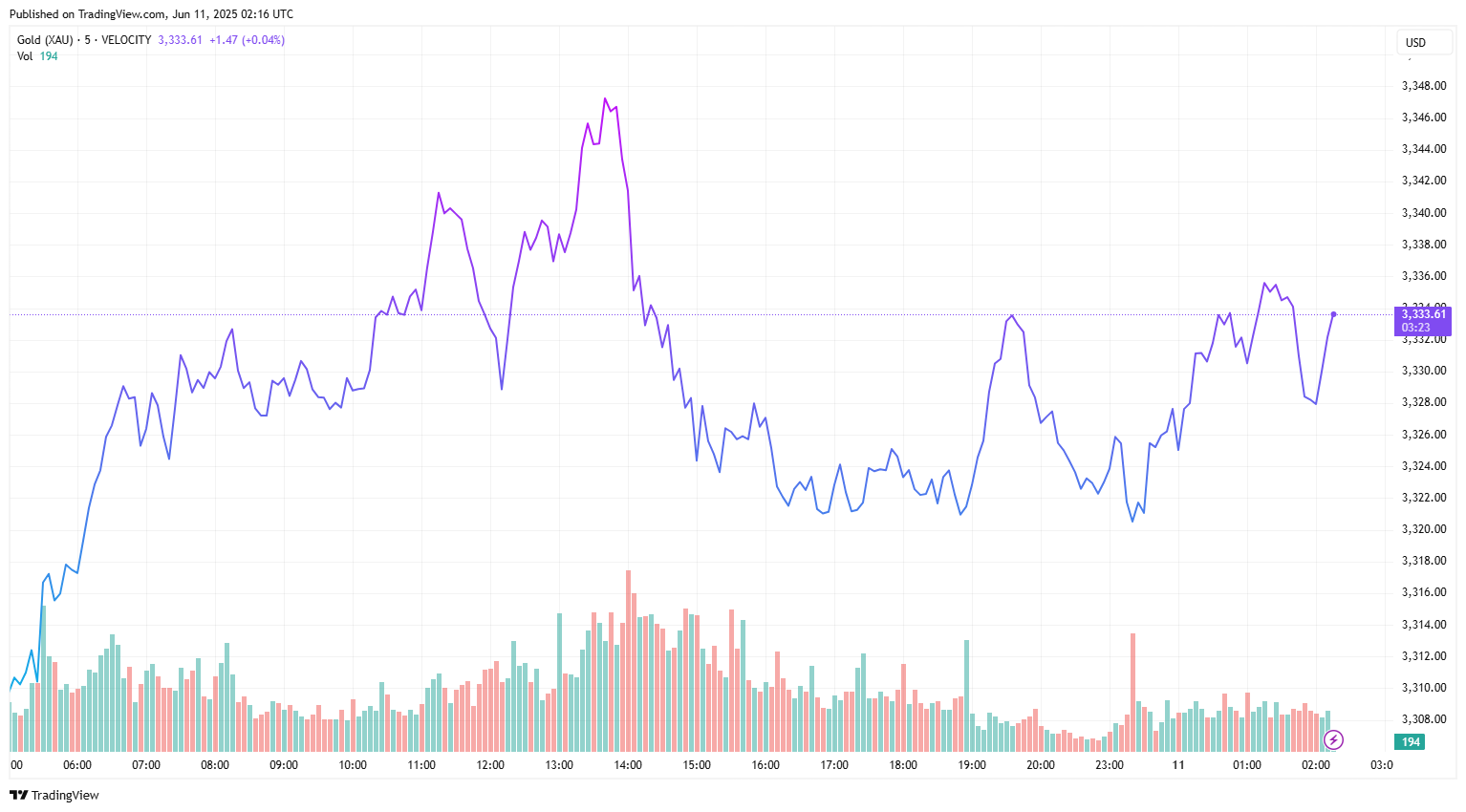

Meanwhile, gold, a major safe-haven asset, also performed calmly. In early Asian trading on Wednesday, gold rose only slightly by 0.2%, hovering around $3,330.

Source: TradingView

Chris Weston, head of research at Pepperstone in Melbourne, believes that the outcome of the talks between the United States and China in London was a positive one, but the lack of market reaction shows that the conclusion of the Geneva agreement framework was completely expected.

Chris Weston said: "The details matter, especially around the degree of rare earths bound for the US, and the subsequent freedom for US-produced chips to head East, but for now, as long as the headlines of talks between the two parties remain constructive, risk assets should remain supported."

Rare earths emerge as market focus

In recent weeks, the Trump administration has suspended exports of a large number of jet engine technologies, semiconductors, chemicals, and mechanical equipment to China. In response, China has also tightened export controls on key rare earths, which can be used in consumer electronics, high-tech defense systems, etc.

The export restrictions of the two countries have disrupted the global supply chain. For example, some European automakers are at risk of closure due to China's control of rare earth resources.

In an interview after the London talks, U.S. negotiators said: "We do absolutely expect that the topic of rare earth minerals and magnets with respect to the United States of America will be resolved in this framework implementation."

“Also, there were a number of measures the United States of America put on when those rare earths were not coming,” Lutnick added. “You should expect those to come off, sort of, as President Trump said, in a balanced way. When they approve the licenses, then you should expect that our export implementation will come down as well.”

Read more

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.