Chinese AI Company To Invest $300 Million in XRP

Webus International, a Nasdaq-listed Chinese AI solutions company, announced today that it’s planning to invest up to $300 million in an XRP reserve. The firm claims that this strategy is primarily aimed at facilitating cross-border payments.

Additionally, Webus aims to use XRP to help expand an AI-native company’s other blockchain-related development ambitions. Depending on the investment’s success, the firm may incorporate on-chain solutions in several fields.

Chinese Firm Bets Big on XRP

In recent months, many corporations have made serious attempts to hold substantial amounts of cryptocurrency.

Obviously, Bitcoin has been an early and enduring favorite, but certain companies have begun experimenting with altcoins like Solana. Today, one Chinese firm is innovating again by considering investing up to $300 million in an XRP reserve.

Webus is not the only Chinese company considering a massive crypto investment this month, but its XRP reserve plan seems more deliberate.

Two weeks ago, Addentax Group, a logistics firm, considered investing $800 million in BTC and TRUMP. This may have been an attempt to secure tariff relief, and Addentax barely mentioned its crypto ambitions.

On the other hand, Webus described a long-term vision for the XRP reserve in explicit detail:

“These strategic developments have the potential to create a powerful synergy between our domestic and international operations. The integration of an XRP blockchain integration has the potential to revolutionize how we handle cross-border payments for both partners and travelers worldwide,” claimed Nan Zheng, CEO of Webus.

In other words, Webus’ AI solutions cater to customers around the globe, and DeFi may help smooth over recurring problems. Chinese firms can experience difficulties with bank processing across borders, but XRP may provide a solution.

Webus mentions using the tokens for lending, shareholder guarantees, third-party credit, and other core financial interactions.

Furthermore, a $300 million investment could help an AI-specific firm access the other advantages of Web3. In addition to improving cross-chain payment operations, XRP integration will help develop the company’s blockchain infrastructure.

Webus’ press release mentions a few concrete goals like on-chain record keeping, loyalty tokens, and customer wallets.

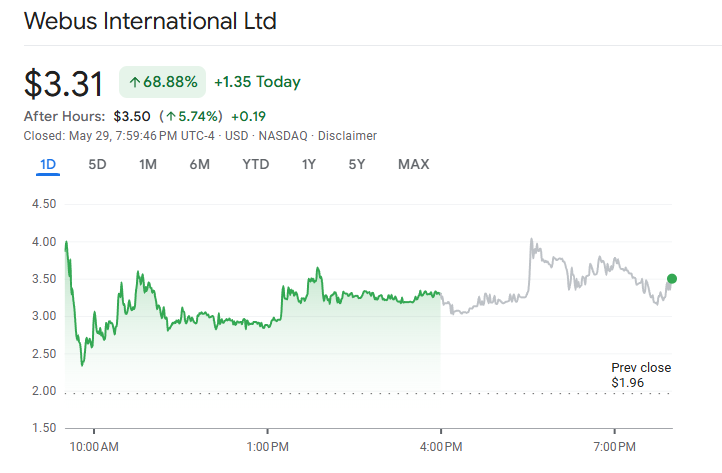

Meanwhile, the company’s stock price has surged over 60% in after-market prices since the announcement.

Webus International Stock Price. Source: Google Finance

Webus International Stock Price. Source: Google Finance

XRP is already a leading cryptoasset, but $300 million is a substantial amount of money by any metric. If Webus helps integrate the token into the Chinese AI ecosystem, it could prove highly beneficial for XRP and the company.

Depending on the success of this reserve strategy, Webus could be setting a new trend for crypto’s worldwide integration.