Bitcoin Whales Continue to Reduce Holdings After All-Time High

Bitcoin (BTC) has been hitting fresh all-time highs in recent days, though it’s down nearly 2% in the last 24 hours. At the Bitcoin 2025 Conference, US Vice President JD Vance publicly backed BTC, calling it a hedge against inflation and political overreach.

Meanwhile, the Federal Reserve’s latest meeting minutes flagged rising risks of both inflation and unemployment, fueling macroeconomic uncertainty. Together, political endorsement and economic instability are reinforcing Bitcoin’s narrative as a hedge asset in volatile times.

JD Vance Backs Bitcoin as Fed Flags Inflation-Unemployment Storm

US Vice President JD Vance took the stage at the Bitcoin 2025 Conference in Las Vegas today, voicing strong support for crypto and Bitcoin in particular. In his remarks, Vance said:

“Crypto is a hedge against bad policymaking from Washington, no matter what party’s in control,” he said. “It’s a hedge against skyrocketing inflation, which has eroded the real savings rates of Americans over the last four years. And as you all know well, it’s a hedge against a private sector that’s increasingly willing to discriminate against consumers on the basis of their basic beliefs, including their politics.”

He confirmed that he personally holds Bitcoin, boosting its image as a symbol of financial freedom and resistance to centralized control.

At the same time, minutes from the Federal Reserve’s May meeting revealed growing concerns over rising inflation and unemployment.

Fed officials warned of “difficult tradeoffs” ahead, as they balance inflation control with job support. Tariffs proposed by the Trump administration add more pressure, and despite delays, recession fears remain.

This mix of economic stress, policy uncertainty, and political backing may strengthen Bitcoin’s appeal as a hedge. Investors looking for protection from instability could be drawn to BTC.

Bitcoin Whales Retreat After Price Peak, Cloud Signals Caution

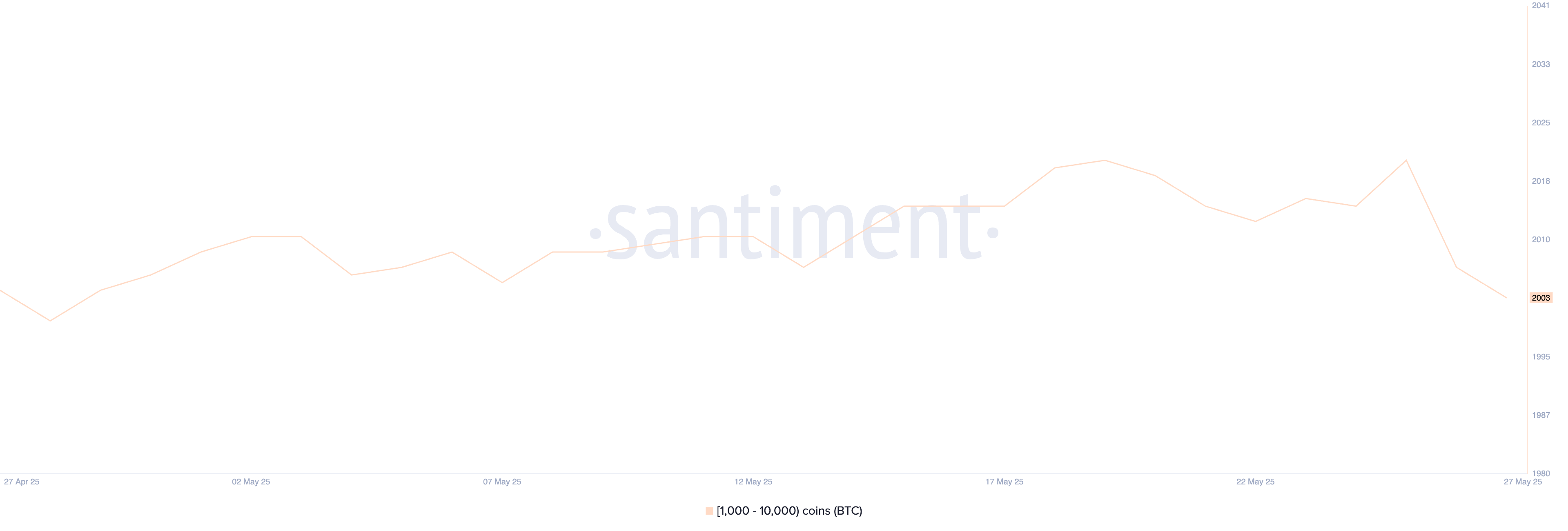

The number of Bitcoin whales—wallets holding between 1,000 and 10,000 BTC—climbed to 2,021 on May 25, marking the highest level seen in nearly a year.

These large holders are considered some of the most influential participants in the market. A rising whale count is typically interpreted as a sign of growing confidence among long-term investors, especially when it coincides with bullish price action.

Bitcoin Whales. Source: Santiment.

Bitcoin Whales. Source: Santiment.

However, just two days after hitting that one-year high, the number of whales dropped sharply to 2,003 on May 27.

This sudden decline may signal that some large holders have begun to take profits following Bitcoin’s rally to an all-time high near $112,000.

When whale wallets begin to shrink in number, it can indicate that distribution is underway, which sometimes precedes increased volatility or short-term pullbacks.

In the current Ichimoku Cloud chart for Bitcoin, the Tenkan-sen (blue line) remains above the Kijun-sen (red line), indicating that short-term momentum is stronger than the medium-term trend.

This is typically a bullish signal. However, Bitcoin price has dipped into the green Kumo (cloud), which suggests uncertainty and potential consolidation.

BTC Ichimoku Cloud. Source: TradingView.

BTC Ichimoku Cloud. Source: TradingView.

When the price enters the cloud, the market is considered neutral or indecisive, especially following a sharp upward trend. Leading Span A (green line) is still above Leading Span B (red line), another indicator that the longer-term trend is technically still bullish.

However, the flattening and narrowing of the cloud ahead imply fading momentum, and if Bitcoin fails to hold above the lower cloud boundary, it could face increased selling pressure.

Conversely, a bounce from the cloud could set up another bullish leg if buyers step in.

BTC Bulls Eye $112,000 – But Death Cross Risk Looms

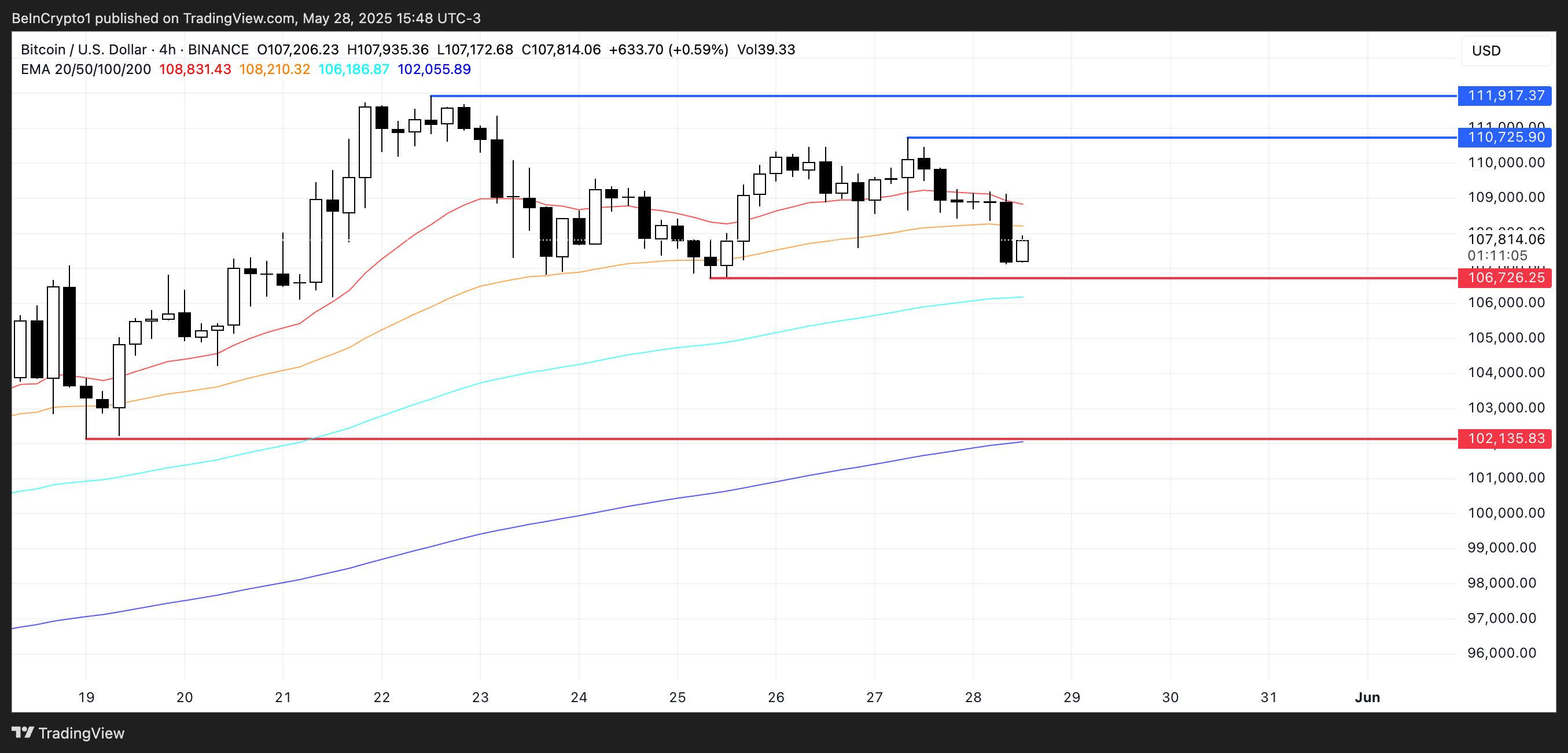

Bitcoin’s EMA lines still reflect a bullish trend, with short-term moving averages positioned above the longer-term ones.

However, the gap between them is narrowing, signaling weakening momentum.

If a death cross forms—where a short-term EMA crosses below a long-term one—it could trigger a deeper pullback.

BTC Price Analysis. Source: TradingView.

BTC Price Analysis. Source: TradingView.

In that case, BTC may test the support level at $106,726, and if that level is breached, $102,135 becomes the next key area to watch.

On the flip side, if buyers regain control and momentum recovers, BTC could retest the resistance around $110,725.

A breakout there may open the door for another push toward the $112,000 zone, which recently marked its all-time high.