Bitcoin Whale Doubles Down With $1.25 Billion Long Bet on Hyperliquid

Crypto whale James Wynn has made headlines again after dramatically increasing his Bitcoin exposure. He placed a $1.2 billion long position on Hyperliquid, a decentralized derivatives exchange.

This comes shortly after he closed out positions in Ethereum, Sui, and PEPE. The move signals a strategic shift toward Bitcoin as the market rallies.

Crypto Whale Exits Altcoins to Place $1.2 Billion Leveraged Bet on Bitcoin

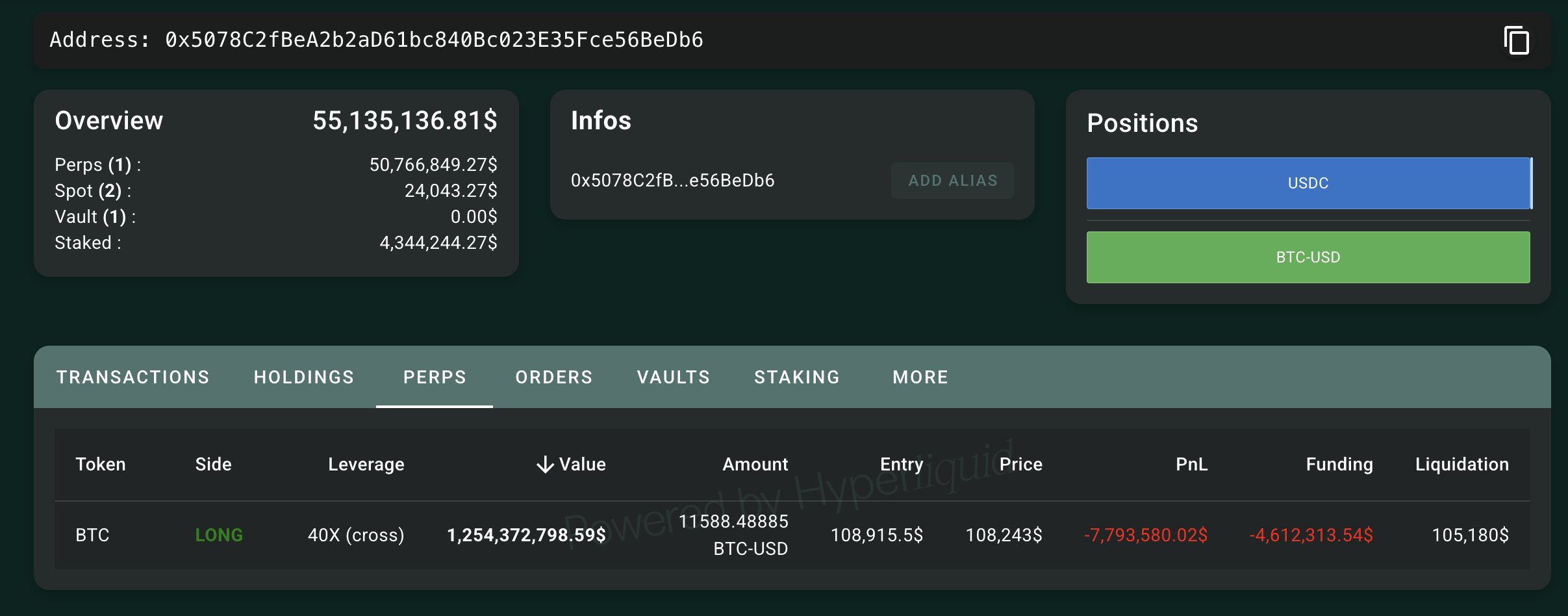

On May 24, blockchain tracker Lookonchain revealed that Wynn had opened a 40x leveraged position totaling 11,588 BTC, worth approximately $1.25 billion. His liquidation level is set at $105,180.

James Wynn Bitcoin Bet on Hyperliquid. Source: Lookonchain

James Wynn Bitcoin Bet on Hyperliquid. Source: Lookonchain

This move extends a series of aggressive Bitcoin trades Wynn began earlier in the week. On May 21, he opened a long position worth $830 million, from which he took a $400 million profit on the same day.

Since then, he has reloaded his position to over $1 billion as Bitcoin’s price climbed over the past two days.

Over the past week, Bitcoin price jumped to a new all-time high of more than $111,000—its highest point since January.

The surge has been fueled by rising institutional interest and continued inflows into spot ETFs, driving renewed optimism across the crypto space.

Meanwhile, Wynn appears confident that the rally has more room to run. He projects BTC could climb to between $118,000 and $121,000 in the near term.

“[My prediction is that Bitcoin gets to] $110,500 today. [It should trade between] $118,000 – $121,000 next week,” he stated.

His conviction is grounded in experience as he reportedly made $46 million over a two-month stretch by using leverage between 5x and 40x.

Moreover, he also shared a screenshot on the social platform X showing that his latest Bitcoin long bet was up 13.4%. This means that the position had generated around $4.2 million in unrealized profit.

Wynn’s Bitcoin bet on Hyperliquid. Source: X/Wynn

Wynn’s Bitcoin bet on Hyperliquid. Source: X/Wynn

Still, his track record has its blemishes. He recently closed his positions in Ethereum and Sui with a combined loss of $5.3 million. However, he offset those setbacks with a $25.19 million gain on a trade involving PEPE.