Bitcoin Price Forecast: BTC open interest hits new all-time high, echoing pre-ATH rally setup

- Bitcoin price stabilizes above $106,000 on Wednesday, just 3% shy of its all-time high at $109,588.

- BTC’s open interest hits a new all-time high of $75.14 billion, mirroring the setup of previous bullish cycles.

- Trump’s upcoming “TRUMP Gala” meme coin fundraiser on Thursday could inject fresh volatility into the market.

Bitcoin (BTC) price stabilizes above $106,000 on Wednesday, a few inches away from its all-time high (ATH) of $109,588 set on January 20. BTC’s Open Interest (OI) has surged to a new record high of $75.14 billion, mirroring the setup of previous bullish cycles.

Traders should watch the US President Donald Trump’s “TRUMP Gala” memecoin fundraiser on Thursday, which could be a potential catalyst for volatility and further influence Bitcoin’s next major move.

Bitcoin open interest hits record level of $75.14 billion

Coinglass’ data shows that the futures’ OI in BTC has reached a new all-time high of $75.14 on Wednesday. Historically, when open interest reached a record high, Bitcoin price generally soared to a new all-time high, as seen in previous bullish cycles. This bullish outlook is because an increasing OI represents new or additional money entering the market and new buying, which could fuel Bitcoin to surpass its ATH of $109,588.

BTC open interest chart. Source: Coinglass

Trump’s Gala event could be a potential catalyst for BTC

The upcoming Donald Trump’s “TRUMP Gala” memecoin fundraiser on Thursday is the key event to watch for. This event, also known as ‘Dinner with Trump’ in Washington, DC, tied to the TRUMP meme coin, could be a potential catalyst to bring volatility in the market.

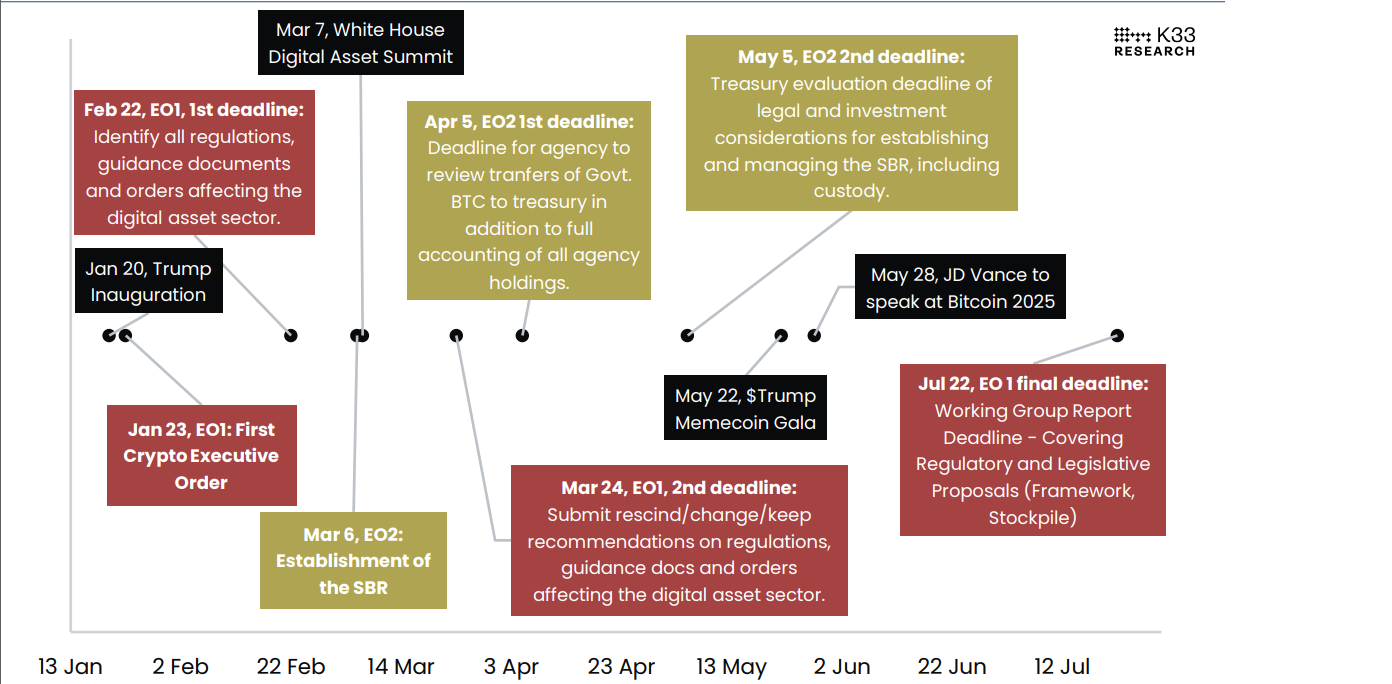

A K33 research report on Tuesday highlighted that there were no substantial updates on Trump’s two crypto-focused executive orders for establishing a Strategic Bitcoin Reserve (SBR) and a national digital asset stockpile.

“We view the SBR initiative as undervalued and eye upcoming events such as President Trump’s “$TRUMP Gala” memecoin fundraiser on Thurday and VP JD Vance’s keynote at Bitcoin 2025 on May 28 as potential events for more information to be shared on the progress of the crypto-specific executive orders,” say K33 analyst.

Bitcoin’s institutional and corporate demand strengthens

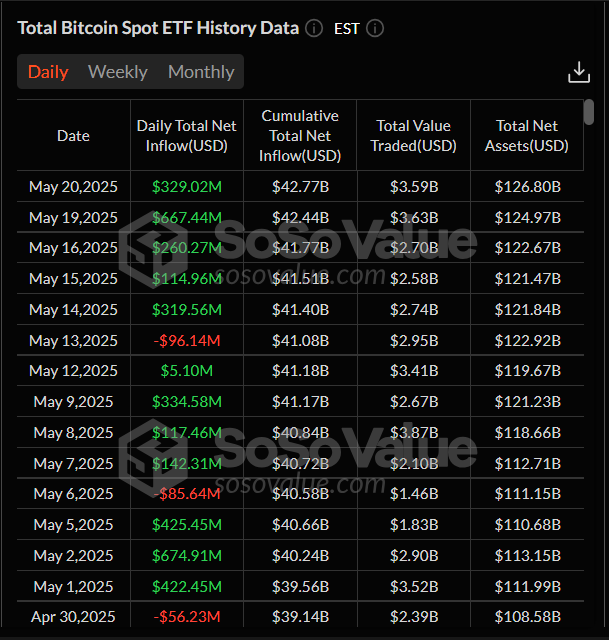

Bitcoin’s institutional demand remains strong so far this week, continuing its five-day streak on inflows since May 14. According to SoSoValue data, US spot Bitcoin Exchange Traded Funds (ETFs) recorded an inflow of $329.02 on Tuesday. The Bitcoin price should benefit if institutional inflows continue and intensify, targeting its all-time high of $109,508.

Total Bitcoin Spot ETFs daily chart. Source: SoSoValue

On Monday, Indonesian fintech firm DigiAsia Corp announced its strategic decision to establish a Bitcoin treasury reserve as approved by its Board of Directors.

“To establish the initial BTC treasury reserve, DigiAsia is actively exploring a capital raise of up to US$100 million, aimed at building a robust Bitcoin position and executing crypto-based yield strategies to optimize treasury performance,” said the firm in a press release.

This news is positive for Bitcoin as it indicates a growing acceptance of BTC as a strategic asset, boosting its legitimacy and potentially driving long-term adoption.

Bitcoin Price Forecast: BTC bulls aim for a new high if $105,000 holds strong

Bitcoin price broke above the $105,000 resistance level on Sunday, holding above this key level since then. At the time of writing on Wednesday, BTC stabilizes at around $106,300.

If the $105,000 remains strong, BTC could extend the rally toward the all-time high of $109,588.

The Relative Strength Index (RSI) on the daily chart reads 69, hovering around its overbought level of 70, indicating signs of bullish exhaustion. Meanwhile, the Moving Average Convergence Divergence (MACD) indicator lines are coiling together, suggesting indecisiveness among traders.

BTC/USDT daily chart

If BTC faces a pullback and closes below $105,000, it could extend the decline to retest its psychological level at $100,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.