Robinhood to Acquire WonderFi for $178.9 Million in Major Canadian Expansion

American financial services company Robinhood has announced that it is set to acquire WonderFi, a leading Canadian fintech and crypto platform, for $178.9 million (250 million CAD). The firm will buy WonderFi’s shares for $0.26 (0.36 CAD) each.

Robinhood announced the deal on May 13. This marks a significant step in its international expansion into the Canadian cryptocurrency market.

Robinhood to Enter Canadian Market via WonderFi Acquisition

According to the official announcement, Robinhood will finance the purchase with cash. The acquisition is expected to close in the second half of 2025, pending regulatory approvals, court approval, and WonderFi shareholder consent.

Notably, WonderFi currently manages over 2.1 billion CAD in custodied assets. It operates two Canadian-regulated digital asset exchanges, Bitbuy and Coinsquare. Furthermore, in 2024, the platform recorded a trading volume of 3.57 billion CAD and revenue of 62.1 million CAD.

“WonderFi has built a formidable family of brands serving beginner and advanced crypto users alike, making them an ideal partner to accelerate Robinhood’s mission in Canada,” Johann Kerbrat, SVP and GM of Robinhood Crypto, stated.

With this latest move, Robinhood aims to expand its offerings in Canada, a growing crypto market. The acquisition will leverage WonderFi’s technologies and products, including crypto trading, staking, and custody services.

Following the agreement, WonderFi will operate under Robinhood Crypto while continuing to deliver its existing products to Canadian customers. The WonderFi leadership team, including President and CEO Dean Skurka, will remain in place. They will join forces with Robinhood’s existing Canadian workforce of over 140 employees, based primarily in Toronto.

“WonderFi and Robinhood are united in our visions of making crypto accessible and bringing more people into the crypto space,” Skurka said.

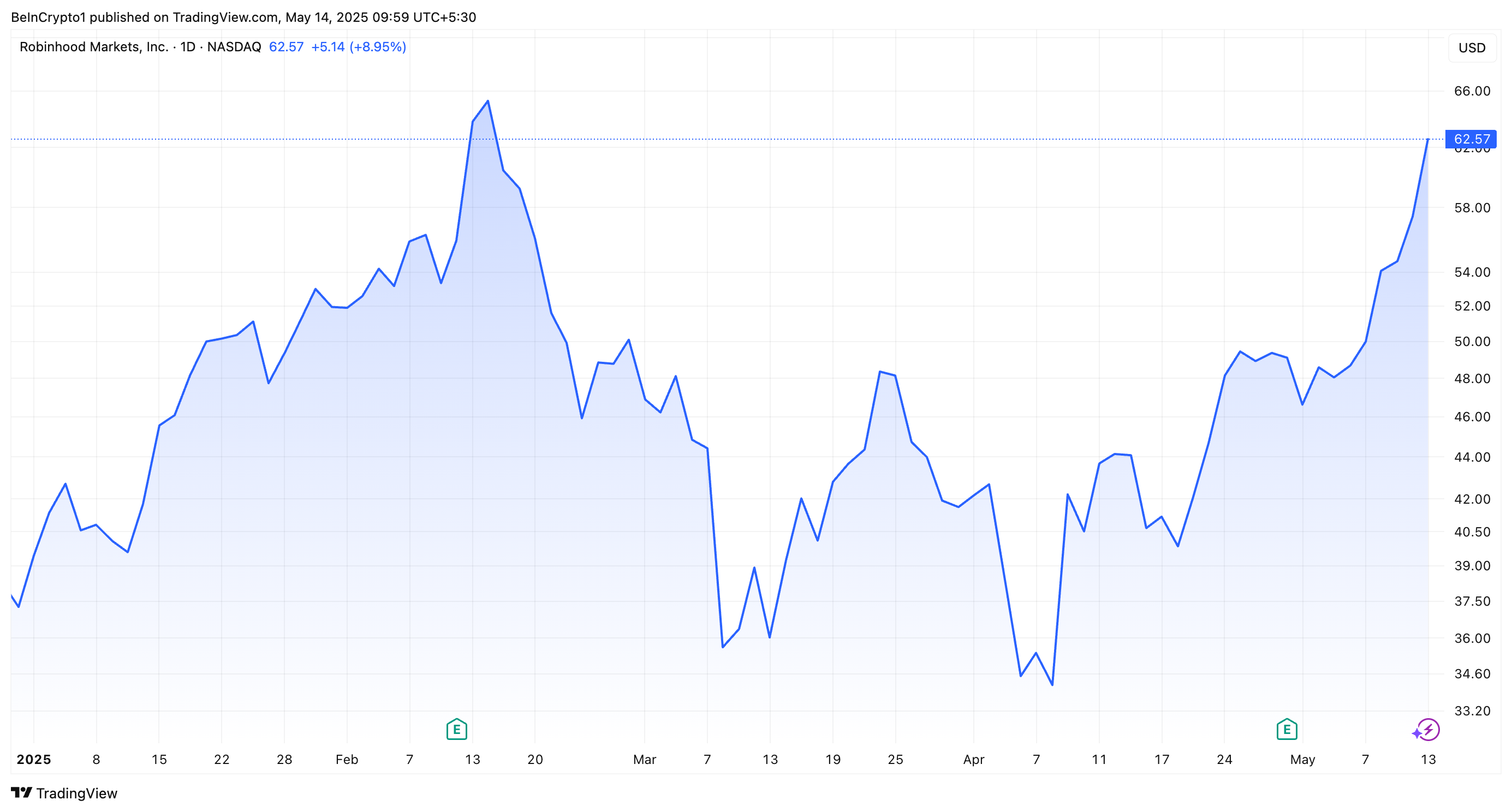

The news positively impacted Robinhood’s stock, HOOD. According to Yahoo Finance data, the stock prices rose 8.9% to $62.5 at market close. Additionally, HOOD appreciated an additional 0.3% to $62.7 in after-hours trading.

Robinhood (HOOD) Stock Performance. Source: TradingView

Robinhood (HOOD) Stock Performance. Source: TradingView

This latest decision aligns with Robinhood’s broader strategy to expand its global footprint in the cryptocurrency sector. In 2024, the firm entered an agreement to acquire Bitstamp.

The $200 million takeover is expected to be completed by mid-2025. Furthermore, BeInCrypto reported on the firm’s upcoming launch of a blockchain-based platform for US stock trading in Europe.

These deals are supported by a more favorable regulatory environment under President Trump’s second term. In fact, in late February, the SEC dropped its investigation into Robinhood, with similar steps taken for Coinbase, OpenSea, and others.

Meanwhile, Robinhood isn’t alone in its expansion plans. On May 8, Coinbase announced its $2.9 billion purchase of Deribit. Preceding that, Ripple acquired Hidden Road for $1.25 billion. In addition, Kraken bought NinjaTrader in a $1.5 billion deal. This reflects a broader trend of major crypto players acquiring financial platforms.