A Trader Made $46 Million on Hyperliquid Using Bitcoin and 3 Meme Coins

A crypto trader known as James Wynn has sparked widespread interest after reportedly earning over $46 million in profits within just two months on the decentralized exchange Hyperliquid.

Since March, he has bagged surprising profits by a series of high-leverage positions on Bitcoin and various meme coins, including PEPE, TRUMP, and Fartcoin.

Hyperliquid Trader Criticizes CEXs While Riding $46 Million Profit Wave

According to on-chain analytics firm Lookonchain, Wynn began actively trading on Hyperliquid around mid-March.

Since then, he has placed aggressive long positions with leverage ranging from 5x to 40x. Five of those positions remain open and are still generating significant unrealized gains.

Lookonchain reported that Wynn’s most lucrative position is a 10x long on meme coin PEPE, which has delivered approximately $23.8 million in unrealized profits. He also holds a 40x long on Bitcoin with about $5.4 million in paper gains.

Other notable trades include a 10x long on the Trump token, which netted $5.57 million. Another trade involves a 5x long on Fartcoin, which generated $5.15 million, and a 5x long on HYPE, which has yielded around $31,000.

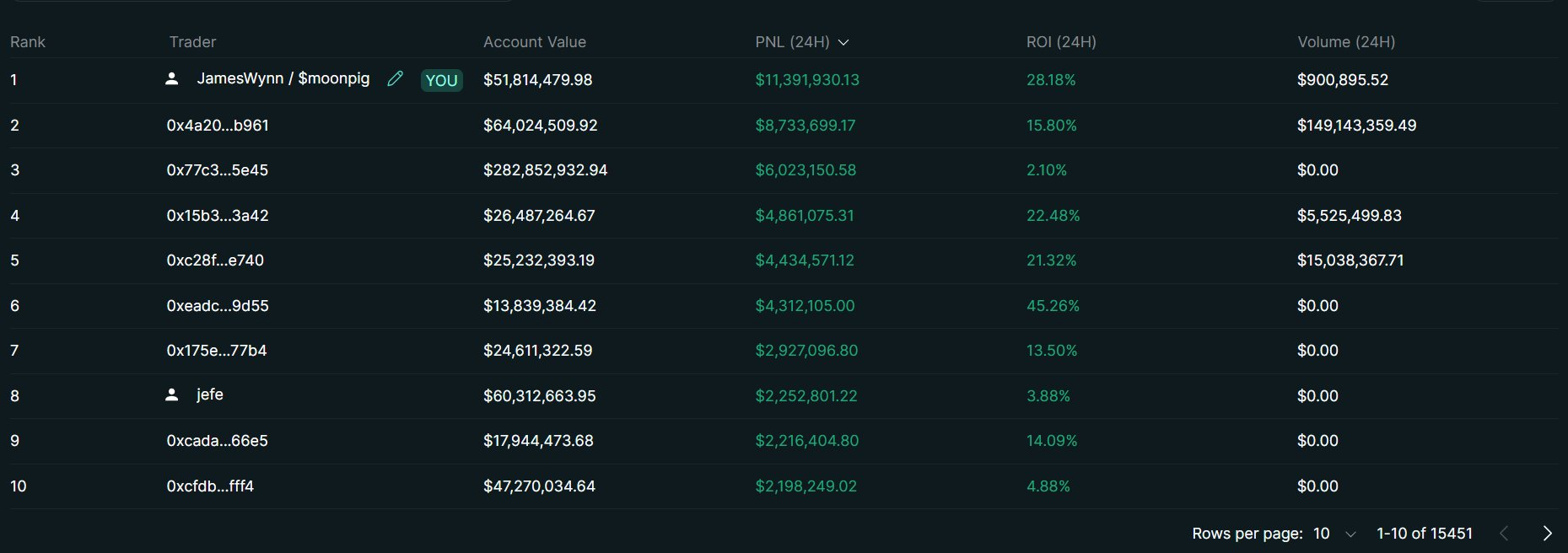

His strategy and consistent performance have put him at the top of Hyperliquid’s trader leaderboard.

In the past 24 hours alone, he reportedly earned $11.4 million, further cementing him as one of the platform’s most successful traders.

Hyperliquid Top Traders List. Source: X/James Wynn

Hyperliquid Top Traders List. Source: X/James Wynn

Hyperliquid User Base Continues to Grow Despite Controversy

Meanwhile, Wynn has gained attention not just for his profits. He has also become a vocal supporter of Hyperliquid and a harsh critic of centralized exchanges.

In public posts, he alleged that platforms like Bybit manipulate token listings for internal gain, suggesting they often introduce tokens to dump them on retail traders.

He stated he would reject a $1 million monthly offer to trade on Bybit, citing ethical concerns.

Instead, Wynn described Hyperliquid as a rare, trustworthy platform in the space. While the platform’s recent controversy surrounding the JELLY meme coin short squeeze has received widespread criticism, several whales and experienced traders continue to support it.

Hyperliquid is designed for perpetual futures trading and delivers rapid on-chain execution. The platform lets users control their funds fully without intermediaries, making it an attractive choice for many day traders.

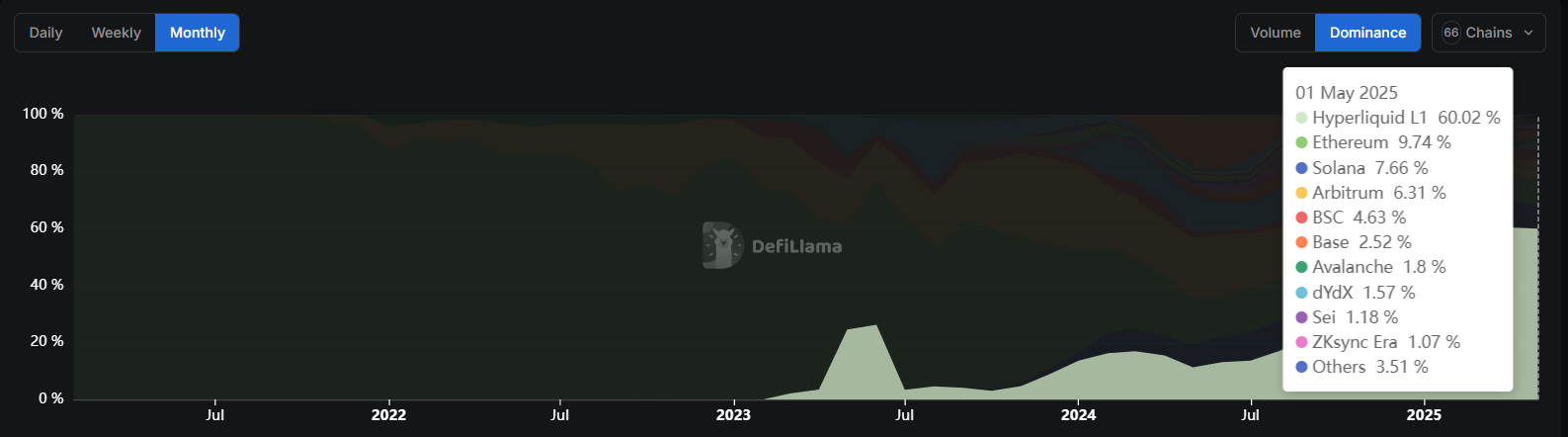

Hyperliquid Market Dominance. Source: DeFiLlama

Hyperliquid Market Dominance. Source: DeFiLlama

Due to this, the platform’s rise has been swift over the past year. According to DeFiLlama, Hyperliquid now commands over 60% of the decentralized perpetual market, up from 44% as of the end of 2024.