Coinbase Launches CFTC-Regulated XRP Futures Contracts

Coinbase, the largest US-based crypto exchange, received regulatory approval from the CFTC (Commodity Futures Trading Commission) to launch XRP futures contracts through its derivatives arm.

This development marks a pivotal moment for institutional access to XRP altcoin, amid a broader derivatives market shakeup.

XRP Futures Now Live on Coinbase

Earlier in the month, Coinbase revealed its intention to bring regulated XRP futures to market, showing that it had filed for the offering with the CFTC. BeInCrypto reported that the US-based exchange filed to self-certify the product.

“We’re excited to announce that Coinbase Derivatives has filed with the CFTC to self-certify XRP futures—bringing a regulated, capital-efficient way to gain exposure to one of the most liquid digital assets,” read the announcement.

The firm anticipated the contract going live on April 21. During the late hours of the US session on Monday, Coinbase confirmed in a follow-up post that the product was live.

“Coinbase Derivatives, LLC now offers CFTC-regulated futures for XRP,” the exchange stated.

This approval suggests a timely endorsement by the CFTC, potentially opening the door to broader crypto derivatives activity in the US.

It is unsurprising, given that the agency recently pivoted toward easing entry into the crypto derivatives sector. As BeInCrypto reported earlier this month, the CFTC rolled back several regulatory hurdles that had previously deterred traditional and crypto-native firms.

“As stated in today’s withdrawal letter, DCR [Division of Clearing and Risk] determined to withdraw the advisory to ensure that it does not suggest that its regulatory treatment of digital asset derivatives will vary from its treatment of other products,” the CFTC explained.

The changes simplify registration requirements and lower operational barriers for launching crypto derivatives products.

XRP Network Activity Soars 67.5%

With XRP historically maintaining high liquidity and a global user base, it represents a strong candidate for derivatives trading, especially in a newly liberalized environment.

Unlike more volatile mid-cap tokens, XRP benefits from a combination of legal clarity following the Ripple lawsuit outcome, broad exchange availability, and a sizable market cap. These elements make it attractive to institutional traders seeking capital-efficient exposure.

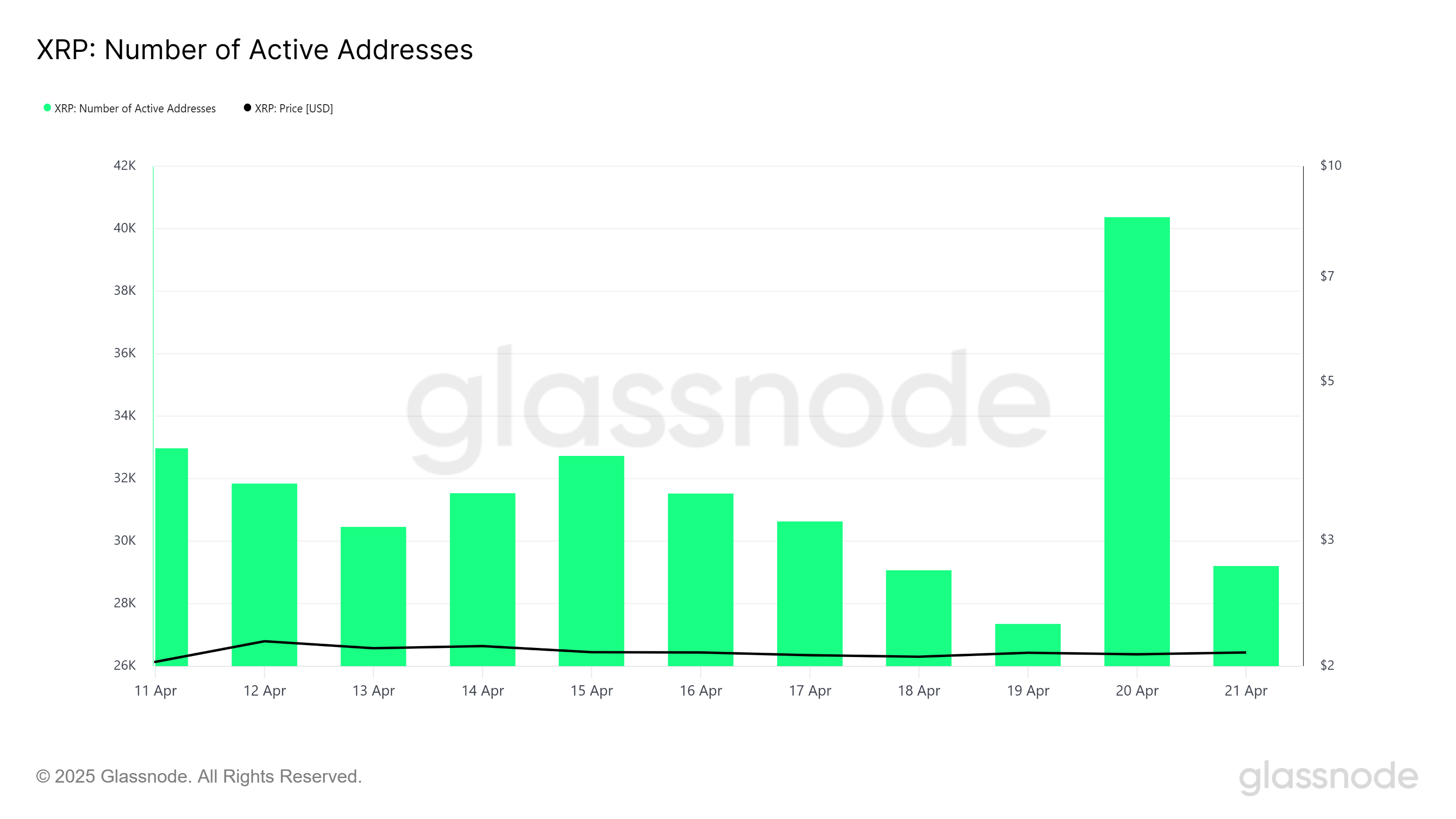

Recent on-chain data reveals a sharp uptick in network activity, further bolstering the case for XRP futures. Data shows XRP active addresses surged by 67.5% between April 19 and 20, ahead of Coinbase Derivatives’ XRP futures debut, climbing from 27,352 to 40,366.

XRP Active Addresses. Source: Glassnode.

XRP Active Addresses. Source: Glassnode.

The spike suggests growing engagement from retail and institutional participants, possibly in anticipation of expanded market access through derivatives.

Still, market sentiment around XRP remains mixed. Despite the regulatory milestone, XRP’s spot price has declined 1.26% in the past 24 hours, reflecting broader market consolidation and investor caution.

XRP Price Performance. Source: BeInCrypto

XRP Price Performance. Source: BeInCrypto

This suggests that while futures listings can enhance liquidity and price discovery over time, short-term price action often diverges from structural developments.