Binance and KuCoin traders panic as Amazon Web Service outage halts Crypto withdrawals

- An AWS technical failure temporarily froze operations at Binance and KuCoin on Monday, alarming traders and halting crypto withdrawals globally.

- The outage emphasizes centralized crypto platforms’ vulnerability to the risk of third-party cloud service disruptions—raising systemic stability concerns.

- Amid the brief service disruption, crypto markets remained stable, with Bitcoin price consolidating above $83,000 and no reported fund losses.

Binance, KuCoin resume trading services after brief AWS outage

On Monday, a technical outage from Amazon Web Services (AWS) temporarily halted operations at top cryptocurrency exchanges, including Binance and KuCoin. The outage disrupted withdrawals and trading services, sparking major concerns among cryptocurrency traders. The incident underscores the vulnerability of centralized crypto platforms to cloud service failures.

Binance, the largest crypto exchange by trading volume, suspended withdrawals after a network issue at an Amazon Web Services (AWS) data center caused systems to go offline. “All services are starting to recover and resume,” the exchange said in a post on X (formerly Twitter), noting that “some services might experience delays” while systems fully recover.

KuCoin, another major global crypto exchange, was similarly affected. The company later confirmed full service restoration, with crypto trading and withdrawals back online. Neither platform reported any loss of funds or security breaches.

AWS outage emphasizes centralization risks in crypto

Notably, the crypto trading outage on Binance and KuCoin on Monday adds to the raging discussion around the risks of cloud dependency among centralized financial and crypto platforms.

With most exchanges built on cloud infrastructure from hyperscale providers like AWS, service outages can quickly trigger global trader panic, and market instability.

Although markets remained relatively stable during the downtime, the event exposed how centralized platforms can become operationally fragile in the face of infrastructure failures.

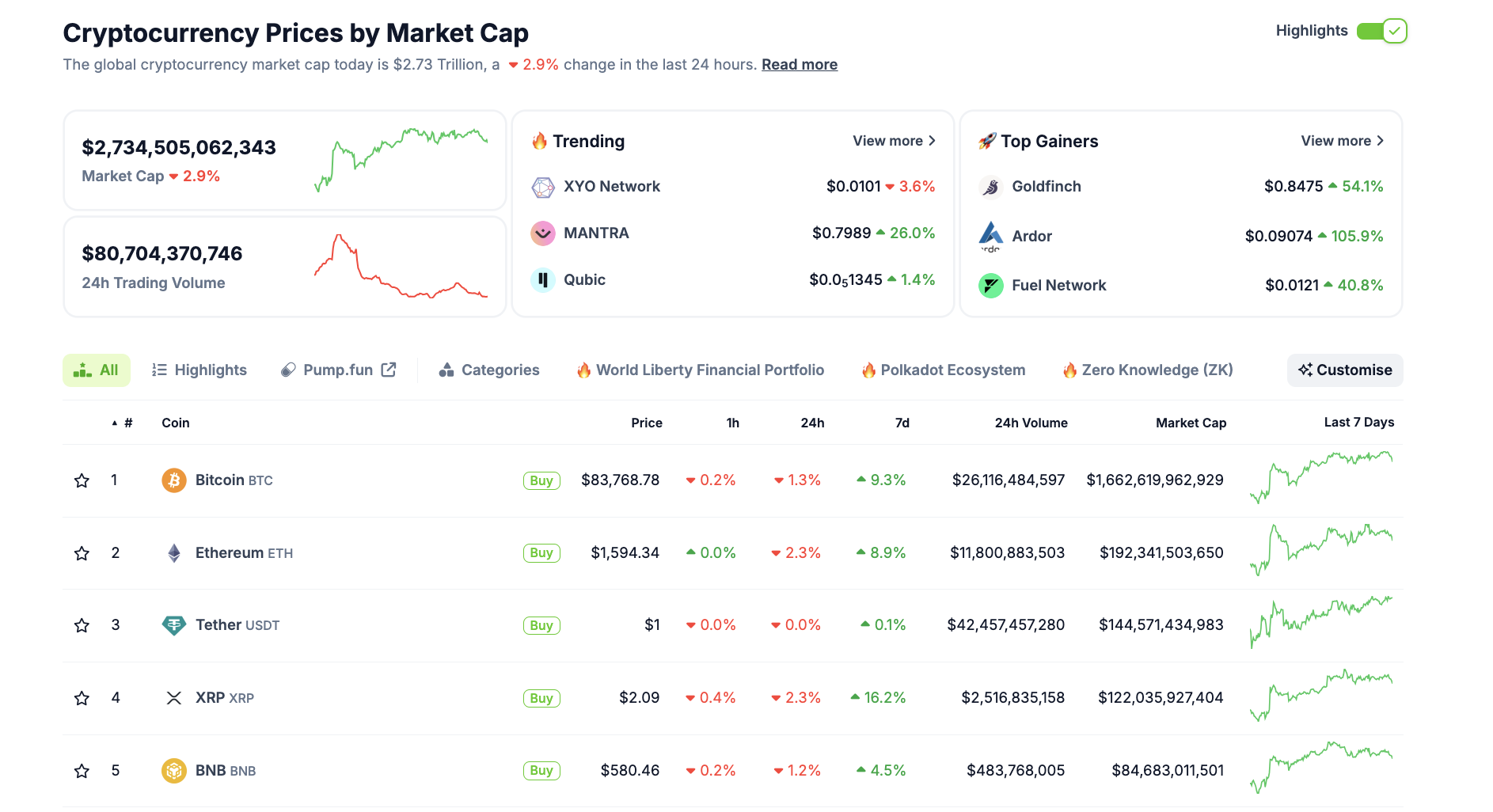

Crypto market performance | April 16 | Source: Coingecko

Both Binance and KuCoin emphasized that user funds remain safe, and ongoing monitoring is in place to maintain platform stability.

“All services are starting to recover and resume. Withdrawals have also reopened. Please note that some services might experience delays while the system fully recovers.

We will continue to monitor to ensure that all operations run smoothly. Thank you for your patience. Binance stated, in an official post on X.

At press time, aggregate cryptocurrency market capitalization stabilizes at $2.7 trillion according to Coingecko data. While Bitcoin price consolidation above $80,000 continues to anchor market optimism, Binance’s native BNB token price also holds key $580 posting a mild 0.8% dip on the daily candle.

As more crypto exchanges and Web3 platforms scale, the conversation around decentralized infrastructure, failover systems, and operational redundancy is likely to intensify.