Warren Buffett holds enough cash to buy 476 companies in the S&P 500 at current values

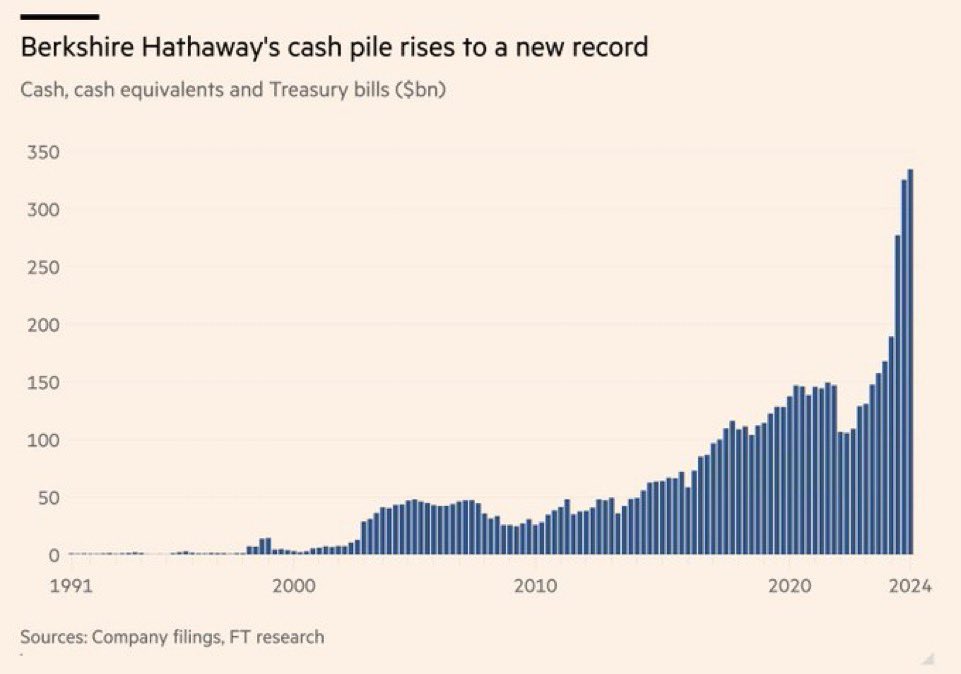

Warren Buffett has stacked up so much cash at Berkshire Hathaway, he could straight-up buy the bottom 476 companies in the S&P 500 right now. His cash pile is sitting at $334 billion, and that’s enough to swallow 95% of the index.

The S&P 500, which covers about 80% of all U.S. public equities by market value, tracks 500 of the country’s biggest companies. Warren has called it a “Who’s Who of American business,” and clearly he’s still keeping his eye on it. But he’s not buying it anymore, for now.

Warren didn’t say a single thing to warn investors last year. He just quietly started unloading stock, pulling out of his favorite names, and walking away from positions he’s held for years. He went from buying to selling overnight. He dumped shares of Apple and reduced his stake in Bank of America.

Warren even shut down Berkshire’s exposure to Vanguard’s S&P 500 ETF and SPDR’s S&P 500 ETF Trust, which had tracked the S&P 500 directly.

Warren’s Berkshire Hathaway is now rich enough to buy nations. Is there a plan ahead?

The market didn’t take long to catch up. In the weeks after Warren emptied those positions, the Nasdaq tanked and the S&P 500 began bleeding points. The indexes were crushed, with trillions wiped every single week.

The beatdown came after President Donald Trump announced his global tariff plan, triggering fears about how higher costs would damage company earnings, pressure consumers, and slam U.S. growth.

Warren didn’t react. He didn’t go hunting for cheap stocks. He didn’t try to “buy the dip.” He just sat. Why? Because, as we reported recently, Warren’s not gonna move unless he sees the Federal Reserve do something first.

This is exactly how he played it in 2020, when the COVID pandemic shut down the global economy. He had billions ready to go. But he didn’t make a single move until Jay Powell, the Fed Chair, stepped in. Powell dropped interest rates to zero and unleashed stimulus on March 23, 2020. After that, the game changed.

“We could have deployed $50 or $75 billion, and right before the Fed acted,” Warren said at the 2021 meeting. “When Jay Powell acted as he did, that was incredibly important. He moved with a speed and a decisiveness on March 23rd that changed the situation where the economy had stopped.”

“We can’t buy companies as cheap as we can buy our own,” he said. “And we can’t buy stocks as cheap as we can buy our own.” That was the entire strategy—don’t overpay, and if nothing’s cheap, buy yourself. It was a repeat of the exact same playbook he’s using right now in 2025.

Warren has always said he doesn’t care if markets shut down tomorrow. His strategy doesn’t need constant action. “I never attempt to make money on the stock market,” he once said. “I buy on the assumption that they could close the market the next day and not reopen it for five years.”

Cryptopolitan Academy: Want to grow your money in 2025? Learn how to do it with DeFi in our upcoming webclass. Save Your Spot