Crypto Whales Bought These Altcoins in the Second Week of April 2025

Despite lingering market uncertainty fueled by Donald Trump’s escalating trade war, the cryptocurrency market showed signs of recovery this week.

On-chain data reveals that crypto whales took advantage of the volatility to accumulate select altcoins, signaling growing confidence in specific digital assets.

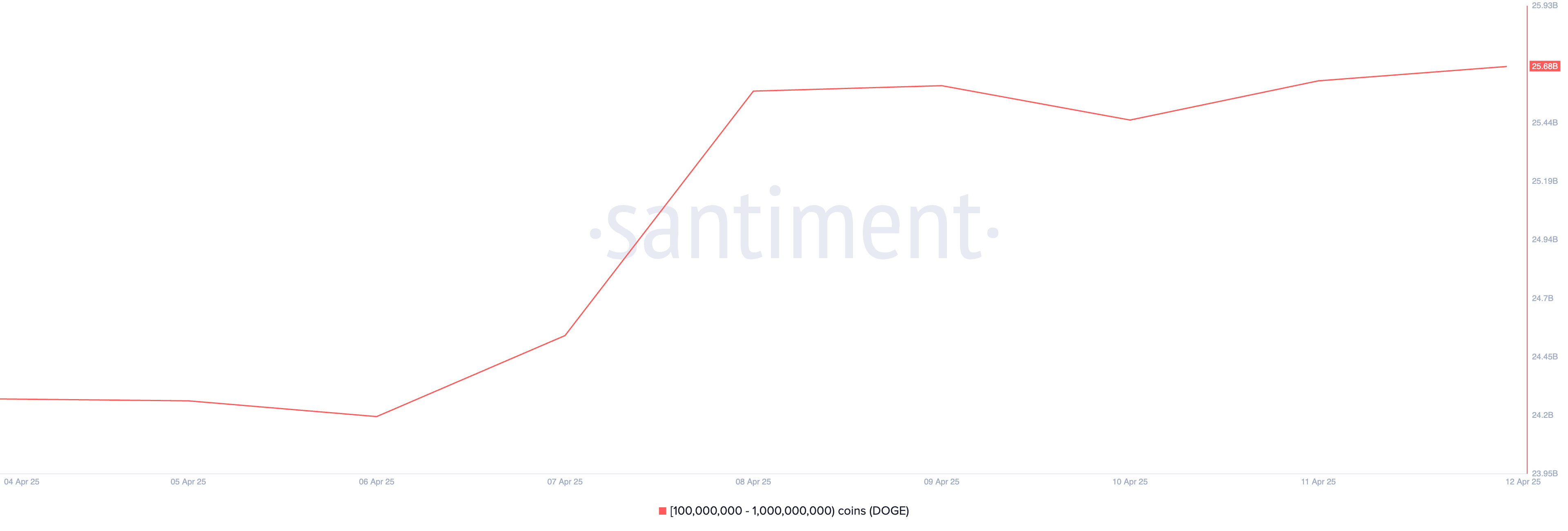

Dogecoin (DOGE)

Leading meme coin Dogecoin (DOGE) has received significant attention from crypto whales this week. This is reflected by the spike in the number of coins purchased over the past seven days by DOGE whale addresses that hold between 100 million and 1 billion coins.

According to data from Santiment, these DOGE holders have accumulated 1.41 billion coins worth over $220 million during the review period. As of press time, their total holdings have surged to 25.68 billion DOGE, marking the highest level since December last year.

DOGE Supply Distribution. Source: Santiment

DOGE Supply Distribution. Source: Santiment

When an asset’s large holders increase their accumulation like this, it suggests increased confidence or anticipation of future price gains. If this continues, DOGE could break above the resistance at $0.17 in the near term and climb toward $0.23.

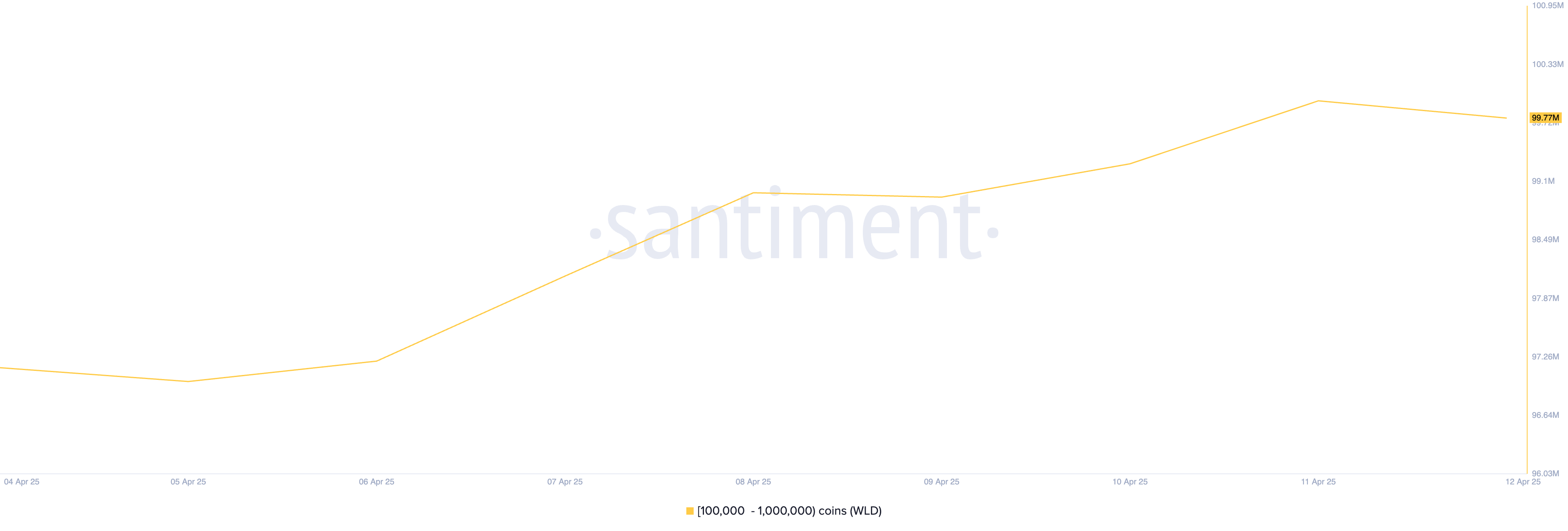

Worldcoin (WLD)

WLD is another altcoin that has caught whales’ attention this week. The Sam Altman-linked token currently trades at $0.74, shedding 1% of its value over the past week.

During that period, whales holding between 100,000 and 1,000,000 WLD have accumulated 2.63 million tokens valued above $1.94 million.

WLD Supply Distribution. Source: Santiment

WLD Supply Distribution. Source: Santiment

If whale accumulation persists, it could make WLD buck the broader market downtrend to record gains.

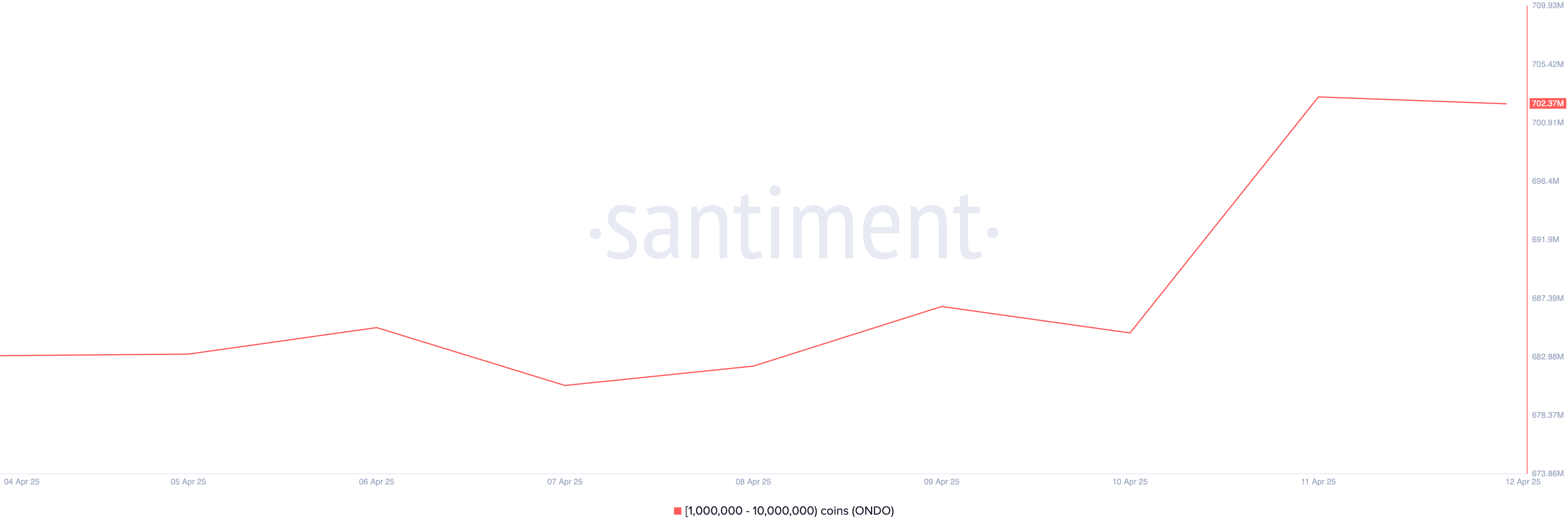

Ondo (ONDO)

The real-world asset-based (RWA) token ONDO is also on this week’s crypto whales’ list. According to Santiment, in the past seven days, whales holding between 1 million and 10 million ONDO have purchased 19.41 million, valued at approximately $17 million.

This cohort of ONDO investors currently holds 702.37 million coins.

ONDO Supply Distribution. Source: Santiment

ONDO Supply Distribution. Source: Santiment

Should this prompt a market-wide ONDO accumulation phase, it could signal the resurgence of interest in RWA-based assets and drive further price momentum in the coming weeks.