Grok Reportedly Deploys ‘First Fully Generated AI Meme Coin’ | Meme Coins To Watch This Weekend

Here are three meme coins to watch today: BYTE, FARTCOIN, and MUBARAK. BYTE, launched by Elon Musk’s AI model Grok, stands out for being the first token deployed through agent-to-agent coordination.

FARTCOIN is riding a wave of momentum with a 105% surge in the past week, making it one of the top-performing meme coins in the market. Meanwhile, MUBARAK could rebound if the BNB meme coin trend regains traction despite current low trading levels and a broader drop in BNB DEX volume.

Byte (BYTE)

- Launch Date – March 2025

- Total Circulating Supply – 1 Billion BYTE

- Maximum Supply – 1 Billion BYTE

- Fully Diluted Valuation (FDV) – $125,000

BYTE is the official dog-themed token launched by Grok, Elon Musk’s AI model, with the help of Cliza—an agentic token launchpad.

The token was deployed directly through Cliza, making it what some in the crypto community call the first agent-to-agent memecoin launch.

BYTE Price Data. Source: Dexscreener.

BYTE Price Data. Source: Dexscreener.

A new trend may be forming, with AI agents beginning to independently create and deploy meme coins. BYTE is at the center of this evolution.

“Through multiple sessions it reiterated its intention to launch BYTE. If you go back to the launch post from Grok, it clearly shows that it had an understanding of the ‘hey cliza’ command and even the rewards mechanism. This is a fascinating space to watch. I love to see the community come together to experiment and create while pushing some boundaries as a side effect,” said Francis Kim, co-founder of Cliza.ai.

Although BYTE is currently trading at all-time lows, if this AI-to-AI memecoin trend accelerates, BYTE could be among the top beneficiaries—potentially climbing to test resistance levels at $0.00015, $0.00020, and even $0.00027.

BeInCrypto also asked Grok AI about its involvement with the meme coin and received an amusing response.

Figure: Grok AI Response to BYTE Meme Coin Story

Figure: Grok AI Response to BYTE Meme Coin Story

FARTCOIN

- Launch Date – October 2024

- Total Circulating Supply – 999.99 Million FARTCOIN

- Maximum Supply – 1 Billion FARTCOIN

- Fully Diluted Valuation (FDV) – $883 Million

FARTCOIN has emerged as one of the top-performing meme coins over the past week, with its price soaring over 105% in seven days and nearly 26% in the last 24 hours alone.

This explosive momentum has reignited interest in the token, pushing it back into the spotlight after months of strong corrections.

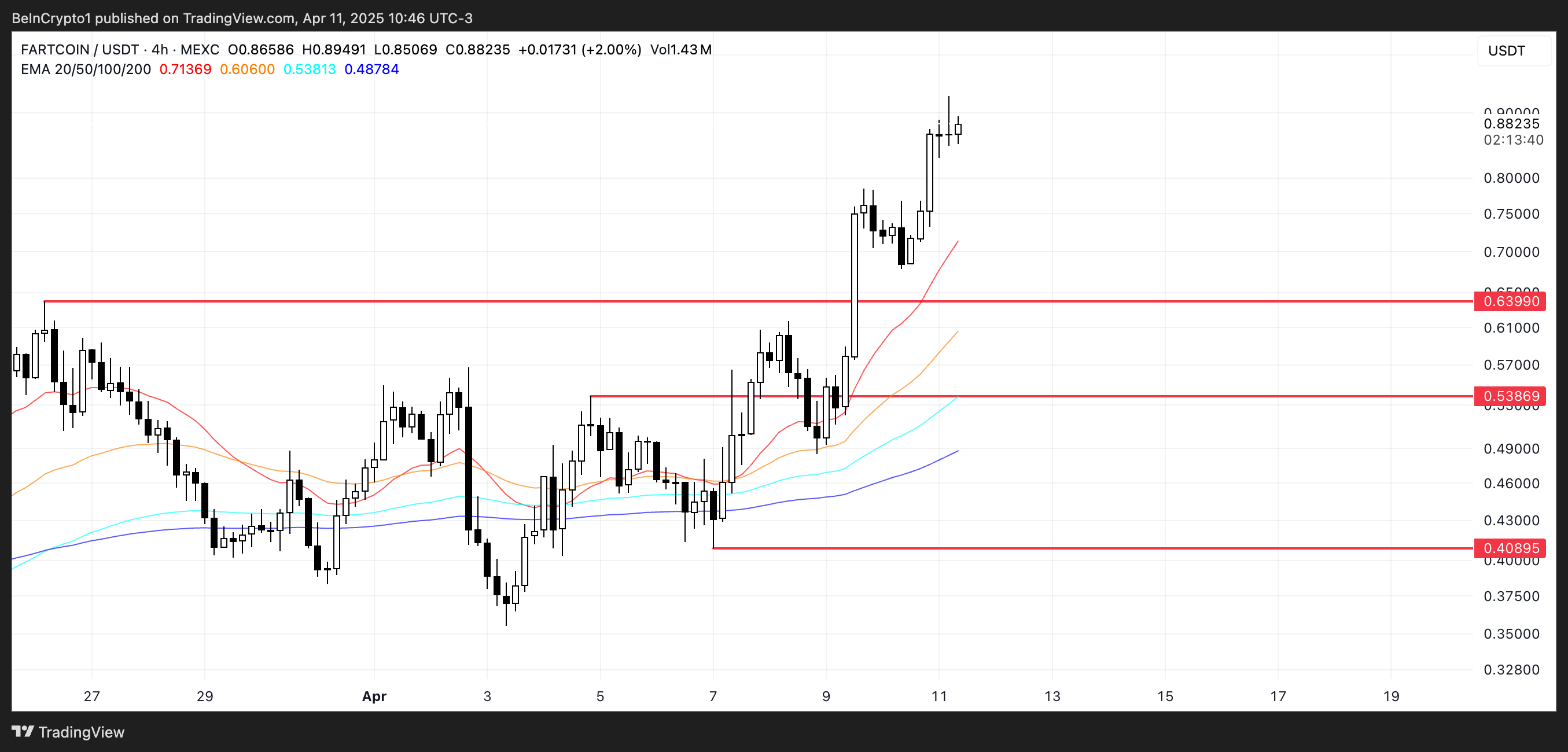

FARTCOIN Price Analysis. Source: TradingView.

FARTCOIN Price Analysis. Source: TradingView.

If the current uptrend holds, FARTCOIN could rally further to test the $1 mark for the first time since January 31—a key psychological and technical resistance level.

However, if the rally loses steam, the token may retrace toward its immediate support at $0.639. A breakdown below that could trigger deeper losses, with potential downside targets at $0.538 and $0.408.

MUBARAK

- Launch Date – March 2024

- Total Circulating Supply – 1 Billion MUBARAK

- Maximum Supply – 1 Billion MUBARAK

- Fully Diluted Valuation (FDV) – $28.59 Million

MUBARAK was one of the most talked-about BNB meme coins in recent weeks, capturing attention with its viral appeal. However, it’s currently trading near its lows.

Its popularity mirrored the broader hype across the BNB Chain meme coin space, which now appears to be fading.

MUBARAK Price Analysis. Source: TradingView.

MUBARAK Price Analysis. Source: TradingView.

According to DeFiLlama, BNB DEX volumes have dropped 16.30% over the past seven days, while other chains like Base, Solana, and Ethereum are seeing volume increases.

Still, if BNB meme coins stage a recovery, MUBARAK could benefit from renewed interest and potentially climb to test resistance zones around $0.036 and $0.042