$790M liquidation in BTC ahead? Here’s how Bitcoin price could react to China’s 34% tariffs on US imports

- China announces 34% retaliatory tariffs on US imports taking effect on April 10 barely 48 hours after Trump’s reciprocal tariff announcements.

- Bitcoin price remains on the back foot, correcting to near $82,000 on Friday with $91 million in BTC long positions liquidated in the last 24 hours.

- Liquidation map data shows bulls traders risk losing another $793.4 million if the BTC price plunges below the $81,000 mark.

Bitcoin (BTC) price plunged as low as $81,600 on Friday, facing renewed downside pressure as China retaliated against the United States (US) with steep import tariffs, heightening market uncertainty.

China retaliates with 34% tariffs as US trade war escalates, impacting Bitcoin market

On Friday, China imposed 34% reciprocal tariffs on US imports, intensifying global economic tensions. China's retaliatory measures come barely 48 hours after President Donald Trump levied 34% tariffs on Chinese goods, during the Liberation day speech on Wednesday.

The move amplifies fears of a prolonged trade war, sending shockwaves across financial markets, including Bitcoin and the broader cryptocurrency sector.

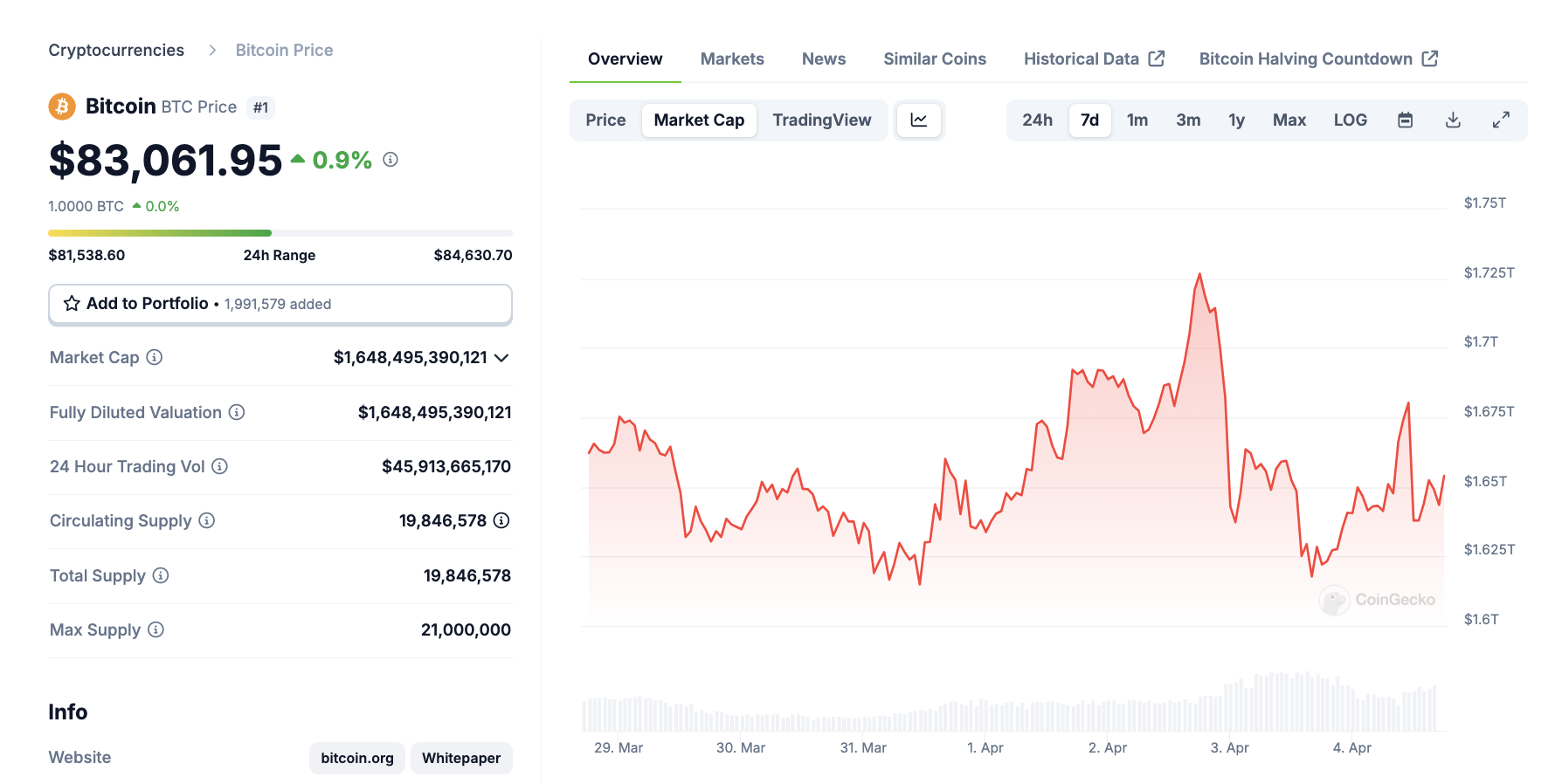

Bitcoin price action after China announced retaliatory tariffs on US, April 4 | Source: Coingecko

Bitcoin price has been on the backfoot this week, struggling to hold above the $82,000 support level.

According to Coinmarketcap data, China’s tariff announcement triggered another downswing as BTC price tumbled as low as $81,600, before rebounding towards the $83,200 mark at press time.

Bull traders must defend $81,000 support to avoid $793 million liquidations

While traders weigh the impact of the latest geo-political developments surrounding the US trade war, BTC derivatives market data trends suggest many bull traders holding BTC positions around the current prices are highly-leveraged.

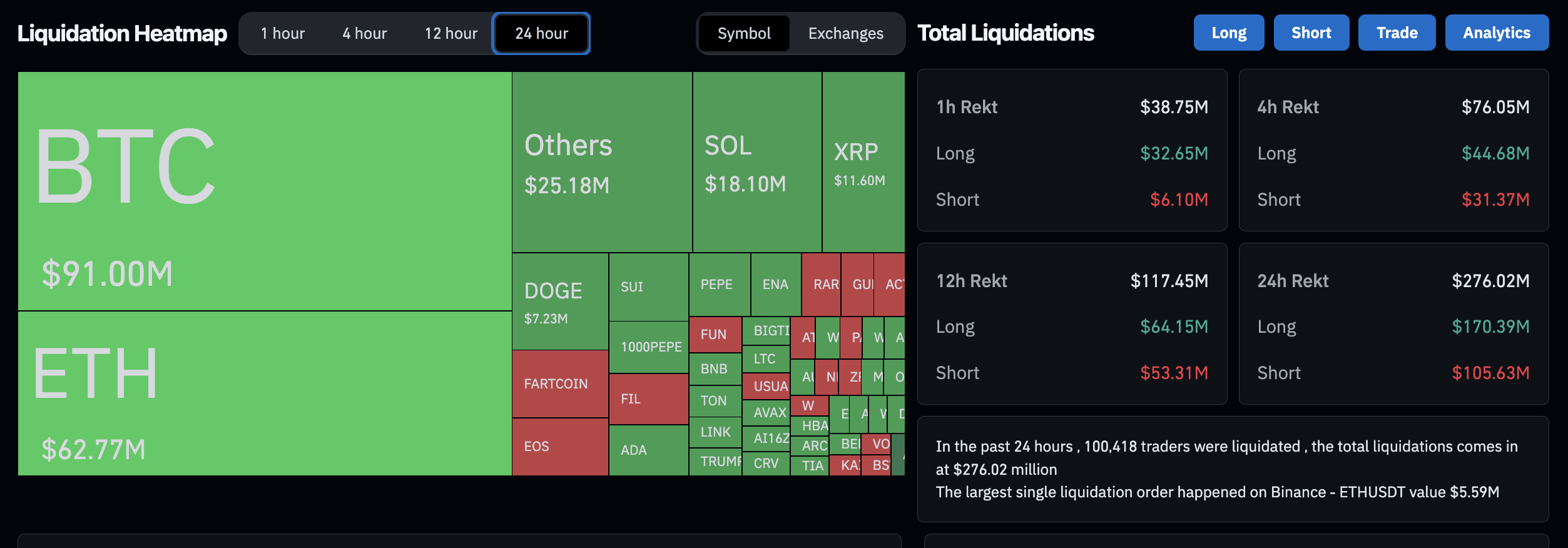

Crypto market liquidations | Source: Coinglass

At first glance, Coinglass data shows that BTC long positions worth $91 million have been liquidated in the last 24 hours as panic sellers executed early exits after Trump’s tariff announcements.

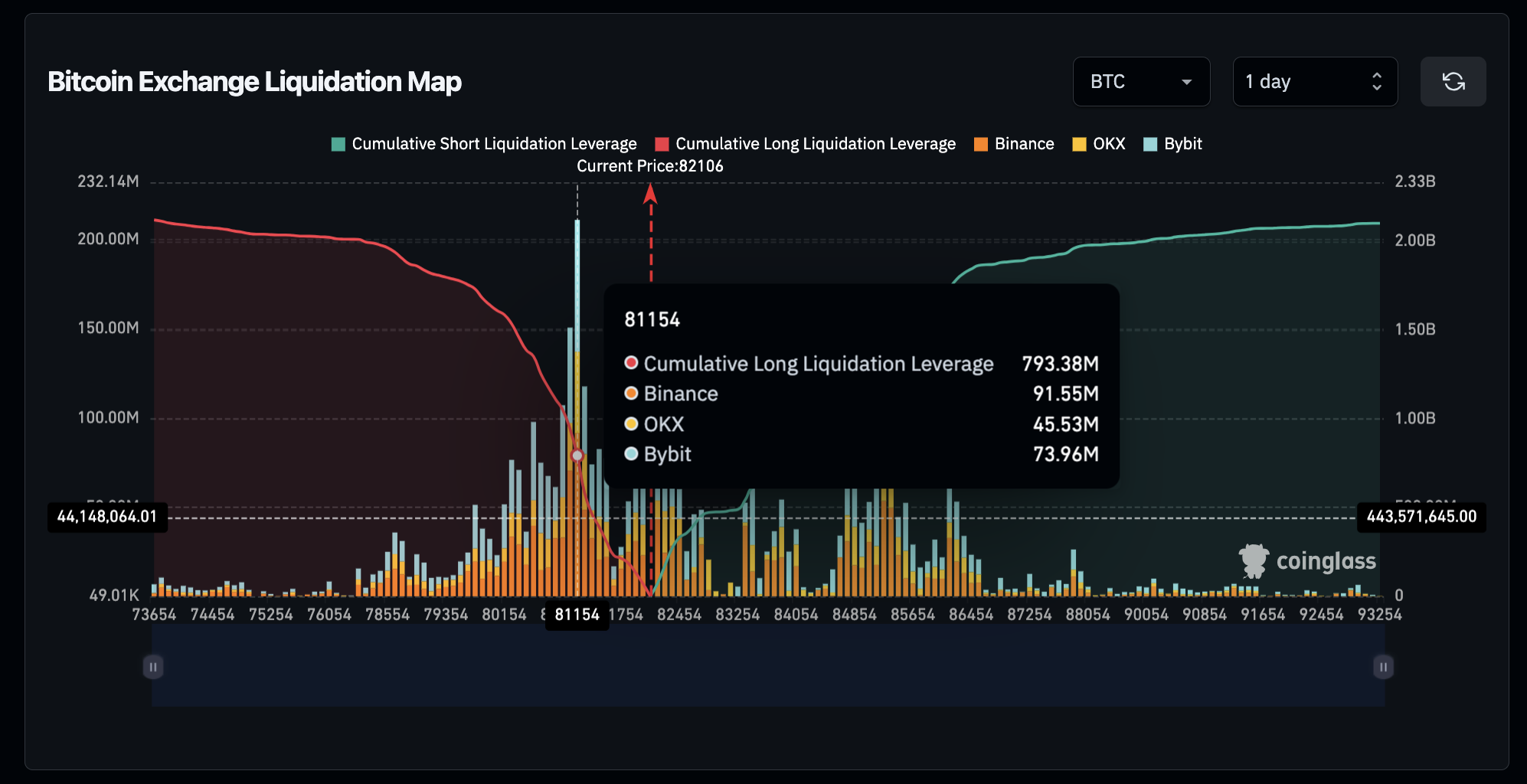

But digging deeper into liquidation map data, Bitcoin traders face a much larger wave of losses if BTC falls below the critical $81,000 support level. As shown below, approximately $793.4 million worth of BTC long positions are clustered around $81,100.

Bitcoin Liquidation Map | Source: Coinglass

Essentially, the investors holding BTC positions around this level are now incentivized to avoid further downswings.

This may explain why BTC price has consistently attracted rapid buying support each time prices fell below $82,000 this week.

Is BTC decoupling from US stocks?

Notably, the Bitcoin price has managed to close above $82,000 each day of trading this week, despite cascading liquidations and intense bearish sentiment from the US trade war.

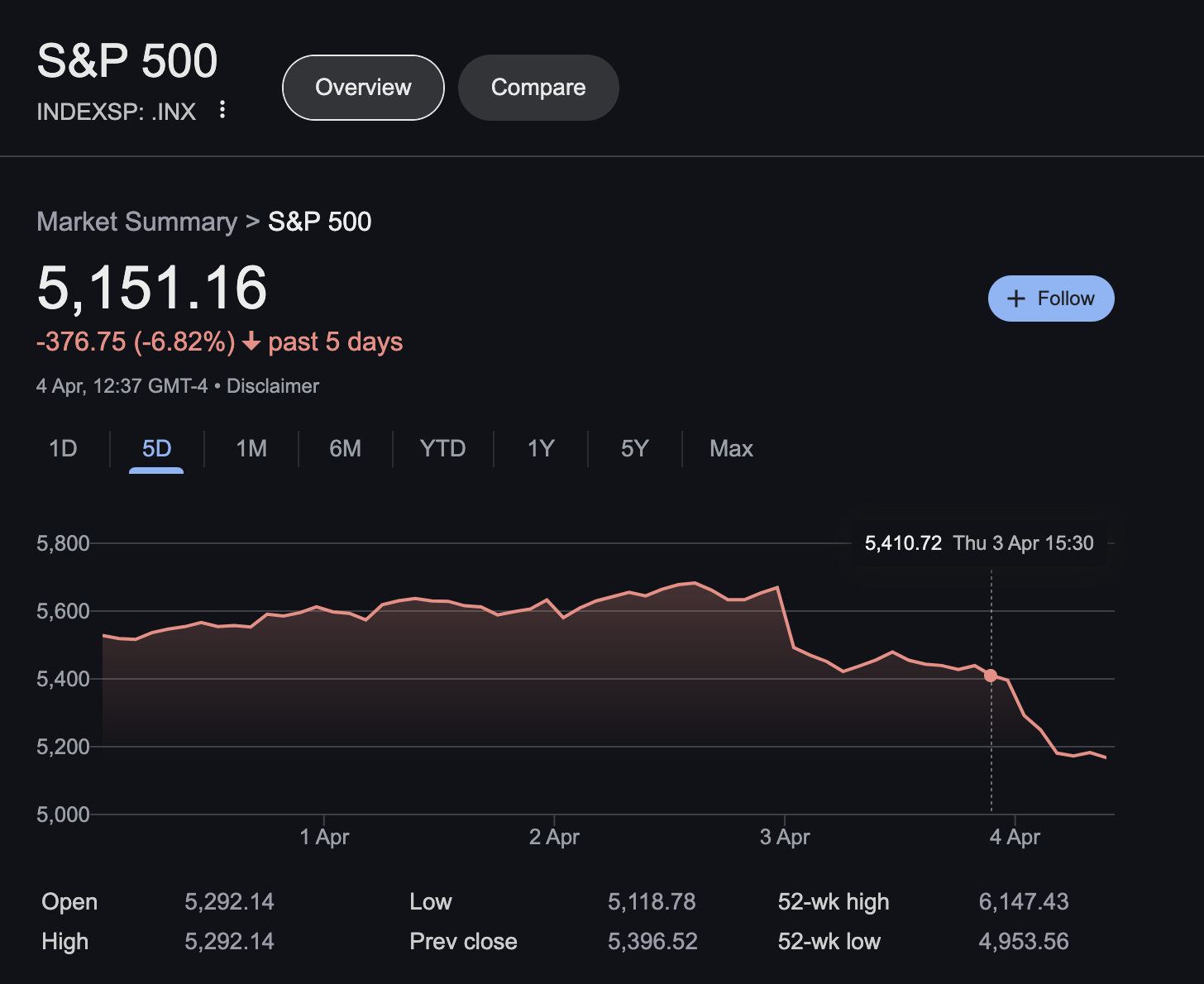

For context, the S&P 500 has plunged 6%, setting lower closing values the last two days of trading.

S&P 500 Performance, April 4 | Source: Nasdaq

If Bitcoin’s resilience this week persists and decouples from the ongoing US stock crash, BTC could begin to attract hedge demand from investors seeking “flight-to-safety” plays to mitigate trade war exposure risks currently searing across the US stock markets.

If this scenario plays out, Bitcoin price will likely form a local bottom above the $81,200 mark, as the demand from hedge traders could create a dual catalyst with the existing buying pressure from traders looking to avert the looming $790 million liquidation risks in the derivatives markets.