Dogecoin price could rally 7% eyes comeback to $0.10 while sentiment among traders remains negative

- Dogecoin is likely experiencing an expansion of its network with a steady increase in new DOGE wallet addresses.

- Rising network activity supports a bullish thesis for DOGE price recovery.

- Dogecoin price could rally 7%, and surpass resistance at $0.1061 in the current uptrend.

Dogecoin noted spikes in its daily active addresses on December 14, 19 and in the past week. This increase supports a bullish thesis for DOGE price recovery. The meme coin is likely to surpass its resistance and rally towards the $0.1118 level, previously seen in December 2022.

Also read: Four altcoins most likely to bounce during Christmas holidays: LTC, STORJ, ILV, DYDX

Dogecoin on-chain metrics support DOGE price recovery thesis

According to Santiment data, active addresses and volume of DOGE climbed between December 14 and 24. This supports a bullish outlook on the meme coin.

%20[11.45.36,%2024%20Dec,%202023]-638389964644759525.png)

DOGE active addresses and volume. Source: Santiment

The weighted sentiment among market participants remained negative on Sunday, while the count of daily active addresses increased.

%20[11.06.50,%2024%20Dec,%202023]-638389965023879750.png)

Weighted sentiment and price. Source: Santiment

IntoTheBlock data reveals 110,540 new addresses were created on December 23. DOGE added 31.35% new addresses in the past week. The increase in addresses supports the thesis of an upcoming recovery in the asset. New addresses signal increase in demand for the meme coin among market participants.

DOGE price eyes 7% rally

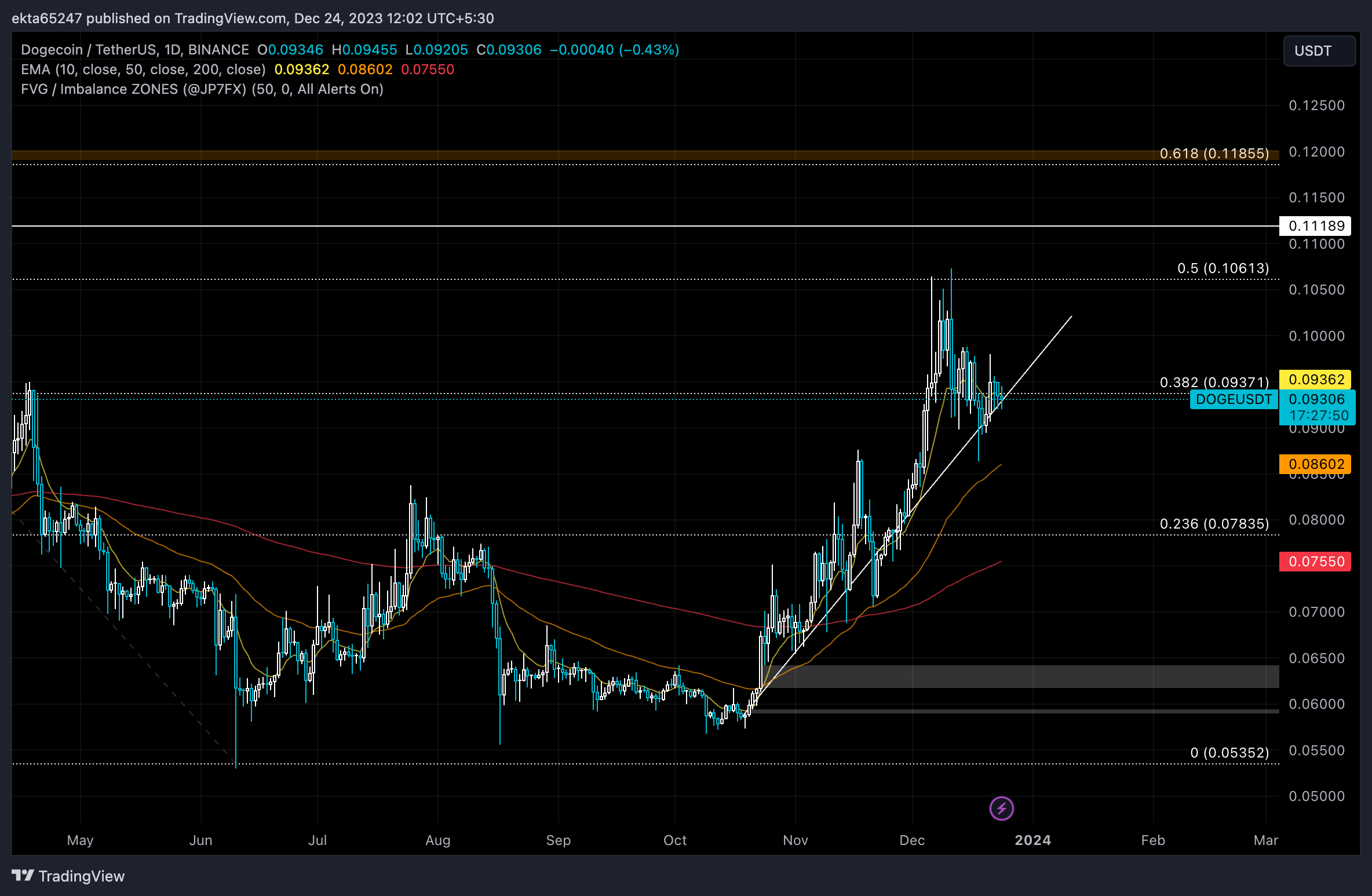

Dogecoin price is currently in an uptrend that started on October 18, 2023. DOGE price is above its 50 and 200-day Exponential Moving Averages at $0.0860 and $0.0754. The meme coin faces two resistances in its path to $0.1118, at the 38.2% and 50% Fib level of the decline from November 2022 top of $0.1587 to the June 2023 low of $0.0535.

DOGE/USDT 1-day chart

At the time of writing, DOGE price is $0.0930 on Binance.