Blast gears up for February 29 mainnet launch, crosses $2 billion TVL

- Blast, an extension of the Blur NFT marketplace, has over 150,000 community members.

- Blast’s Total Value Locked reached $2 billion ahead of its February 29 mainnet launch.

- BLUR price notes a slight decline on Tuesday in a sell-the-news move by holders.

Blast, a project designed to support Blur with Layer 2 solutions, is close to its mainnet launch on February 29. Market participants have locked over $2 billion in crypto assets in Blast’s bridge to earn yield and Blast points.

Also read: Blast Layer 2 locks users’ $568 million for three months, drawing criticism from Paradigm

Blast prepares for mainnet launch on February 29

Blast, an Ethereum Layer 2 chain that was designed to support the Blur NFT marketplace, is ready for its mainnet launch on Thursday, February 29. The chain was designed to boost both platforms.

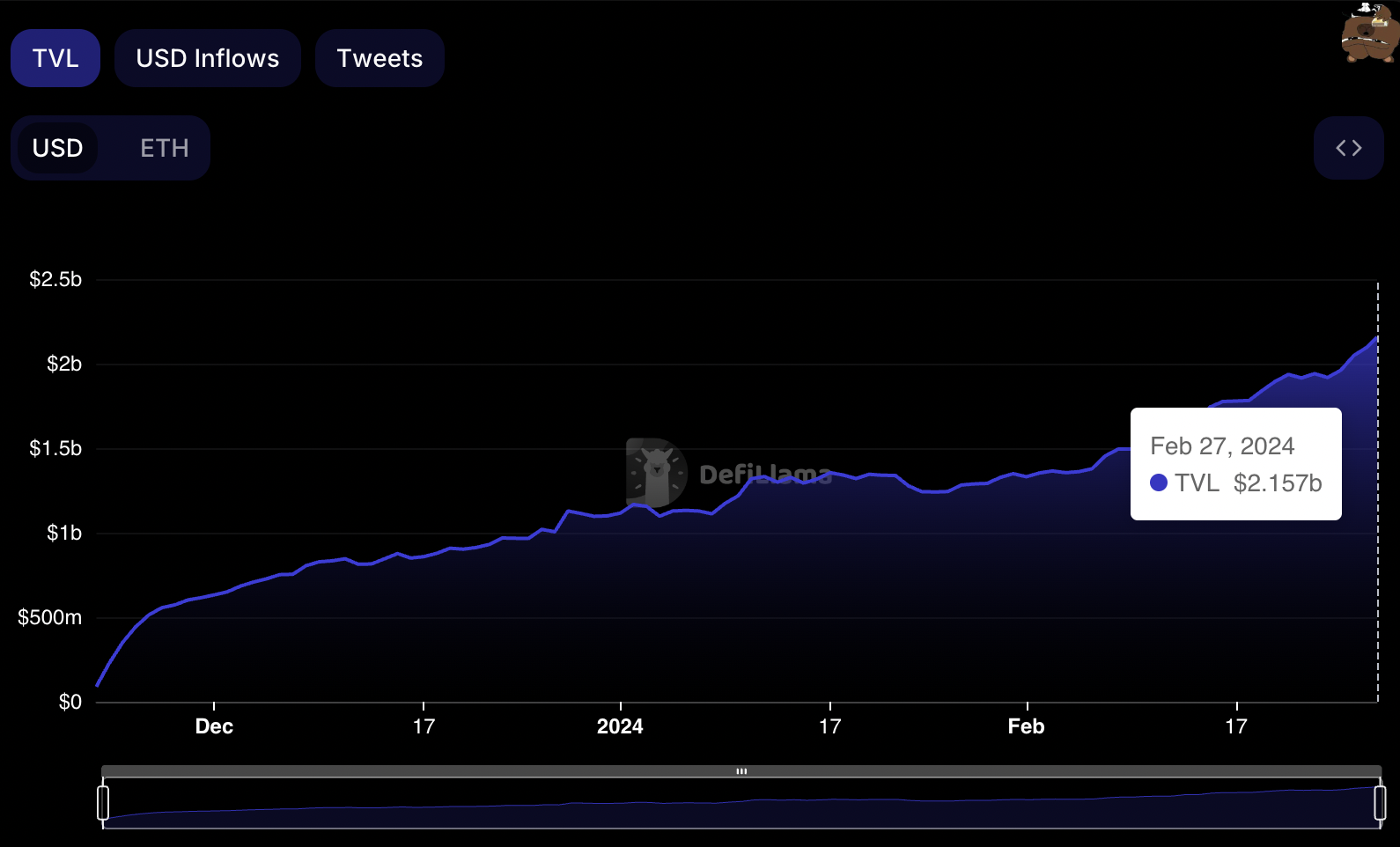

Between November 2023 and February 2024, Blast has secured over $2 billion in TVL from assets sent by market participants to Blast’s bridge. According to data from DeFiLlama, Blast’s TVL is $2.157 billion on February 27.

Blast TVL as seen on DeFiLlama. Source: DeFiLlama

The Blast community has 157,638 members who are earning yield and points. Blast’s program offered Blast Points to users for staking their assets and for referring new users. The staked assets were to remain locked until mainnet launch in February 2024.

Some crypto experts criticized the project for its “pyramid scheme-like” marketing program. However, so far, the project has kept up its schedule, and it is ready to release its mainnet as planned on February 29.

BLUR, the token of the NFT marketplace, price dipped nearly 5% in the past week, leading up to Blast mainnet release. The mainnet release could turn out to be a “sell-the-news” event and see BLUR holders shed their asset holdings closer to the event and immediately after. This could push BLUR price lower.

At the time of writing, BLUR price is $0.7425.