Bitcoin Falls from the Shadows: Privacy Coins Now Dominate Dark Web Transactions

Bitcoin was once considered the dominant currency in illicit transactions. However, it is now being replaced by privacy-focused cryptocurrencies like Monero (XMR), Zcash (ZEC), Dash, and stablecoins.

The primary reason for Bitcoin’s decline in illegal activities is its transparency.

Reasons for the Shift from Bitcoin to Privacy Coins

Bitcoin (BTC) once dominated illicit activities on the Dark Web, such as Nucleus Marketplace or Brian’s Club. The report from TRM Labs indicated that Bitcoin accounted for 97% of the total cryptocurrency volume associated with illegal activities in 2016.

However, by 2022, this figure had dropped sharply to just 19%, indicating a significant shift toward other cryptocurrencies.

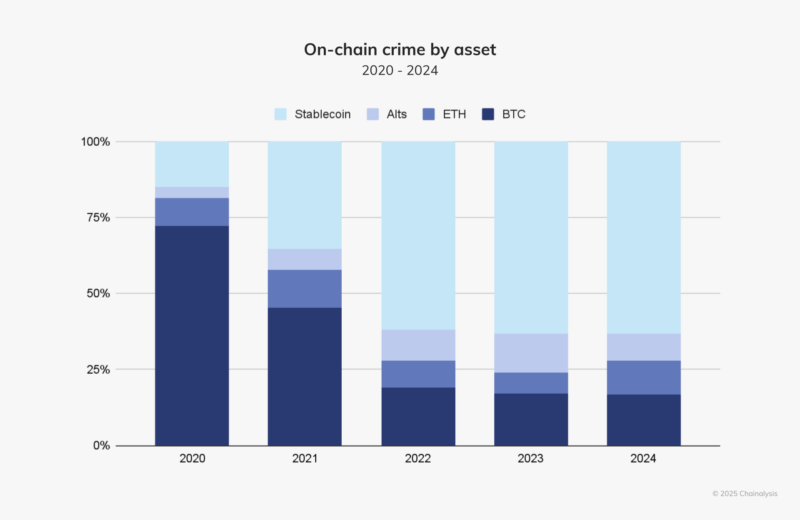

According to the TRM Labs’ report, illegal cryptocurrency activities involving Bitcoin will drop to just 12% by 2024. Tron (TRX) holds the top position with 58%. In another report from Chainalysis, stablecoins now account for the majority of total illicit transaction volume at 63%. The use of Bitcoin in illegal activities also recorded a significant decline.

Stablecoins gained 63% of illicit trading activity by 2024. Source: Chainalysis

Stablecoins gained 63% of illicit trading activity by 2024. Source: Chainalysis

White House Market, one of the largest Dark Web marketplaces, stopped accepting Bitcoin and exclusively used Monero (XMR) for transactions in 2020.

“The Bitcoin workaround was supposed to be there just to help with transition to XMR and as we are concerned, it’s done, therefore we are now Monero only, just as planned,” stated White House Market.

Elliptic researchers uncovered $11 billion in illicit trades using USDT on Cambodia’s Huione Guarantee marketplace in July 2024. Japanese law enforcement tracked Monero, marking the country’s first arrest linked to Monero transaction analysis.

The decision was driven by Bitcoin’s limitations, particularly its blockchain transparency. This move reflected a strategic shift in Dark Web markets and highlighted the rise of privacy coins like Monero, which are designed to provide enhanced anonymity.

The Popularity of Privacy Coins on the Dark Web

The decline of Bitcoin in illegal activities is not coincidental but rather stems from its inherent limitations. First and foremost, Bitcoin’s blockchain is a public ledger. When combined with additional data such as IP addresses or exchange records, every transaction can be tracked.

This transparency has enabled law enforcement agencies like the FBI to use blockchain analytics tools from Chainalysis and Elliptic to dismantle major Dark Web markets. Examples include the Silk Road shutdown in 2013, AlphaBay in 2017, Hydra in 2022, and Incognito Market in 2024.

Additionally, Bitcoin faces technical challenges, including high transaction fees and slow confirmation times. In contrast, privacy coins like Monero, Zcash, and Dash leverage advanced technologies to ensure high levels of anonymity, making transaction tracking extremely difficult. The Research from ScienceDirect suggests that privacy coins are closely linked to Dark Web traffic, further increasing their popularity in illicit markets.

The Two Sides of the Shift to Privacy Coins

On the positive side, Bitcoin’s declining role in illegal activities may improve its reputation as a legitimate financial tool. This could lead to wider acceptance and attract more users and investors.

However, the shift from Bitcoin to privacy coins and stablecoins has made it more challenging for law enforcement agencies to track and prevent illegal transactions. Despite advanced blockchain analytics tools that can detect transaction trails through mixers and tumblers, dealing with Monero and other privacy coins remains a significant challenge.

Global regulators are increasingly scrutinizing privacy coins and stablecoins. Some countries have outright banned privacy coins, while stablecoins are subjected to stricter oversight.

The transition from Bitcoin to privacy coins and stablecoins on the Dark Web is a clear trend, driven by the growing demand for anonymity and efficiency in illicit transactions. While Bitcoin still plays a role in certain crypto-related crimes, its transparency makes it less attractive to the Dark Web.

Meanwhile, Monero, Zcash, Dash, and stablecoins have become the preferred choices due to their enhanced security and privacy. This trend poses significant challenges for law enforcement agencies while driving advancements in blockchain analytics tools.

However, it also raises concerns about using cryptocurrencies in illegal activities, necessitating a balance between technological innovation and regulatory oversight to ensure transparency and security in the digital financial ecosystem.