Bitcoin Price Approaches 8% Breakout as Holders Signal Reversal

Bitcoin is positioning itself for a potential breakout that could push its price above $91,000. The leading cryptocurrency is currently trading within a symmetrical triangle, signaling a possible bullish move.

However, this rally faces challenges as short-term holders (STHs) adjust their stance while long-term holders (LTHs) contribute to selling pressure.

Bitcoin Holders Are Settling Down

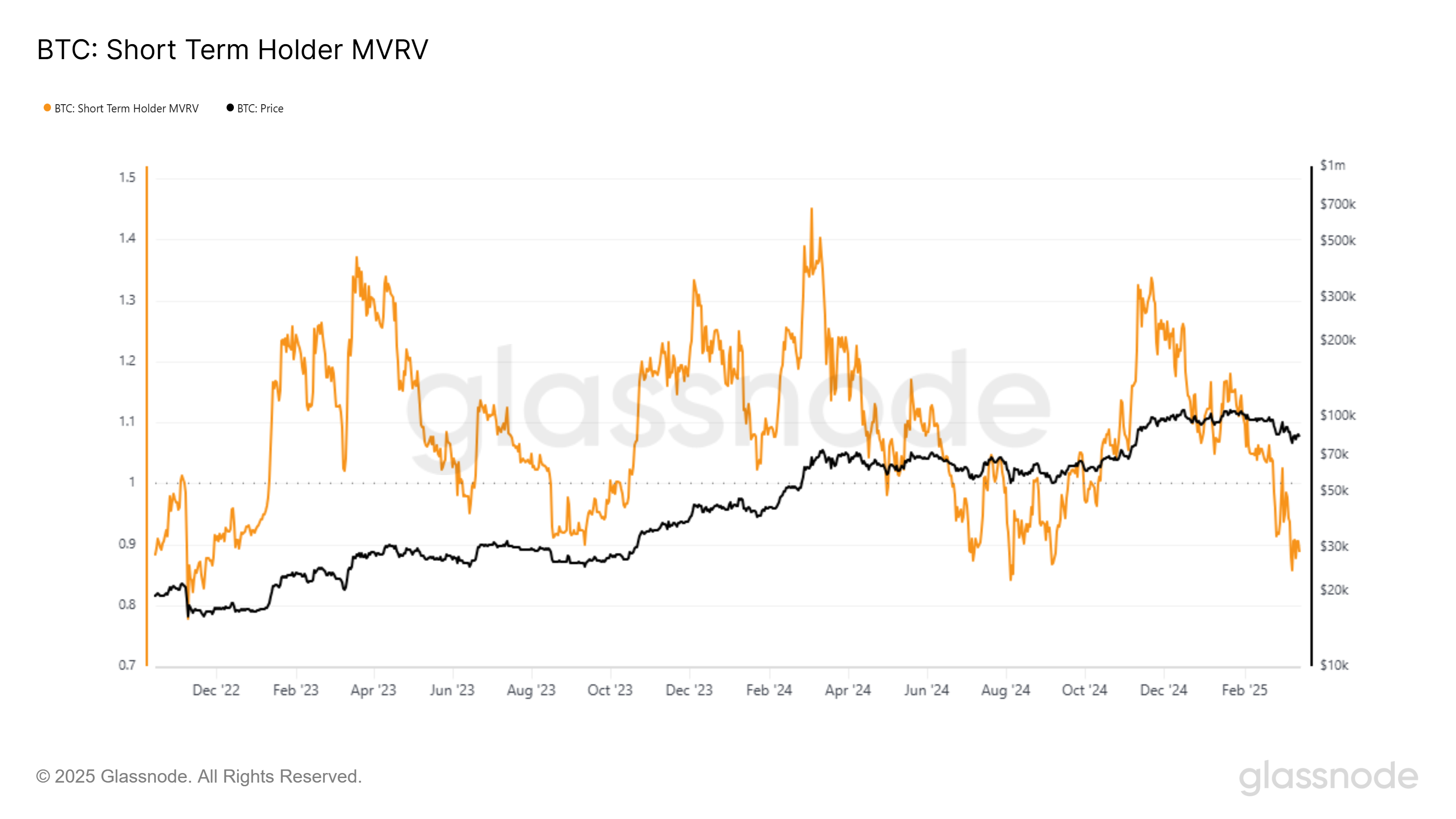

The Short-Term MVRV has fallen below the 0.9 mark, a level historically associated with saturation points for STH selling. This indicator often signals the end of a selling phase and a potential price reversal. If history repeats itself, Bitcoin may soon witness renewed buying pressure, setting the stage for recovery.

Bitcoin has previously shown a pattern of price rebounds when the Short-Term MVRV dips to these levels. If the same trend follows, BTC could gain upward momentum in the short term.

Bitcoin STH MVRV. Source: Glassnode

Bitcoin STH MVRV. Source: Glassnode

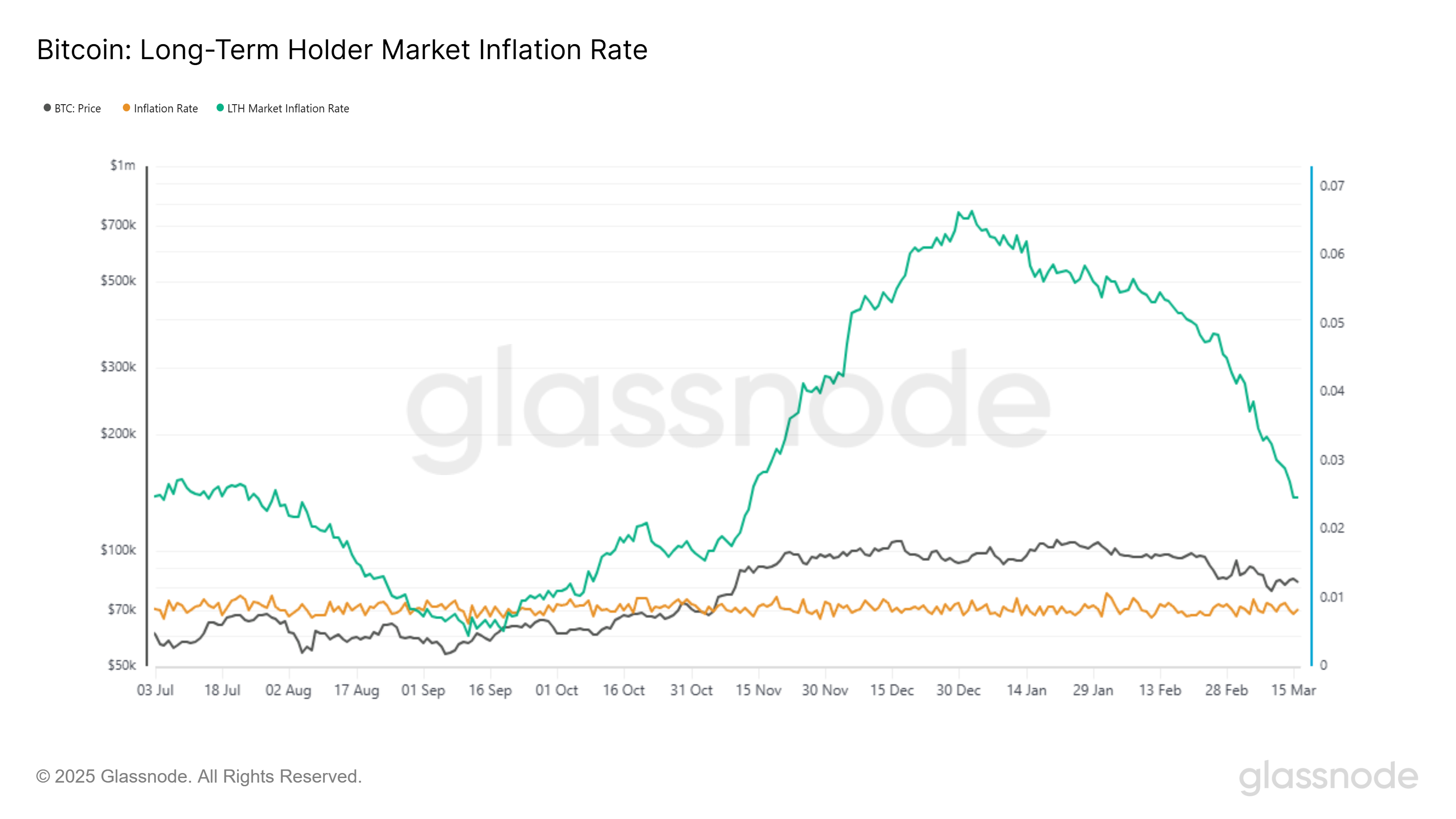

The Long-Term Holder Market Inflation Rate measures the annualized rate of net accumulation or distribution by LTHs relative to miner issuance. Currently, values of 0.025 suggest that LTHs are still adding to sell-side pressure. Although this indicator is noting a downtick, it continues to impact Bitcoin’s price movement.

Once the LTH Market Inflation Rate drops below miner issuance levels (inflation rate at 0.008), the pressure on Bitcoin’s price will likely ease. This shift would allow BTC to gain traction, increasing its chances of breaking through resistance. Until then, the market remains vulnerable to fluctuations driven by LTH selling activity.

Bitcoin LTH Market Inflation Rate. Source: Glassnode

Bitcoin LTH Market Inflation Rate. Source: Glassnode

BTC Price Breakout Ahead

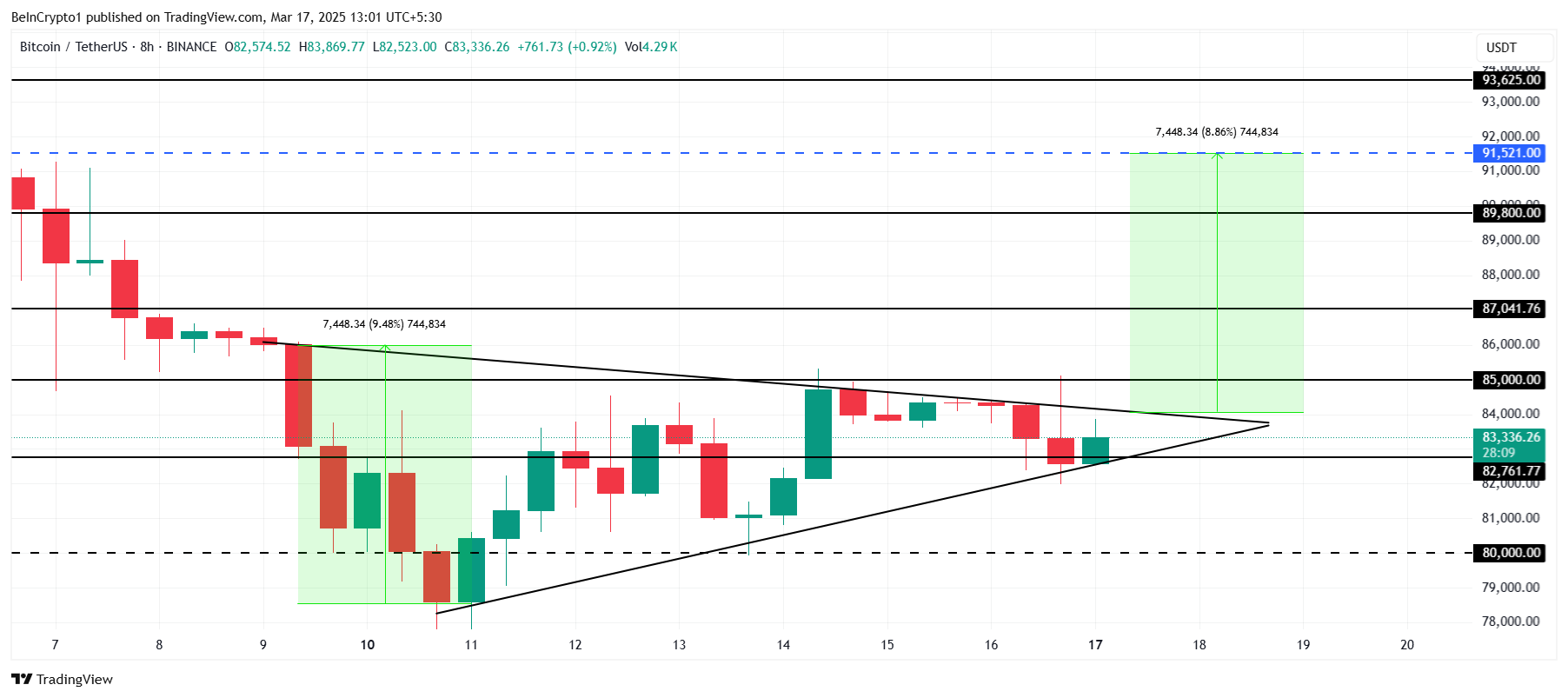

Bitcoin is currently trading at $83,336, holding above the crucial $82,761 support level. The symmetrical triangle pattern suggests a potential 8.8% breakout, indicating a price move that could send BTC higher in the coming days.

The breakout target of $91,521 will only become viable once Bitcoin breaches $85,000 and establishes $87,041 as a support level. Achieving this milestone would bring Bitcoin closer to recovering its recent losses, reinforcing a bullish outlook for the cryptocurrency.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

However, failure to break past $85,000 could result in Bitcoin sliding back to $82,761 or even dropping further to $80,000. This scenario would invalidate the bullish pattern and introduce additional downside risk, delaying any potential recovery in the short term.