Chainlink Price Shows Signs Of Recovery — Why $15 Is The Level To Watch

The Chainlink price has had its fair share of the early-2025 struggles, falling to a new low just above the $12 level earlier this week. The altcoin has had to contend with the widespread bearish pressure and worsening investor sentiment in the general crypto market.

Chainlink Price Overview

On Tuesday, March 11, the Chainlink price succumbed to the market-wide downward pressure that saw the largest cryptocurrency Bitcoin hit $77,000 for the first time in over four months. Other large-cap assets also suffered in this recent market downturn, with the price of Ethereum also dropping beneath $2,000.

The price of Chainlink appears to be recovering well in the past few days, making a play for $15 on Friday, March 14. In a show of strong resurgence, the altcoin ranked as one of the best daily gainers with an almost 10% positive performance on the day.

After initially crossing $14.5 earlier in the day, the Chainlink price has returned to below the psychological $14 level. As of this writing, the price of LINK stands at around $13.83, reflecting an almost 6% increase in the past 24 hours.

This single-day performance, however, was not enough to wipe off the altcoin’s loss on the weekly timeframe. According to data from CoinGecko, the LINK price is down by more than 13% in the past seven days.

Can LINK Price Climb To $16?

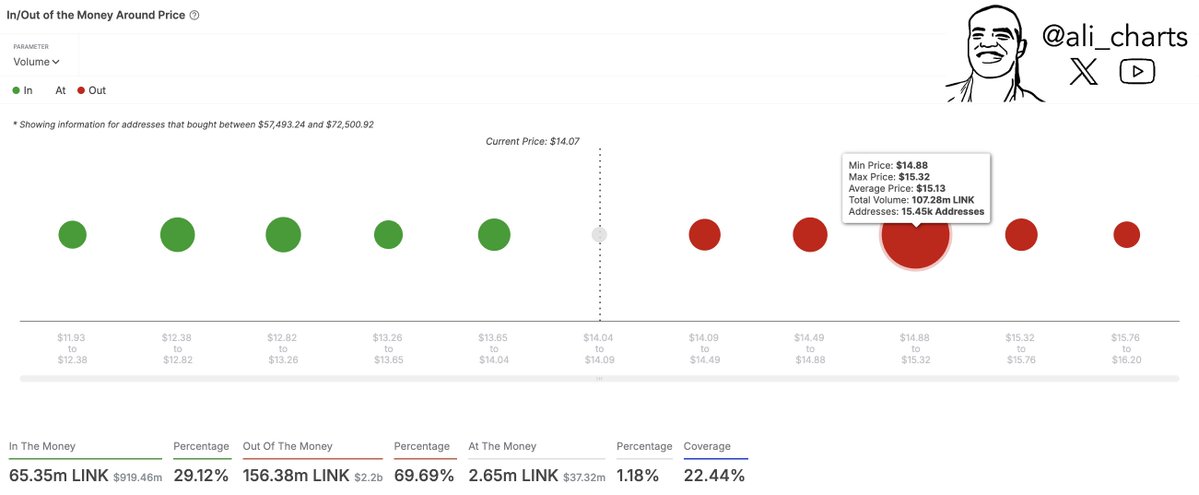

While the fortunes of the Chainlink price do appear to be changing, a particular price level might be crucial to its long-term trajectory. In a post on X, popular crypto analyst Ali Martinez offered insights into crucial on-chain levels for the LINK price.

This analysis revolves around the average cost basis of several LINK investors. In cost-basis analysis, the capacity of a level to serve as support or resistance depends on the total amount of coins last purchased by investors in the region.

As seen in the chart above, the size of the dot represents and directly corresponds to the number of LINK tokens acquired within a price bracket — while reflecting the strength of each level. Based on this analysis, Martinez noted that the Chainlink price faces major resistance around the $14.88 – $15 region where 15,450 investors bought 107.28 million LINK tokens (worth $1.62 billion at an average price of $15.13).

The high investor activity has led to the formation of a supply barrier around the $15.13 region. The Chainlink price is likely to witness significant selling pressure due to investors wanting to sell their tokens after returning to their cost basis, thereby hindering further price increases and leading to price pullback.

However, it is worth noting that no significant resistance levels lie beyond this $15.13 price region. Hence, investors could see the price of LINK climb to as high as $16 should it successfully breach the $15 resistance level.