Ethereum Faces Drop Below $2,000 as ETH/BTC Ratio Plummets to 4-Year Low

Ethereum’s price has plunged over 30% in the past 30 days. This has dragged its performance against Bitcoin (BTC) to its lowest level since January 2021.

As selling pressure intensifies, ETH risks further downside, with key technical indicators pointing to a prolonged bearish trend.

Price Drops to 2023 Levels as ETH/BTC Ratio Hits 4-Year Low

ETH oscillated within a narrow price range for most of February. However, as selloffs strengthened, the coin broke below the lower trend line of this horizontal channel on February 25 and has since been in a downtrend. Currently trading at $2,089, ETH’s value has dropped to levels last seen in December 2023.

This price drop has weakened the ETH/BTC ratio, which is now at its lowest since January 2021. At press time, it is 0.02.

ETH/BTC Ratio. Source: TradingView

ETH/BTC Ratio. Source: TradingView

The ETH/BTC pair represents the ratio between ETH’s and BTC’s price. It measures how much BTC is required to purchase one ETH. If the ratio increases, ETH is outperforming BTC, either because ETH’s price is rising faster or BTC’s price is falling. Conversely, as is the case now, if the ratio decreases, ETH is underperforming in the market.

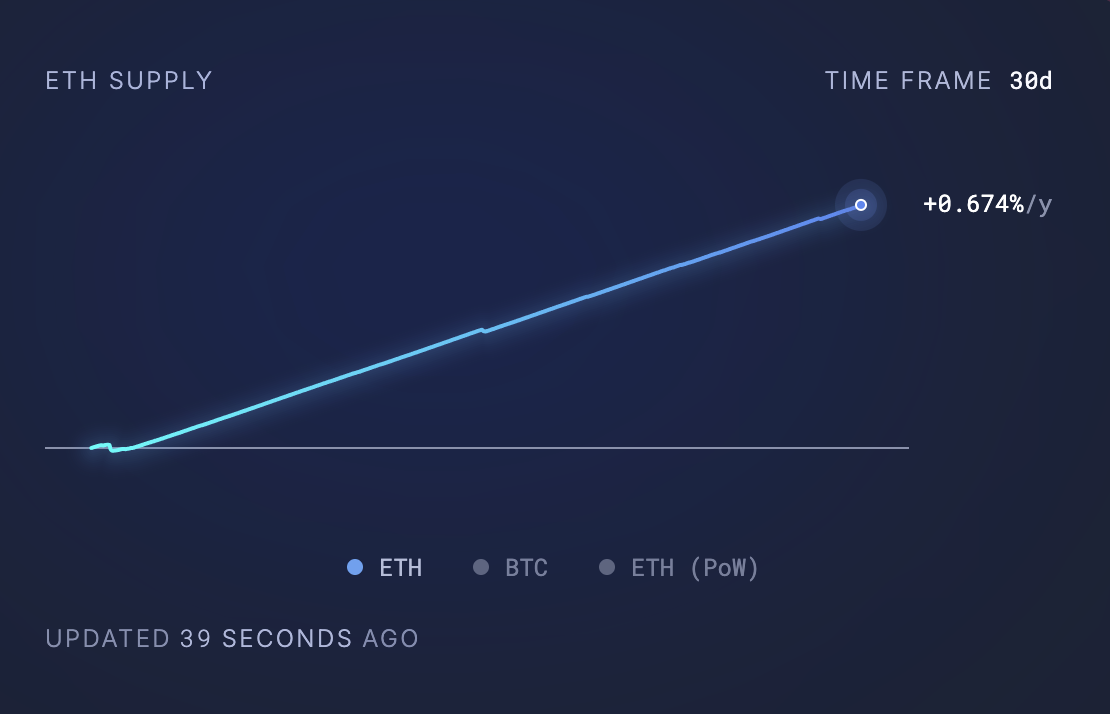

In addition to the broader bearish macro trends, the surge in ETH’s circulating supply due to its reduced burn rate has contributed to the downward pressure on its price.

According to Ultra Sound Money, 66,748.91 ETH coins valued above $140 million at current market prices have been added to the ETH’s circulating supply in the past month.

ETH Supply. Source: Ultra Sound Money

ETH Supply. Source: Ultra Sound Money

When more ETH tokens enter into circulation, the overall supply available for purchase rises. As is the current trend, this typically results in a price dip, especially if the available demand cannot absorb the excess supply.

Will ETH Bears Push Price Below $2,000?

On the daily chart, ETH trades below the lower trend line of its long-term descending parallel channel. When an asset’s price breaks below the lower line of this bearish pattern, it suggests an acceleration in selling momentum.

This raises the risk of further ETH price declines in the short term. In this scenario, its price could break below $2000 and trade at $1,922.

ETH Price Analysis. Source: TradingView

ETH Price Analysis. Source: TradingView

However, if demand for the altcoin resumes, it could cause its price to rally toward $2,223.