ONDO Finance partners with Mastercard: Tokenized Real-World Assets (RWA) to Multi-Token Network (MNT)

- Ondo Finance announces a partnership with Mastercard to bring tokenized Real-World Assets (RWAs) to Mastercard’s Multi-Token Network (MNT).

- This integration will bring Ondo’s OUSG token to MTN, enabling businesses to access the benefits of tokenized treasuries seamlessly.

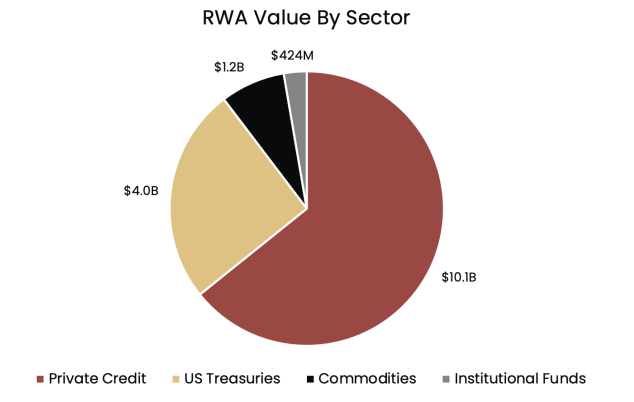

- A K33 research reports that the institutional adoption of the RWA sector is growing, currently sitting at over $15 billion (excluding stablecoins).

Ondo Finance (ONDO) announces a partnership with Mastercard to bring tokenized Real-World Assets (RWAs) to Mastercard’s Multi-Token Network (MNT). This integration will bring Ondo’s Short-Term US Government Treasuries Fund (OUSG) to MTN, enabling businesses to access the benefits of tokenized treasuries seamlessly. Moreover, K33 Research reports that the institutional adoption of the RWA sector is growing, currently sitting at over $15 billion (excluding stablecoins).

Ondo partners with Mastercard

On Wednesday, Ondo Finance announces a partnership with Mastercard to bring tokenized Real-World Assets (RWAs) to Mastercard’s Multi-Token Network (MNT). Mastercard’s MTN will onboard Ondo Finance as its first provider of tokenized RWAs.

“The MTN enables banks to offer digital financial services to integrated businesses, and Ondo’s Short Term US Treasuries Fund (OUSG) will be the first tokenized RWA solution providing businesses onchain with access to daily yield and flexible cash management,” says Ondo on its official social media platform X.

“With the addition of OUSG, MTN is breaking new ground by connecting a private payments network with tokenized assets on public blockchains for the very first time.” says Ondo in its blog post.

It continued by bridging the gap between traditional finance and blockchain technology; this integration offers businesses a way to integrate tokenized treasuries into their operations effortlessly.

Moreover, a K33 Research report on Wednesday highlighted that the institutional adoption of the RWA sector is growing as pioneers in the cross-section of crypto and TradFi seek to improve efficiency, accessibility, and liquidity through RWA architecture.

The report continued with BlackRock leading the charge and regulatory frameworks providing increasingly clear guidance on asset tokenization; RWAs only stand to continue their growth story, currently sitting at over $15 billion (when excluding stablecoins) and US Treasuries like ONDO at $4 billion.

RWA value by sector chart. Source: K33 Research