Crypto Whales Bought These Altcoins in the Third Week of February 2025

Trading activity in the crypto market has picked up this week, with the global cryptocurrency market cap rising by 2% over the past seven days.

Amid this uptick, crypto whales have been actively accumulating select altcoins, including DeFi token Maker (MKR), governance token Lido (LDO), and utility token ApeCoin (APE).

Maker (MKR)

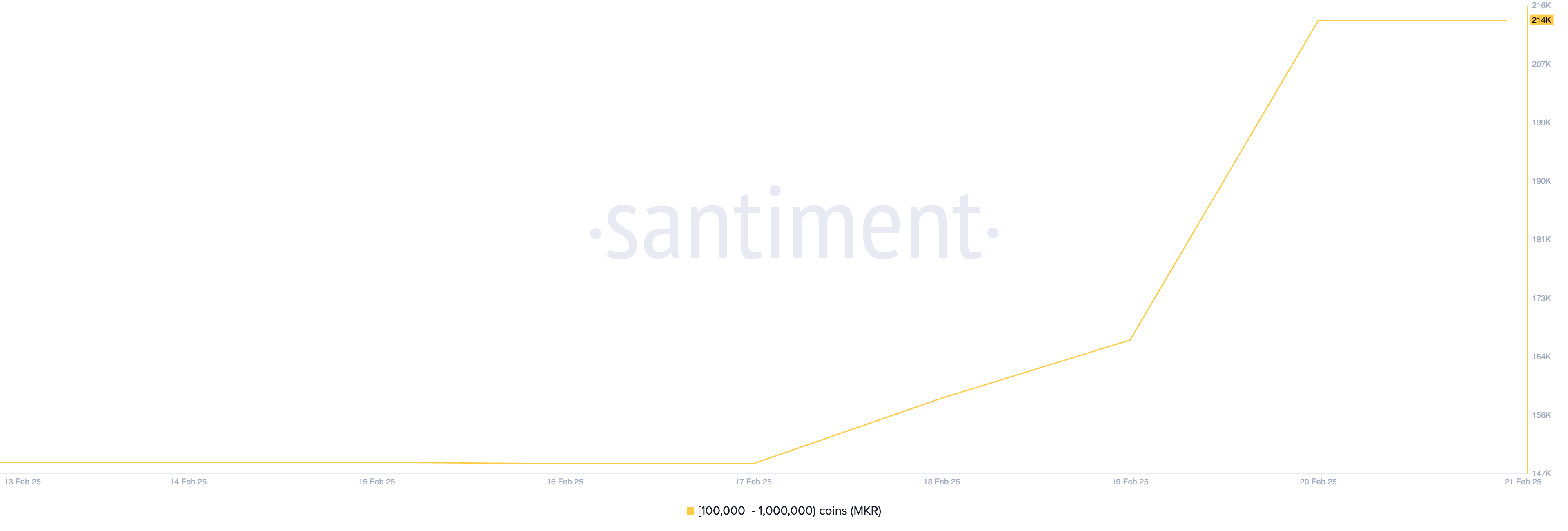

DeFi token MKR has seen increased whale activity this week. This is reflected in the surge in its supply held by whale addresses that hold between 100,000 and 1,000,000 tokens.

MKR Supply Distribution. Source: Santiment

MKR Supply Distribution. Source: Santiment

According to Santiment, this cohort of investors has accumulated 65,000 MKR tokens valued above $92 million at current market prices in the past seven days. At press time, they hold 214,000 MKR, their largest count since April 2023.

MKR currently trades at $1,436. The rise in whale accumulation has pushed its price up by 41% in the past seven days. If this trend persists, MKR could rally to $1,780.

Lido (LDO)

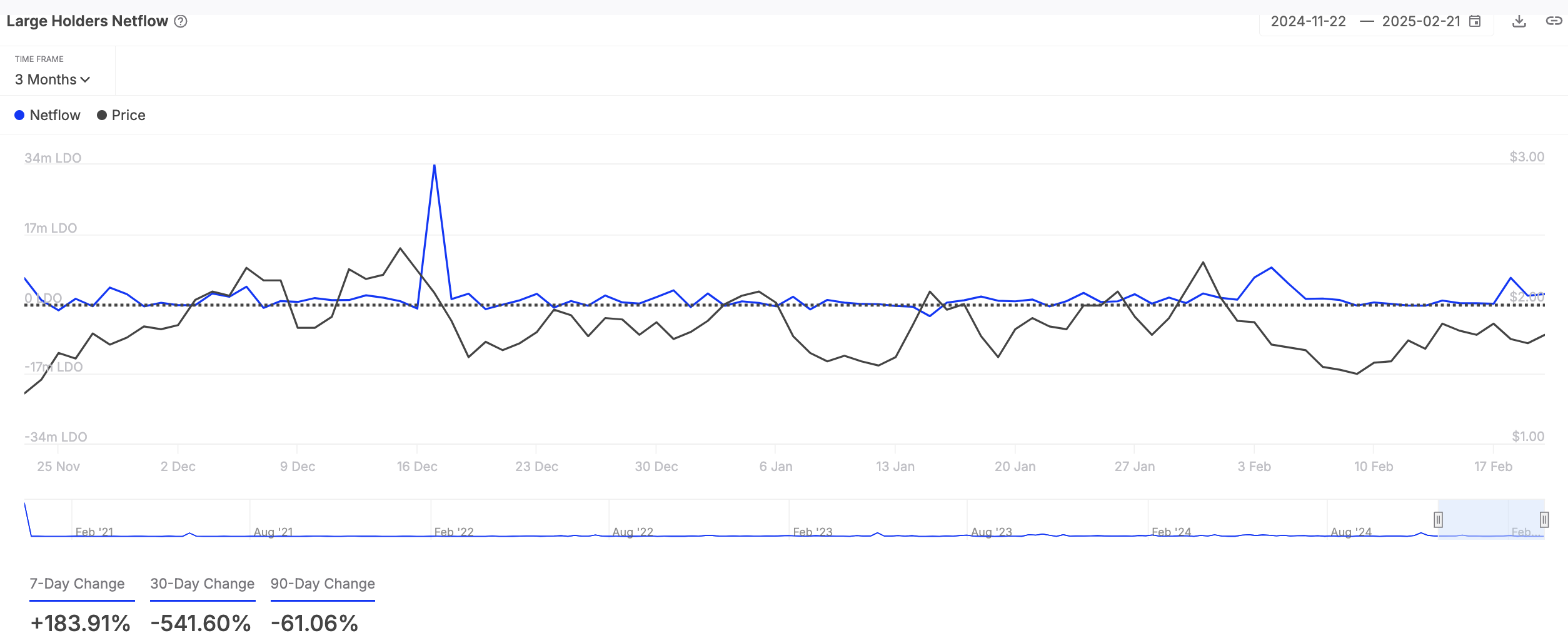

LDO, the governance token of liquid staking protocol Lido, is another altcoin on the whales’ radar this week. Data from IntoTheBlock shows an 184% rise in its large holders’ netflow during the review period.

LDO Large Holders’ Netflow. Source: IntoTheBlock

LDO Large Holders’ Netflow. Source: IntoTheBlock

Large holders are investors who control more than 0.1% of an asset’s circulating supply. Their netflow measures the difference between the coins they buy and sell over a set period.

When an asset’s large holders’ netflow spikes, it signals that major investors are accumulating more coins. This bullish trend could encourage retail traders to follow suit, driving increased demand and putting more upward pressure on the asset’s price.

LDO currently trades at $1.83. If whale accumulation persists, it could push the coin’s price above $2 in the near term.

ApeCoin (APE)

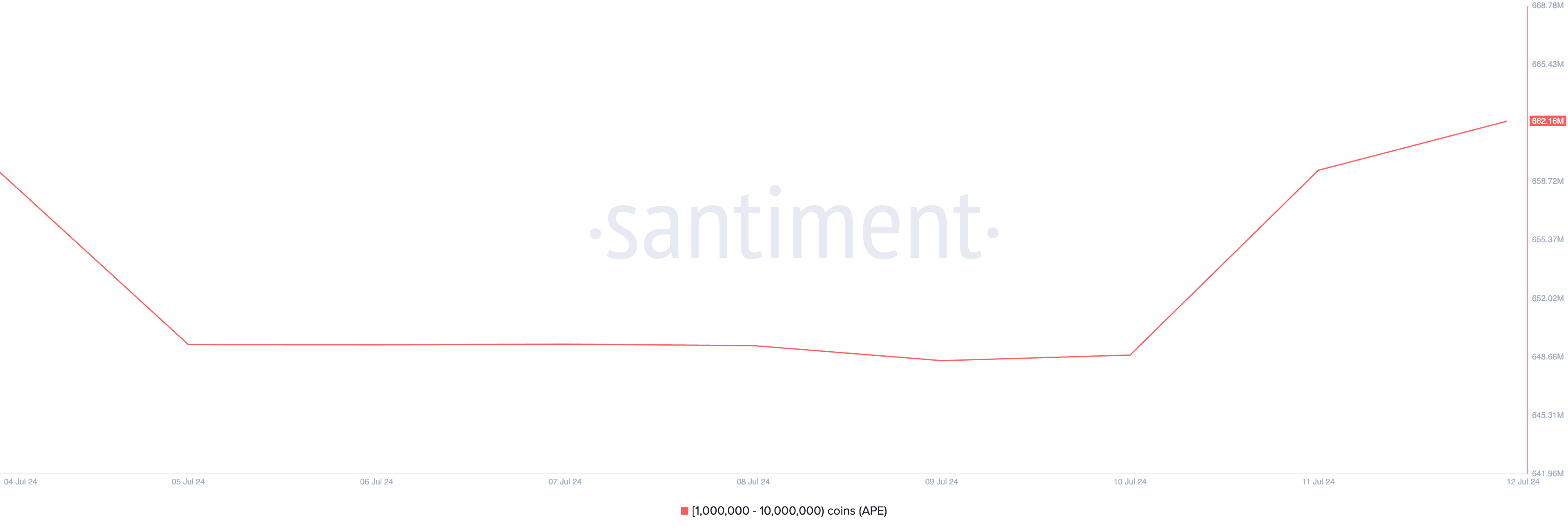

Another altcoin that crypto whales have paid attention to this week is ApeCoin’s utility token APE. It currently trades at $0.740, noting a 9% price uptick in the past 24 hours.

During the period in review, whale addresses holding between 1 million and 10 million tokens have cumulatively acquired 2.93 million APE. As of this writing, this group of APE investors holds 662.16 million tokens out of the circulating supply of 752.65 million.

APE Supply Distribution. Source: Santiment

APE Supply Distribution. Source: Santiment

Whale activity like this often signals strong confidence or strategic positioning ahead of potential price movements. Hence, if APE demand continues to increase, it may push its price toward $0.92.