The success of Elon Musk’s D.O.G.E will send the US economy into a depression

Elon Musk’s government-cutting machine, the Department of Government Efficiency (D.O.G.E), is pushing the US economy into dangerous territory. Within the first two weeks of its existence, D.O.G.E announced it could slash 20% of the annual $1.8 trillion deficit.

And that’s where the problem’s at. You see, when you do the math, you realize that Elon’s planned spending cuts could shrink US GDP by 9.4%, a drop worse than the 2008 recession, and that would be a massive disaster, one that will almost certainly push the economy into a depression.

If Elon’s daily cuts reach $2 billion, inflation could decline, but GDP would collapse. Reducing federal spending by $1.8 trillion in one year would cut GDP by $2.8 trillion, or 9.4%. The Great Recession of 2008 only saw a 4% drop. Millions of jobs (both government and private) would vanish.

Bankruptcies would surge and industries dependent on federal contracts would crumble. The worst-case scenario? A depression larger than anything since the 1930s. But the US has few options left.

If the government keeps spending $2 trillion annually on borrowed money, inflation and debt will continue to spiral. Without that spending, the economy won’t function “normally.” How alarming is that?

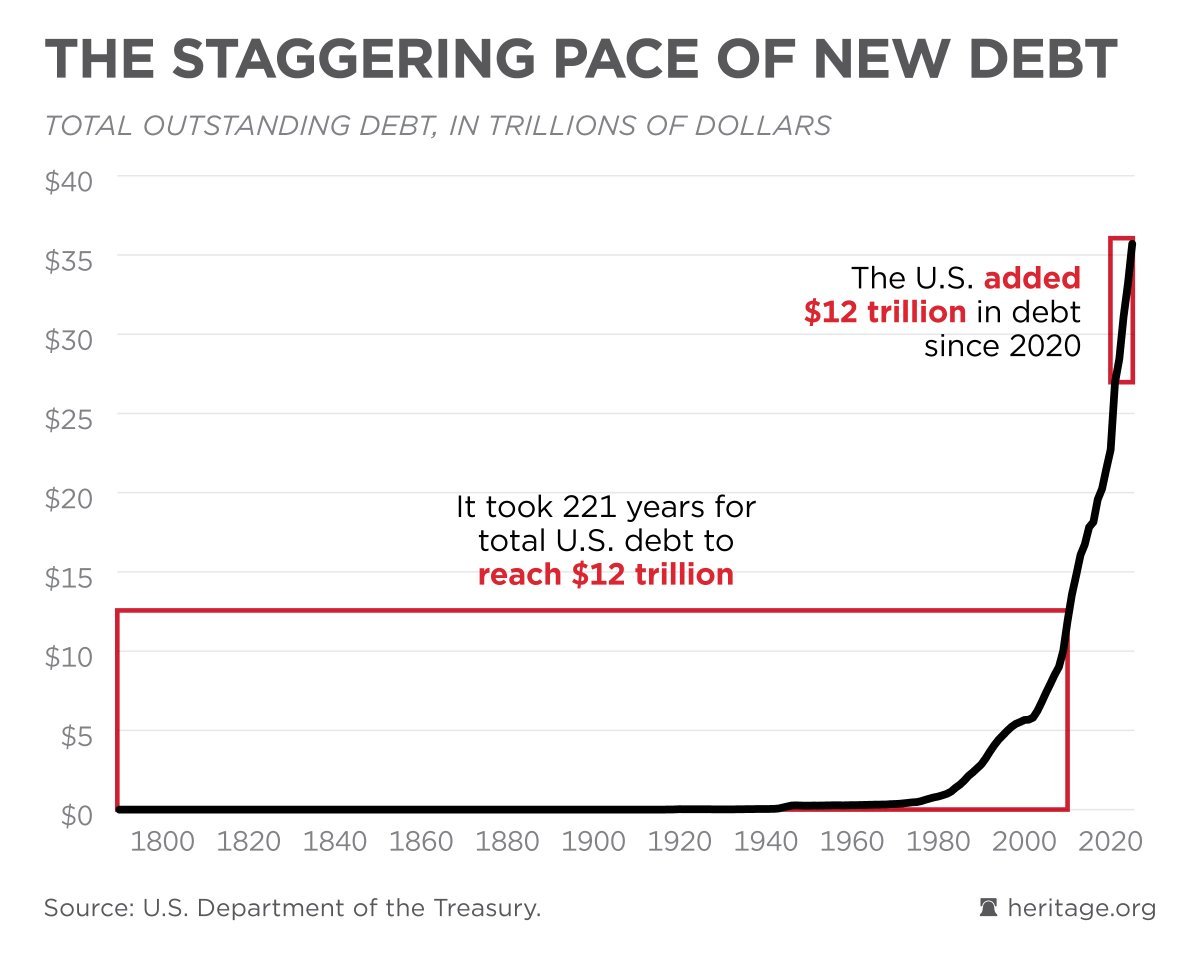

National debt increases by $12 trillion in five years

From 2020 to 2023, US debt surged by $10 trillion, with total debt ballooning past $35 trillion. For perspective, the US took 221 years to rack up its first $12 trillion in debt. But thanks to years of reckless spending by the Biden administration via USAID, the same amount of money was added in just five years.

The debt ceiling, suspended until late 2025, means the federal government can spend freely. And they have—adding over $12 trillion since 2020. Elon’s D.O.G.E is meant to reverse this.

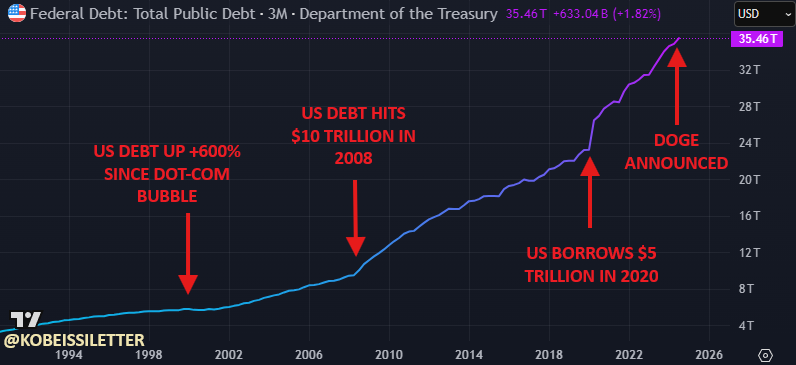

Treasury data shows that since the 2008 financial crisis, total US debt has soared by 360%. And as Elon sees it, unchecked deficit spending is dragging the US economy to the edge of collapse. One of the key issues is the flood of Treasury bonds being pumped into the market to fund federal spending.

On day eight of D.O.G.E’s operations, Elon shared on X that $1 billion in daily savings had already been achieved. The Tesla CEO promised he could eventually get to $4 billion per day by 2026. By his estimates, that would reduce the projected $1.87 trillion deficit to just $410 billion—a 78% drop.

Cutting down on office buildings, fraud, and blockchain proposals

D.O.G.E is going after two of the government’s largest money pits: unused office space and fraudulent spending. Elon’s plan to cut up to two-thirds of federal office space comes at a critical time.

Real estate prices for office buildings have already fallen more than 30% from their peak, and no major government agency currently uses more than 50% of its available space.

With 511 million square feet of federal property, maintenance alone costs $76 billion per year. Factoring in other expenses, that’s over $100 billion annually—roughly 6% of the FY2024 deficit.

But of course, a lot of people don’t agree with his method. Three weeks after D.O.G.E’s spending cuts began, Elon’s access to federal spending databases was blocked. Elon said, “When I asked if anyone at Treasury had a rough guess for what percentage of that number is unequivocal and obvious fraud, the consensus in the room was about half, so $50B/year or $1B/week!! This is utterly insane and must be addressed immediately.”