Bonk Price Forecast: 2.02 trillion BONK coins will be burn

- Bonk price recovers slightly on Thursday after falling over 5% so far this week.

- BONK announces it will burn 2.02 trillion tokens to celebrate the BONKdragon event and the 2025 Lunar New Year.

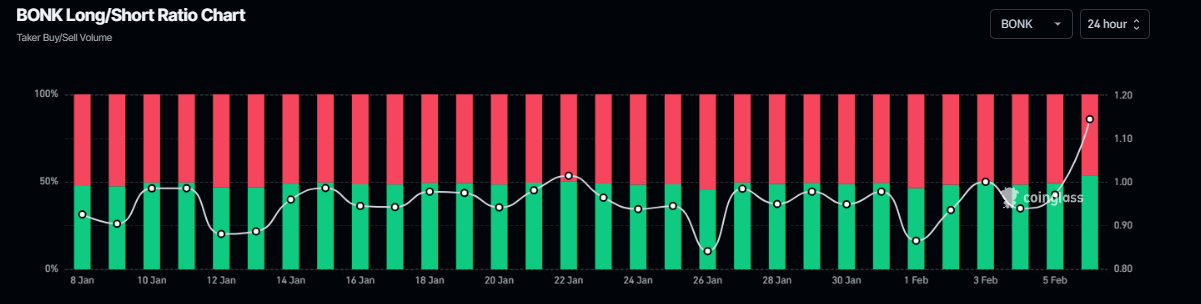

- Coinglass data shows that the BONK long-to-short ratio reached the highest level in over a month, indicating more traders are betting on Bonk’s price to rise.

Bonk price recovers slightly, trading around $0.000018 at the time of writing on Thursday after falling over 5% so far this week. Bonk announced on its social media platform X that it will burn 2.02 trillion tokens to celebrate the BONKdragon event and the 2025 Lunar New Year. Coinglass data shows that the BONK long-to-short ratio reached the highest level in over a month, indicating more traders are betting on Bonk’s price to rise.

Bonk announces 2.02 trillion token burn

Bonk announced on its social media platform X on Thursday that it will burn 2.02 trillion tokens to celebrate the BONKdragon event and the 2025 Lunar New Year. The token burn is expected to positively impact its value by reducing supply and increasing its scarcity.

The Dragon breathes and BONK coins will be BURNED

— BONK!!! (@bonk_inu) February 6, 2025

2,025,000,000,000 $BONK will be burnt to celebrate the BONKdragon event and 2025 Lunar New Year❗️❗️❗️ pic.twitter.com/Oe2VeEut63

Bonk technical outlook: Bulls aim for 40% gains

Bonk price retested and bounced off its key support range between $0.000015 and $0.000014 on Monday. Bonk is recovering slightly, around $0.000018 at the time of writing on Thursday.

If the support range holds, Bonk's price would extend the rally by 40% to retest its daily resistance level at $0.000025.

The Relative Strength Index (RSI) momentum indicator on the daily chart trades at 30, rebounding from its overbought levels, indicating mild signs of strength. For the bullish momentum to be sustained, the RSI must trade above the neutral level of 50.

BONK/USDT daily chart

Another bullish sign is Coinglass’s BONK long-to-short ratio, which reads 1.14, the highest level in over a month. This ratio above one reflects bullish sentiment in the markets as more traders are betting for the asset price to rise.

Bonk long-to-short ratio chart. Source: Coinglass