Bitcoin HODLer Selloff Extends To 1.1 Million BTC As Profit-Taking Continues

On-chain data shows the Bitcoin long-term holders have shed a significant amount of the cryptocurrency from their holdings recently.

Bitcoin Long-Term Holders Have Been Realizing Notable Profits Recently

In its latest weekly report, the on-chain analytics firm Glassnode has discussed about how supply has shifted between BTC short-term holders and long-term holders recently.

The “short-term holders” (STHs) and “long-term holders” (LTHs) here refer to the two main divisions of the Bitcoin market done on the basis of holding time. The investors who bought their coins within the past 155 days fall in the former cohort, while those who have been holding for longer than this period are put in the latter one.

Statistically, the longer an investor holds onto their coins, the less likely they become to sell said coins at any point. Thus, the STHs can be considered to include the weak hands of the market, while the LTHs represent the resolute entities.

Now, here is the chart for the supplies of the two groups shared by the analytics firm in the report:

As displayed in the above graph, the Bitcoin LTHs have participated in a selloff recently, as their total holdings have decreased by around 1.1 million BTC. This suggests the price explosion beyond $100,000 has been too good for even these diamond hands to sit out on.

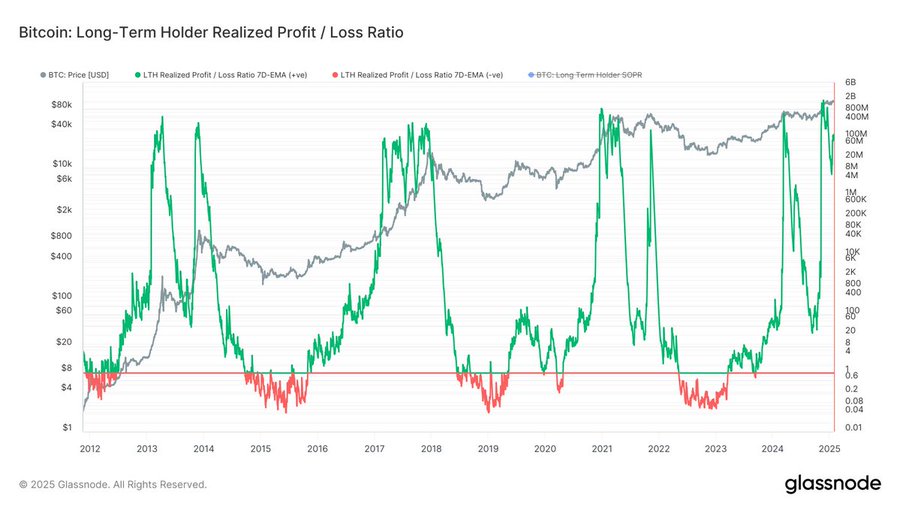

In a post on X, Glassnode has shared the data of how the ratio between the profit and loss locked in by the LTHs has compared has recently.

From the graph, it’s visible that the Bitcoin LTHs have seen a much more massive profit-taking volume than loss-taking one recently. This trend was also witnessed in each of the past bull runs.

The pattern isn’t surprising, as the LTHs tend to amass such a huge amount of gains through their patience that by the time the bull run rolls around, they are ready to harvest big numbers.

Naturally, as the latest selling from the LTHs has occurred, the STH supply has increased by the same amount. Whenever the LTHs sell, some new buyer comes in to take their coins.

During bull markets, a high amount of fresh demand tends to flow in that absorbs the profit-taking from the LTHs. So long as the balance in the market maintains, the rally continues. Once the demand runs out, however, the price reaches a top.

It now remains to be seen how long the Bitcoin market can continue to absorb the aggressive profit-taking spree from the HODLers.

BTC Price

At the time of writing, Bitcoin is trading around $105,100, up more than 2% over the last week.