Jupiter Acquires Moonshot to Bolster Meme Coin Trading on Solana

Jupiter, a leading decentralized exchange (DEX) on Solana, has acquired a majority stake in Moonshot, a platform designed to streamline meme coin trading.

This acquisition reflects Jupiter’s strategic focus on capitalizing on the rising popularity of meme coins.

Jupiter Acquires Moonshot and SonarWatch

Jupiter revealed the acquisition on January 25, with its founder, Meow, highlighting Moonshot’s innovative team.

“The [Moonshot] team is amongst the smartest, most driven group of people i have ever met & it has been incredibly fun jamming on the future of memes together,” Meow said.

Although specific details remain under wraps, the move is expected to enhance Jupiter’s offerings in the meme coin market. Moonshot’s unique capability to enable users to buy meme coins using Apple Pay complements Jupiter’s expertise in Solana-based token trading.

Moonshot’s user base has grown significantly over the past week, particularly following the launch of the Official Trump meme coin. During the token’s debut, Moonshot facilitated nearly $400 million in trading volume, establishing itself as a rising force in the crypto space.

Meanwhile, the acquisition also aligns with Jupiter’s efforts to improve user experience. The DEX has integrated portfolio tracking through its recent purchase of SonarWatch. This tool will enable users to monitor their Solana-based activity directly on the DEX platform.

“While we’ve had a very successful product, our focus is now shifting entirely to Solana coverage. Our goal is to create the best-in-class Portfolio tracker! As a result, our platform will be discontinued in a few months. During this time, we’ll continue adding new protocols, but the tool will no longer be available after the transition period,” SonarWatch stated.

The SonarWatch team announced plans to discontinue the platform’s native SONAR token and burn the remaining supply. They also informed SONAR holders that they could exchange their tokens for JUP.

Jupiter Introduces New Features

Jupiter is also rolling out new features to expand its capabilities. A proposed lending system will allow users to deposit JLP tokens as collateral to borrow USDC.

This will offer higher yields for JLP holders and better USDC utilization. Liquidations will occur seamlessly, releasing collateral against liquidity pools.

“Today, we’re publishing an idea to allow you to deposit JLP and borrow USDC. This can drive higher utilization rates for USDC, and improve APY for JLP holders. Liquidations will be done by redeeming JLP natively, releasing their collateral against the pool,” Jupiter wrote on X.

Furthermore, the trading platform now offers “Ultra Mode,” which optimizes transaction processes by automating slippage adjustments, prioritizing dynamic fees, and boosting overall efficiency. The DEX is also preparing to launch Jupiter Shield, a security tool that protects user assets.

“There will also be a comprehensive upgrade to Manual Mode, including brand new Routing and Broadcast options to make the most powerful,” Jupiter added.

All of these developments follow Jupiter’s recent JUP token airdrop. The Solana-based DEX distributed 700 million tokens valued at more than $500 million to over 2 million wallets. Although the initial distribution led to price fluctuations, JUP price has since shown signs of recovery, with a 10% increase to $0.92 as of press time.

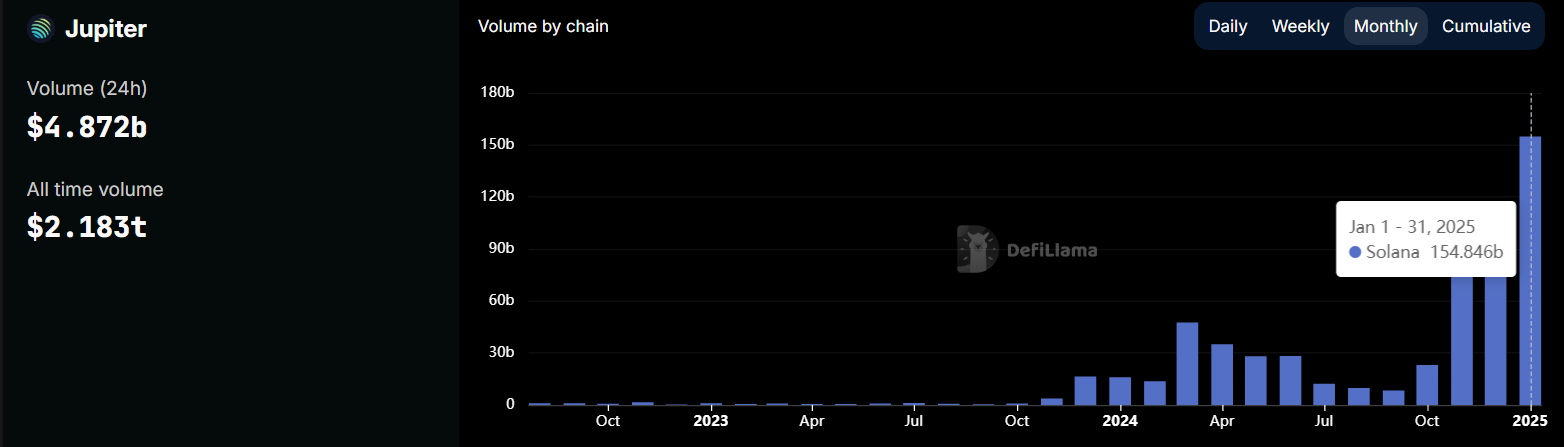

Solana-based Jupiter DEX. Source: DeFiLlama

Solana-based Jupiter DEX. Source: DeFiLlama

Jupiter remains one of the leader in the Solana DEX ecosystem. The platform processed $4.87 billion in trading volume within the past day and boasts an all-time trading volume of $2.18 trillion, per DeFiLlama data. January 2025 has been particularly notable, with the platform facilitating $155 billion in trades.