Crypto Today: BTC, Solana, XRP mount $3.5T support as Ross Ulbricht and Tornado Cash rulings spark optimism

- The global crypto market capitalization fell 1.7% to hit $3.5 trillion on Wednesday.

- Bitcoin, Solana and XRP held firm above their respective critical support levels at $103,000, $3 and $250.

- President Trump’s decision to pardon Ross Ulbricht has boosted investor confidence in privacy-preserving technologies.

Bitcoin Market Updates: Trump inauguration drives Bitcoin price to all time high

- Bitcoin price experienced a relatively long period of consolidation on Wednesday, stabilizing above $103,500 at press time.

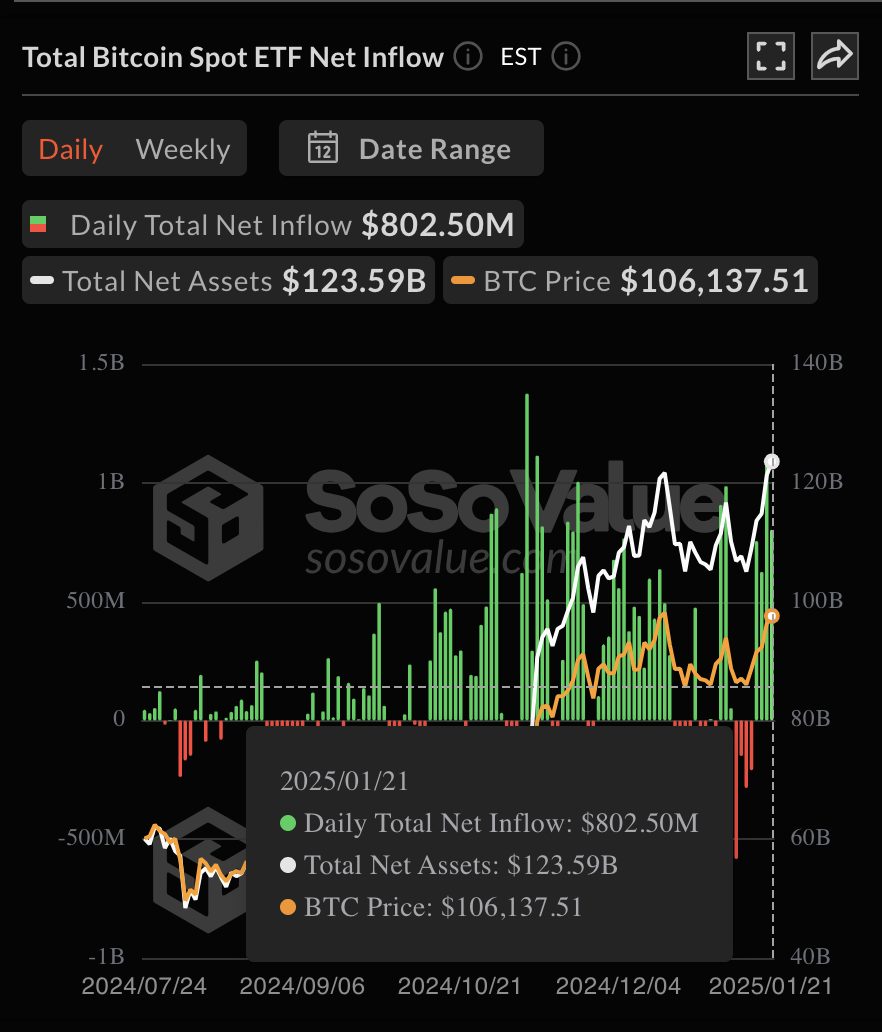

- Bitcoin ETFs recorded four consecutive days of inflows, raking in $802 million on the day.

Bitcoin ETF Performance, as on January 23 2025, Source: SosoValue

Bitcoin ETF Performance, as on January 23 2025, Source: SosoValue

In the four-day buying streak dating back to January 15, the US-based Bitcoin ETFs led by Blackrock have acquired $3.2 billion worth of BTC.

This comes amid ongoing discussions surrounding potential altcoin ETF approvals and the recent introduction of President Donald Trump's meme coin, $TRUMP deepening crypto adoption across the US.

Notably, BlackRock CEO Larry Fink suggested that Bitcoin's price could soar to $700,000 if more funds allocate 2% to 5% of their investments into the cryptocurrency.

Altcoin Market Updates: SOL and XRP Lead Gains Amid ETF Prospects

- Solana (SOL) has experienced a notable price increase, currently trading at $257.56, with an intraday high of $270.39.

Polymarkets Traders Pricing in 93% Chance of Solana ETF approval.

Polymarkets Traders Pricing in 93% Chance of Solana ETF approval.

This surge is attributed to the high probability of a Solana ETF gaining approval in 2025, with Polymarket data suggesting a 93% likelihood.

XRP is trading at $3.17, maintaining its position with minimal change from the previous close.

The stability of XRP is supported by an imminent listing on CME Group world-renowned derivatives trading exchange, adding luster to Ripple’s regulatory credentials.

Meme Coin Market: Trump’s meme token adoption race fuels ETF Filings

President Donald Trump's recently launched meme coin, $TRUMP, has rapidly amassed a market capitalization of $8.4 billion.

This event has drawn both investor interest and criticism due to potential conflicts of interest and ethical concerns.

In response to the coin's popularity, asset management firms REX Advisers and Osprey Funds have sought regulatory approval to debut an ETF tied to $TRUMP and other meme coins, including DOGE and BONK, as well as established tokens like Solana and XRP.

Chart of the day: Layer-1 Sector dips 2.4% amid mixed market reactions and intense speculation

The Layer-1 sector experienced a 2.4% decline today, reflecting mixed market reactions and heightened speculation. Avalanche (AVAX) is trading at $36.61, down 1.32% from the previous close. Hedera (HBAR) stands at $0.324433, decreasing by 3.61%. Cardano (ADA) is priced at $0.980223, reflecting a 3.52% decline. These movements suggest a cautious market sentiment as investors assess recent developments.

Layer-1 Sector Performance, January 24 2025 | Source: Coingecko

Layer-1 Sector Performance, January 24 2025 | Source: Coingecko

Notably, President Donald Trump's full pardon of Ross Ulbricht, founder of Silk Road, and the reversal of sanctions against Tornado Cash by a Texas District Court have significantly impacted the market.

These actions have sparked dramatic increases in privacy coins. Monero (XMR) rose to $222.51, up 1.3%. Dash (DASH) is at $35.74, down 3.2%. Toncoin (TON) is trading at $1.72, down 2.27%.

The surge in XMR highlights growing investor interest in privacy-focused cryptocurrencies.

Additionally, the potential approval of altcoin ETFs has generated optimism. Reports indicate that Solana and XRP have ongoing ETF application filings with U.S. regulators.

Investors are hopeful that these developments could pave the way for institutional adoption of Layer-1 altcoins.

Crypto News Updates:

- BlackRock CEO Larry Fink Speculates Bitcoin Could Reach $700,000

At the World Economic Forum in Davos, BlackRock CEO Larry Fink discussed Bitcoin's growth potential, suggesting it could reach $500,000 to $700,000 per token.

This estimate assumes major investors allocate 2% to 5% of their portfolios to the cryptocurrency, reflecting its potential mainstream adoption.

Fink clarified that his comments were theoretical and not promotional, emphasizing that such growth depends on broader adoption and investor participation.

Fink also highlighted Bitcoin’s potential to enhance financial security in economically unstable regions. He noted his growing appreciation for the cryptocurrency democratizing benefits, particularly its ability to provide financial inclusion in emerging markets.

- Coinbase Exec Identifies 430 BTC Linked to Ross Ulbricht, Untouched Since Silk Road Era

Coinbase’s Director of Product Strategy and Business Operations, Conor Grogan, has uncovered 430 Bitcoins tied to wallets associated with Silk Road founder Ross Ulbricht.

These funds, untouched for over 13 years, are separate from the 174,000 BTC previously confiscated by U.S. authorities.

The discovery coincides with Ross Ulbricht receiving a presidential pardon, ending over a decade of imprisonment.

- Coinbase Addresses Solana Delays, Plans Infrastructure Upgrades

Coinbase has reported substantial delays in Solana transactions, citing heightened activity on the Solana blockchain as the cause.

In response, the exchange has committed to implementing infrastructure upgrades to enhance service reliability and expedite transaction processing times.

The company is collaborating with the Solana Foundation to resolve the issues and reassures users that all assets remain secure and fully backed.

These efforts aim to restore confidence and improve uptime on the Solana network.

- Virtune Launches Finland’s First Crypto ETPs on Nasdaq Helsinki

Virtune, a Swedish-regulated crypto asset manager, has introduced Finland's first crypto exchange-traded products (ETPs) on Nasdaq Helsinki.

This development provides Finnish investors access to euro-denominated, regulated financial instruments for investing in crypto assets.

The offerings include single and staked asset ETPs, along with an altcoin index, enabling diversified investments in major cryptocurrencies.