Donald Trump’s World Liberty Financial crypto holdings loss over $4.8 million

- Lookonchain data shows that Trump’s backed DeFi platform World Liberty Financial faces a $4.84 million loss in its crypto holdings.

- WLFI’s X account announced routine crypto movements for treasury management, fees, and working capital needs.

- A whale bought 200 million WLFI tokens worth $3 million.

Donald Trump-backed DeFi platform World Liberty Financial (WFLI) faces a $4.84 million loss in its crypto holdings due to the recent market correction, according to Lookonchain data. On Wednesday, WLFI’s official X account posted that WLFI is making routine movements of their crypto holdings as part of regular treasury management, payment of fees and expenses, and address of working capital requirements. Moreover, a whale bought 200 million WLFI tokens worth $3 million.

Trump’s World Liberty Financial portfolio faces losses amid market correction

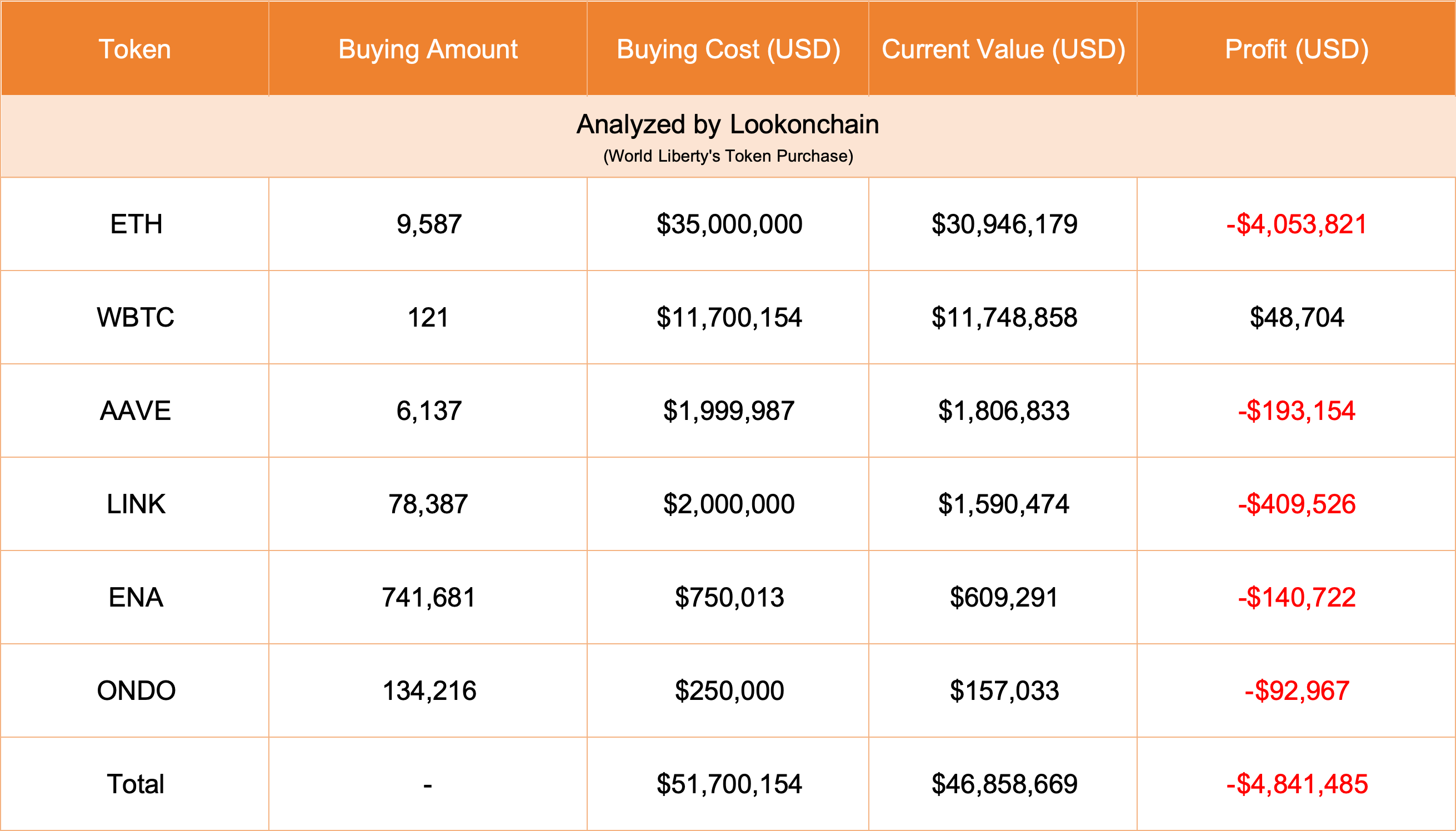

According to Lookonchain data, the Donald Trump-backed DeFi platform, World Liberty Financial, faces a $4.84 million loss in its crypto holdings. The Defi platform had purchased a total of $51.70 million worth of tokens like Ethereum (ETH), Wrapped Bitcoin (WBTC), AAVE, Chainlink (LINK), (...) and current values stand at $46.85 million due to the recent crypto market correction.

World Liberty’s Token Purchase chart. Source: Lookonchain

Moreover, on Wednesday, Trump’s WFLI exchanged 103 WBTC, worth $9.89 million, for 3,075 ETH at $0.03354 and deposited 18,536 ETH, worth $59.8 million, into CoinbasePrime. Afterward, World Liberty spent 1.7 million USDT to buy 17.62 WBTC at $96,491, according to Lookonchain data.

Trump's World Liberty(@worldlibertyfi) exchanged 103 $WBTC($9.89M) for 3,075 $ETH at a rate of $0.03354 and deposited 18,536 $ETH($59.8M) into #CoinbasePrime.

— Lookonchain (@lookonchain) January 15, 2025

Afterward, World Liberty spent 1.7M $USDT to buy 17.62 $WBTC at $96,491.

The $ETH, $WBTC, $AAVE, $LINK, $ENA, and $ONDO… pic.twitter.com/EVyF6KmgSG

During the same period, WLFI’s official X account posted that WLFI is making routine movements of their crypto holdings as part of regular treasury management, payment of fees and expenses, and address of working capital requirements.

“To be clear, we are not selling tokens — we are simply reallocating assets for ordinary business purposes,” says the WLFI’s X post.

WLFI concluded that these actions are intended to be part of maintaining a strong, secure, and efficient treasury. There is no need to speculate — this is all standard practice for managing operations at WLFI.

We’re making routine movements of our crypto holdings as part of regular treasury management, and payment of fees and expenses and to address working capital requirements. To be clear, we are not selling tokens—we are simply reallocating assets for ordinary business purposes.…

— WLFI (@worldlibertyfi) January 14, 2025

Lastly, according to Lockonchain, a whale spent 3 million USDC stablecoin on Tuesday to buy 200 million WLFI tokens on Tuesday, indicating rising investors' demand for Donald Trump-backed DeFi platform World Liberty Financial.

Someone spent 3M $USDC to buy 200M $WLFI from #Trump's @worldlibertyfi.https://t.co/kqfzkvyv0n pic.twitter.com/3bMaZDNLy8

— Lookonchain (@lookonchain) January 14, 2025