AAVE Faces Major Price Drop As TD Sequential Signals Sell – Details

The Aave (AAVE) market suffered significant losses in the past week as price declined by 17.07% according to data from CoinMarketCap. While the DeFi token has shown some stability in the last 24 hours, certain market indicators suggest the bearish storm may be far from over.

AAVE Could Crash By 30% If Signal Holds

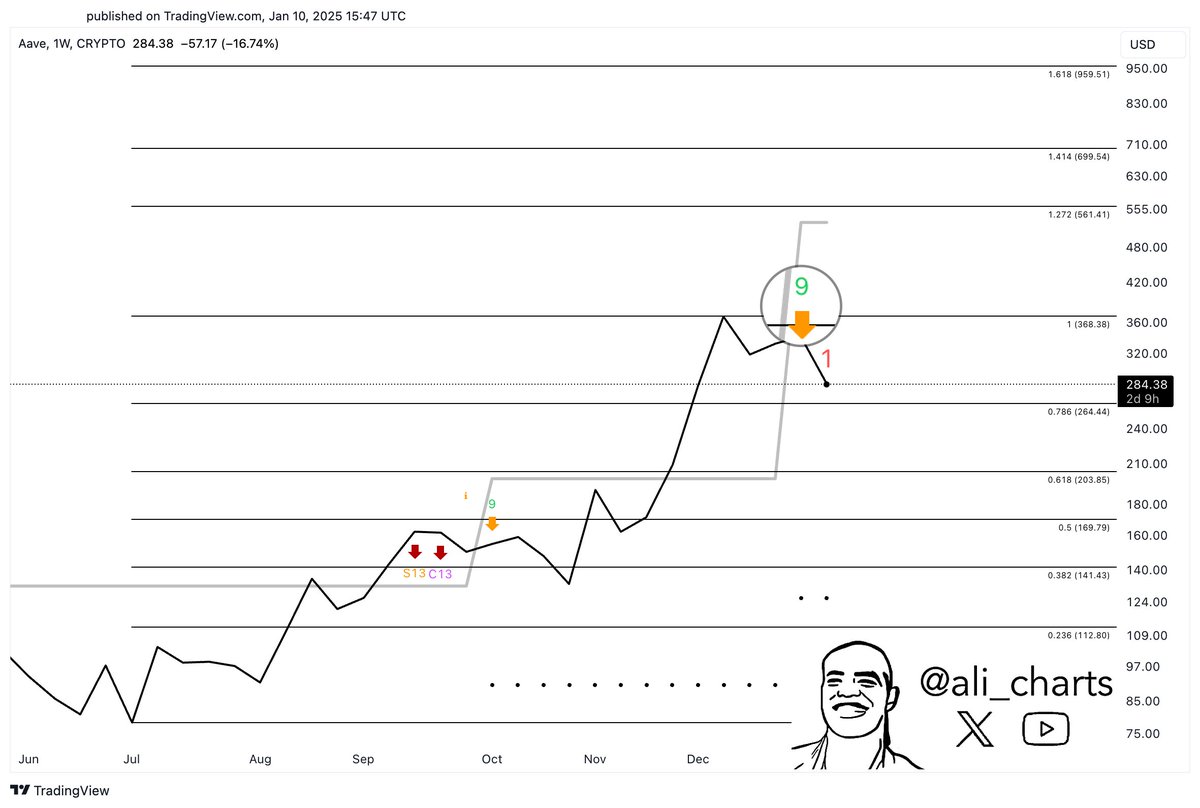

In a recent post on social media platform X, crypto analyst Ali Martinez shared a hawkish prediction on the AAVE market. According to Martinez, the TD Sequential indicator has presented a sell signal on the AAVE weekly chart, suggesting a major decline on the horizon.

In trading, the TD Sequential developed by Tom DeMark is used to identify potential turning points in price trades. It basically indicates when an asset’s price is overextended in a particular direction and due for a reversal.

Based on Martinez’s forecast, if the TD Sequential sell signal holds, AAVE could undergo a significant correction falling to around $264. However, in the presence of overwhelming selling pressure, the L2 token could be headed for $203, indicating a possible 29.5% decline from AAVE’s current price.

Interestingly, this bearish prediction is backed by other indicators. Firstly, Relative Strength Index indicator has a value of 62.57 indicating that AAVE is still far from the oversold zone and may experience further decline in the coming weeks.

Furthermore, the asset’s 100-day simple average is also far below the current price which can be interpreted as another bearish signal. Clearly, there’s much need to apply caution in engaging the present market. At press time, AAVE trades at $290.04 after a slight 2.48% gain in the last 24 hours. However, its daily trading volume has dipped by 48.99% which may potentially indicate that selling pressure is beginning to ease up.

Aave Set To Launch V4

Despite the ongoing price struggle, the Aave protocol continues to record positive development. Most recently, NewsBTC reported that Aave registered $35 billion in total net deposits, representing an all-time high value since 2021.

In addition to this, the DeFi protocol is preparing to launch its V4 network upgrade that is expected to introduce advanced risk tools and unified liquidity among other benefits. According to data from DeFiilama, AAVE continues to rank as the second largest DeFi protocol with a Total Value Locked (TVL) of $20.4 billion.

The decentralized lending platform falls only behind liquid staking protocol Lido Finance which boasts of a TVL of $31.60 billion.