Litecoin HODLing Strong Despite 15% Crash: 54% Of Supply Dormant Since 1+ Years

On-chain data shows HODLing behavior on the Litecoin network has remained strong recently despite the plunge that LTC’s value has observed.

Litecoin HODLers Currently Control The Majority Of Supply

In a new post on X, Litecoin’s official handle talks about how the asset supply is distributed between its different cohorts right now. The investors have been divided into the groups in question based on holding time.

There are three such cohorts relevant here: Traders, Cruisers, and HODLers. The first of these, the Traders, refers to the investors who bought their coins within the past month. This cohort includes the new investors and short-term traders of the market, so the supply held by them is constantly in motion.

Holders that make it past the one-month cutoff are put into the Cruisers group. This cohort represents the side of the sector that has the potential to evolve into a resolute wall.

Investors that hold past the one-year mark without moving their coins even once can be assumed to have lived up to this potential and are put in the HODLers category.

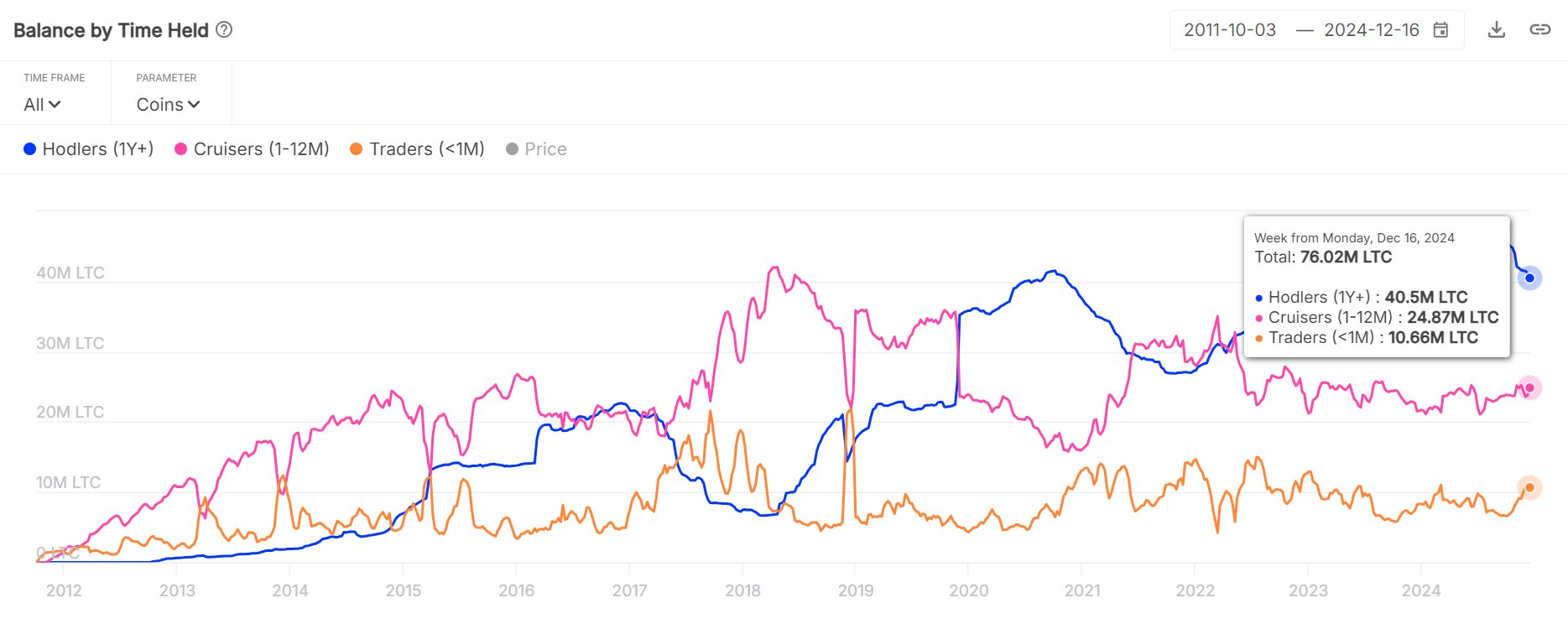

Below is the chart from the market intelligence platform IntoTheBlock shared by the Litecoin X account that shows how the supply held by each of these three groups has changed over the course of the network’s history:

As displayed in the graph, the supply held by Litecoin Traders has observed an increase recently, which suggests the older cohorts have been breaking their dormancy.

It’s also visible, however, that the Cruisers have witnessed their supply moving sideways at the same time, implying the coins on the move have been older than one year. That is, the HODLers have potentially been participating in a selloff.

These investors generally tend to be quite resolute, but it’s not unusual to see them taking profits during bull runs. The decline in their supply has also not been anything too significant so far. More importantly, the latest crash in the Litecoin price hasn’t caused these investors to panic and sell.

After the decrease, the HODLers carry 40.5 million LTC in their wallets, equivalent to almost 54% of the total LTC supply. A lot of this supply is also actually much older than one year, as the cryptocurrency’s handle has revealed the average holding time on the network is 2.4 years per token.

Something to note is that while selling registers immediately in the supply charts of the older cohorts, buying isn’t the same. Whenever the Cruisers or HODLers see an increase in their supply, it doesn’t mean that accumulation is happening in the present, but rather that it occurred one month or one year ago.

This is naturally due to the fact that coins have to age up sufficiently first in order to be counted among these cohorts. In contrast, transactions instantly reset back their age to zero, which is why selling is immediate.

LTC Price

At the time of writing, Litecoin is trading around $102, down 15% over the last week.