Lido to Shut Down Staking on Polygon Amid Shifting DeFi Plays

Lido, one of the largest liquid staking protocols, has announced it will discontinue its staking services on the Polygon network.

The decision, revealed in a recent blog post, follows extensive community discussions and a governance vote by Lido DAO (LDO) token holders.

Lido Justifies Polygon Sunsetting

Based on the blog, the shutdown process will begin over the coming months. It marks the end of Lido’s efforts to establish itself as a key liquid staking solution on the Polygon Proof-of-Stake (PoS) network.

“Due to the termination of development and technical support of Lido on Polygon, from 16th of December, 2024, the staking function is not available anymore. Please, unstake your funds via UI before the 16th of June, 2025,” Lido said.

Lido on Polygon launched in 2021 with high expectations following a proposal from Shard Labs. However, the protocol fell short of its goals, ultimately leading to the decision to shut down its operations on Polygon.

The blog cites challenges such as limited user adoption, insufficient staking rewards, and resource-intensive maintenance. According to Lido, the shifting dynamics of the DeFi ecosystem have further contributed to this outcome.

One of the primary challenges has been the rise of zkEVM-based solutions, which have shifted DeFi activity away from Polygon PoS. This reduced demand for liquid staking solutions on the network, undermining Lido’s position as a foundational DeFi building block on Polygon.

Additionally, alternative liquid staking services such as EigenLayer emerged in a smaller-than-anticipated ecosystem. This enhanced competition, further limiting Lido’s impact.

Lido DAO’s governance decisions also played a key role. Recent initiatives, such as GOOSE and reGOOSE, have prioritized strategic focus on Ethereum. This led to a reevaluation of Lido’s presence on other networks, including Polygon.

“While initial expectations were high, Lido on Polygon has faced significant challenges. Combined with evolving DeFi trends and the DAO’s strategic focus, this has prompted a thorough reevaluation of the protocol,” the blog post noted.

A Strategic Realignment for Lido

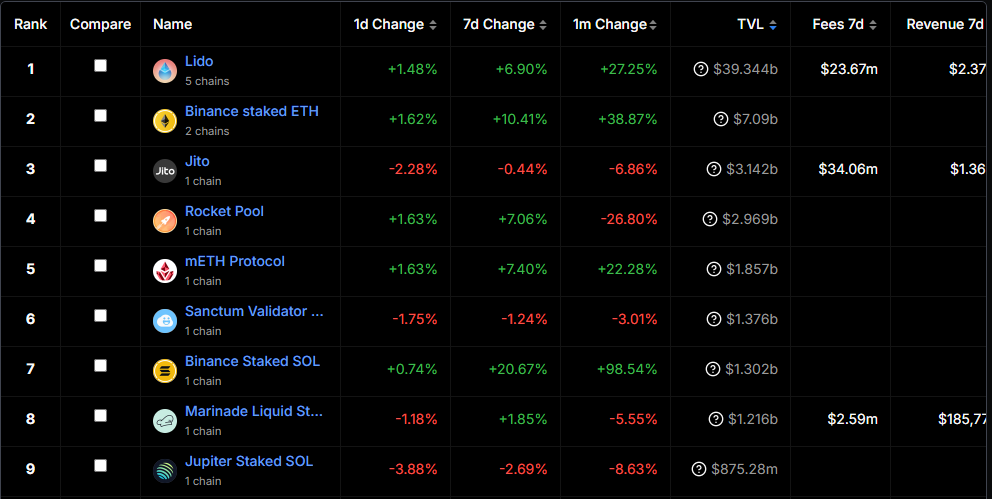

Nevertheless, the decision to sunset Lido on Polygon reflects the DAO’s strategic alignment with its core focus. This includes its Ethereum-based staking solutions, where Lido continues to dominate while it remains among the top DeFi protocols.

Accordingly, this move highlights the challenges protocols face in expanding beyond their primary network amidst changing DeFi alliances. Lido’s decision also reflects the challenges of maintaining multi-network support.

For Polygon, however, the shutdown signals a potential gap in its staking ecosystem as it adapts to the growing focus on zkEVM solutions. While other liquid staking solutions remain active on the network, Lido’s departure raises questions about long-term growth and competitiveness in Polygon’s DeFi space.

Lido Dominates Liquid Staking TVL Rankings. Source: DefiLlama

Lido Dominates Liquid Staking TVL Rankings. Source: DefiLlama

Specifically, the Polygon ecosystem’s adoption for liquid staking fell short of expectations, prompting Lido to prioritize its resources elsewhere. This is despite Polygon’s status as a prominent Layer 2 scaling solution.

Meanwhile, the sunsetting process brings significant changes for users holding stMATIC, Lido’s liquid staking token for Polygon. The discontinuation of the protocol will occur in phases, with key dates and actions outlined for users to withdraw their staked MATIC. Important details and dates for stMATIC holders include:

- Rewards Discontinued: stMATIC holders will no longer earn staking rewards during the transition process.

- Pre-Sunset Pause: The protocol will temporarily halt operations between January 15 and 22, 2025. During this time, withdrawals cannot be processed.

- Withdrawal Process: Users will be able to unstake their MATIC tokens through the Lido on Polygon front-end until June 16, 2025.

- Post-Sunset Access: After June 16, withdrawals will only be possible through blockchain explorer tools, as frontend support will end.

- December 16, 2024: Staking services on Lido for Polygon will officially stop. New stakes will no longer be accepted via the user interface.

- January 15-22, 2025: Temporary pause of operations for protocol maintenance. Withdrawals will be unavailable during this period.

- June 16, 2025: Final date for withdrawals via the Lido UI. Beyond this, users must rely on explorer tools to access their tokens.

With this, Lido asked stMATIC holders to begin the withdrawal process early to avoid disruptions. While withdrawals will remain accessible beyond June 2025 via explorer tools, the absence of front-end support could create technical hurdles for less-experienced users.

POL Price Performance. Source: BeInCrypto

POL Price Performance. Source: BeInCrypto

In the immediate aftermath of this report’s release, first shared on Monday, Polygon’s POL plunged. However, the token is attempting a recovery in line with the broader market trend on Tuesday.