sBTC Launches on Stacks Mainnet, Bringing Bitcoin DeFi to Life

Bitcoin L2 Labs, the core development team behind Stacks, announced the successful mainnet launch of a programmable 1:1 Bitcoin-backed asset, sBTC. It marks a major step toward building an on-chain Bitcoin economy and follows October’s Nakamoto Upgrade, which delivered faster transactions and 100% Bitcoin finality to the Stacks network.

For the broader Bitcoin community, this is more than just a milestone — it signals a new era of programmable Bitcoin. The world’s most secure blockchain can now actively participate in decentralized finance (DeFi).

sBTC Debuts on Stacks Mainnet

sBTC is designed to unlock Bitcoin (BTC) liquidity and comes after Stacks initiated the Nakamoto Upgrade in late August. It will enable BTC holders to access DeFi opportunities while retaining Bitcoin’s unmatched security principles.

Specifically, users can engage in DeFi applications, such as lending and borrowing on protocols like Zest, decentralized exchanges (DEXs) like Bitflow and ALEX, or even AI-based tools like aiBTC.

“Unlike locking BTC in proof-of-stake systems, sBTC is fully expressive and enables an on-chain Bitcoin economy. It can power decentralized lending, DEXs, AI bots, and more while inheriting 100% Bitcoin hash power security,” said Muneeb Ali, Stacks founder, in a press release shared with BeInCrypto.

Among the key features of sBTC is a 1:1 Bitcoin backing, where the pioneer crypto fully collateralizes each sBTC token. Secondly, there is the institutional signer network, which reduces reliance on single entities, thereby enhancing trust.

Additionally, sBTC has 100% Bitcoin finality, which means it is secured by Bitcoin hash power, ensuring strong security. Furthermore, the product has transparent, open-source code, which offers transparency and verifiability for developers and users.

Nevertheless, the current mainnet phase introduces deposit-only functionality, capped at 1,000 BTC. Despite this limitation, this cap will provide initial liquidity for developers and enable further integrations with institutional custodians and ecosystem partners.

According to the press release, withdrawals will only become available in Q1 2025 as the system transitions toward a fully open, permissionless signer set. Depositors will also earn annual rewards of up to 5% in sBTC for holding the asset, presenting a unique yield opportunity for Bitcoin holders.

Unlocking Bitcoin’s Full Potential

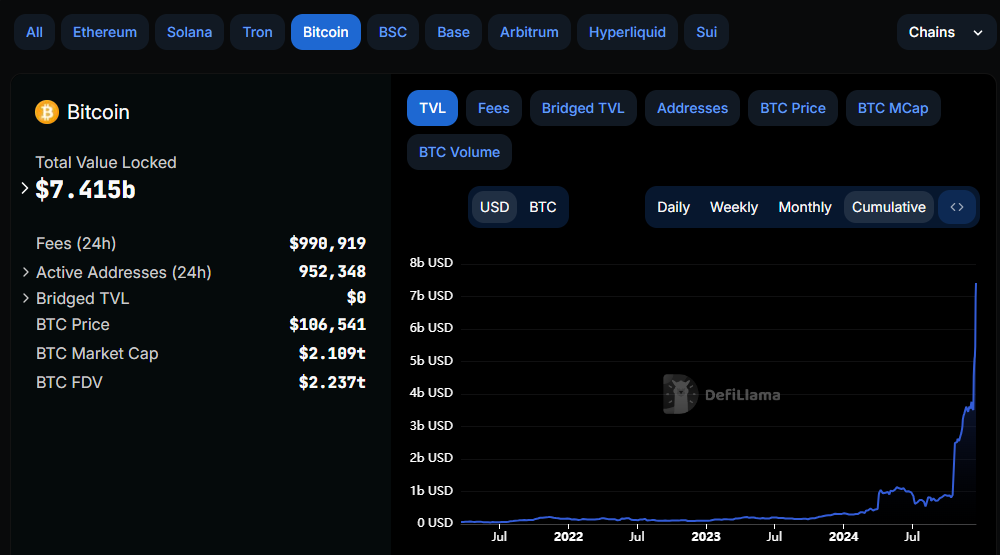

Meanwhile, sBTC’s launch is poised to bring Bitcoin closer to Ethereum’s dominance in the DeFi space. While Ethereum boasts a total value locked (TVL) approaching $80 billion, according to DefiLlama data, Bitcoin is fast approaching after flipping Binance Smart Chain (BSC).

Bitcoin TVL. Source: DefiLlama

Bitcoin TVL. Source: DefiLlama

The successful rollout of sBTC sets the foundation for a stronger Bitcoin Layer-2 ecosystem. The gradual lifting of the BTC cap, the introduction of withdrawals, and the transition toward a permissionless signer network could drive further adoption. With sBTC Bitcoin is no longer just a store of value but a versatile asset for decentralized applications (dApps).

“With sBTC, Bitcoin becomes highly capable beyond a store of value, unlocking the full potential of BTC in decentralized applications,” Andre Serrano, Head of Product at Bitcoin L2 Labs, emphasized.

This development also enhances opportunities for DeFi builders. Zest Protocol, for instance, allows users to earn additional rewards while holding sBTC.

“Earn more Zest points. Just holding sBTC gives users a 5% yield, thanks to the Stacks rewards program. With Zest, users can supercharge their yield with sBTC,” the platform noted.

As Bitcoin capital flows into DeFi protocols, builders, developers, and users will benefit from enhanced liquidity and innovative financial tools.