MicroStrategy Spends $2.1 Billion on Further Bitcoin Purchases

MicroStrategy bought 21,550 more Bitcoin today, spending $2.1 billion. This is the company’s second purchase in December, spending $98,783 per BTC.

Since November, Michael Saylor’s firm has made over $15 billion worth of BTC purchases.

MicroStrategy Buys More Bitcoin

Earlier today, MicroStrategy released a press statement confirming the purchase. Saylor’s continued strategy is hardly surprising, as two days ago, he advocated a “Bitcoin accumulation plan,” defending the asset as a long-term investment.

“Satoshi gave us a game we can all win. Bitcoin is that game,” Saylor said in an interview today.

The firm also purchased a similar amount early in December, spending $1.5 billion on BTC. Saylor has been a committed Bitcoin advocate for years, but his purchases have increased substantially.

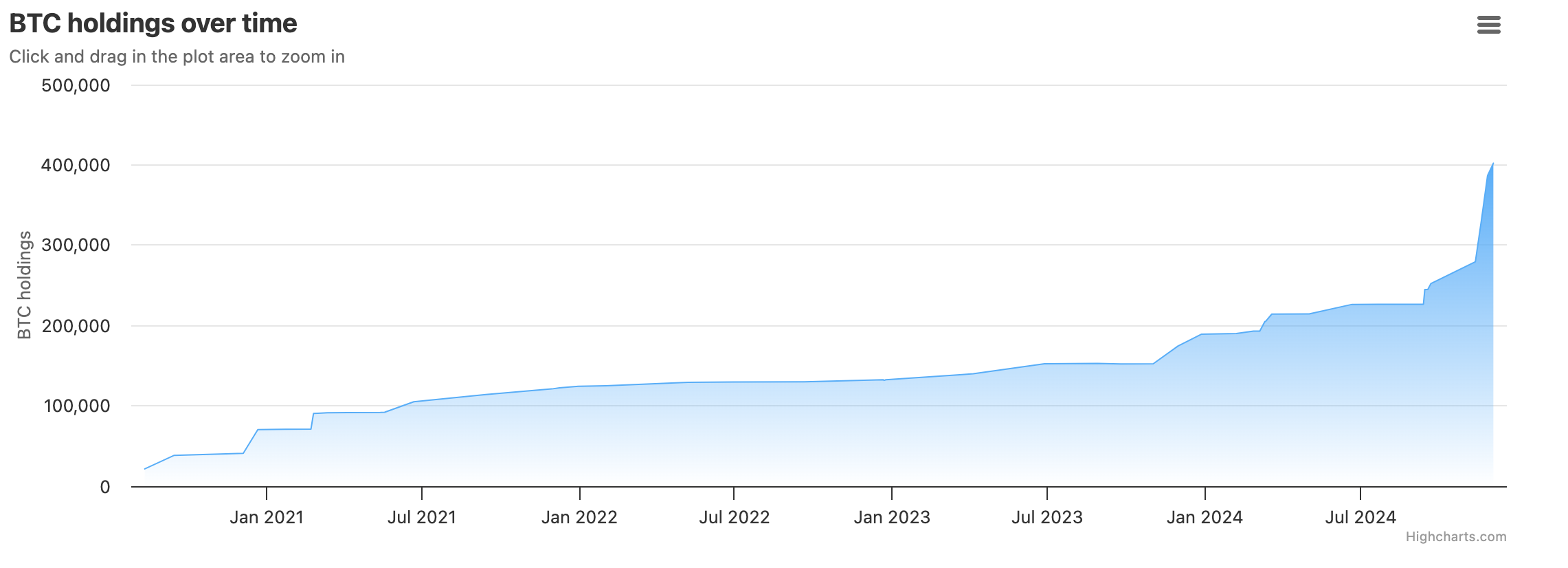

MicroStrategy Bitcoin Purchases. Source: Bitbo

MicroStrategy Bitcoin Purchases. Source: Bitbo

As a result of this rapid new consumption, MicroStrategy is definitively one of the world’s largest Bitcoin holders. These holdings have significantly impacted the firm’s stock price this year. Bitcoin’s bullish cycle since the ETF approval in January has also been reflected in MSTR’s price, as the stock surged by nearly 450% year-to-date.

Overall, 2024 has been Bitcoin’s most successful year, with a price finally reaching $100,000. This bull market has encouraged ravenous BTC purchases from other major institutional investors.

For example, BlackRock, the leading ETF issuer, increased its Bitcoin purchases after the $100,000 milestone. Collectively, the issuers currently own more Bitcoin than Satoshi Nakamoto, which is an astounding feat. MicroStrategy has a long history of Bitcoin purchases and advocacy, but BlackRock’s total AUM is over 100 times larger due to the net inflow in IBIT.

While Michael Saylor considers this Bitcoin-first approach infallible, reports suggest that its underlying capital flows are still tiny compared to spot ETF issuers. However, these scrutinies haven’t stopped other public firms from following in MicroStrategy’s shadow.

As BeInCrypto reported earlier, smaller public companies such as MARA and Metaplanet have also increased their holdings throughout this bull market. These accumulations suggest that public companies see Bitcoin’s target price to be much higher, as they consider these peak prices as buying opportunities.