SEC’s Caroline Crenshaw Faces Crypto Backlash Ahead of Re-Nomination Vote

Caroline Crenshaw’s re-nomination as one of the US SEC agency commissioners is on the balance. Scheduled for a vote by the Senate Banking Committee on Wednesday, the decision could help shape the future of crypto regulation in the US.

If confirmed, Crenshaw would serve on the Securities and Exchange Commission (SEC) until 2029. However, her track record and perceived hostility toward cryptocurrency have drawn sharp criticism.

Crenshaw’s Controversial Crypto Stance

During her tenure at the SEC, Crenshaw has aligned closely with Chair Gary Gensler, known for his strict regulatory approach to cryptocurrencies. Crenshaw’s critics, however, argue that her stance has been even more severe.

Bloomberg ETF analyst James Seyffart described her as “more vehemently anti-crypto than Gensler,” referencing her dissent on the approval of Bitcoin spot exchange-traded Funds (ETFs).

“She wasn’t just an ally to Gensler IMO — she was more vehemently anti-crypto than Gensler. Just read through her dissent letter on the Bitcoin ETF approvals back in January (The other democrat commissioner, Lizárraga, didn’t even join her on that letter),” Seyffart remarked.

The ETF analyst pointed to her January 10 dissent letter, in which Crenshaw argued against approving spot Bitcoin ETFs. In the letter, the SEC commissioner cited concerns about investor protection and market manipulation. Notably, her fellow Democratic Commissioner Jaime Lizárraga did not join her in the dissent, further reflecting the extremity of her position.

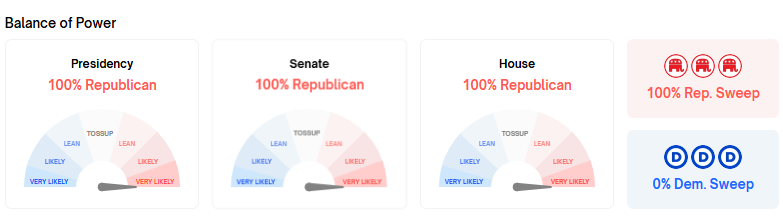

Crenshaw’s re-nomination decision comes at a time when the Republican-controlled Senate and House are signaling a shift in regulatory priorities. According to the prediction market platform Polymarket, the GOP holds a strong majority in both chambers, heightening the stakes for Wednesday’s vote.

“If the Senate votes her through, she’ll be able to serve on the commission until 2029. If she’s not confirmed, Trump will be able to nominate someone else,” Fox Business correspondent Eleanor Terrett stated.

Balance of Power in Trump Administration. Source: Polymarket

Balance of Power in Trump Administration. Source: Polymarket

Broader Implications for Crypto Regulation

Terrett also highlighted Crenshaw’s alignment with Gensler on major issues, suggesting that her policies may face resistance in a Republican-dominated legislature. Apart from her crypto stance, Crenshaw has been an advocate for stringent climate reporting mandates and other progressive policies.

While these priorities resonate with her Democratic base, they have drawn ire from Republican lawmakers who argue that such measures overburden businesses and deter investment.

Meanwhile, Trump, a vocal critic of the SEC’s current crypto policies, has promised sweeping reforms if given the chance. He has vowed to overhaul US crypto rules beyond Gensler’s stringent measures, potentially paving the way for a more innovation-driven approach.

“In short, President Trump is ready to clean house…and it’s not just a house cleaning, and then you don’t know what you’re going to do — there’s actually a systematic process for having people who are qualified, who have done work in our industries over time in the United States,” said Byron Donalds, who cited private discussions between himself and Trump.

Amid the campaign hype, Trump also repeatedly emphasized the need for regulatory clarity. He committed to challenging statutes that stifle innovation and reduce unnecessary red tape, potentially positioning America as the leader in crypto’s future.

Therefore, the cryptocurrency industry will monitor Wednesday’s vote closely amid concerns that Crenshaw’s reappointment would continue a regulatory approach that they believe stifles innovation and hinders the US from competing on a global stage.