Czech Republic Moves to Ease Crypto Taxation Rules

The Czech Republic is advancing legislation that could simplify crypto tax obligations for its residents. Prime Minister Petr Fiala announced plans to exempt digital asset sales from capital gains tax if held for over three years.

This change would significantly benefit long-term holders of digital assets.

A Global Trend of Easing Crypto Tax

In a statement on December 6, Fiala highlighted that the proposal, supported by Chamber of Deputies member Jiří Havránek, aims to relieve taxpayers of certain burdens.

Transactions under 100,000 koruna annually—approximately $4,200—would no longer require reporting. This measure aligns with the government’s efforts to streamline cryptocurrency regulations while fostering a more crypto-friendly environment.

“A new time test will apply, which guarantees that if you hold cryptocurrencies for more than three years, their sale will not be taxed. We make life easier for people and support modern technologies,” Fiala wrote on X (formerly Twitter).

Taxation policies for cryptocurrency transactions vary widely across the globe. In the United States, capital gains tax on digital assets ranges from 15% to 20%, depending on income brackets.

Conversely, Italy initially considered raising its crypto tax above 2,000 euros to 42%. However, the government later scaled back the plan in favor of a proposed 28% rate.

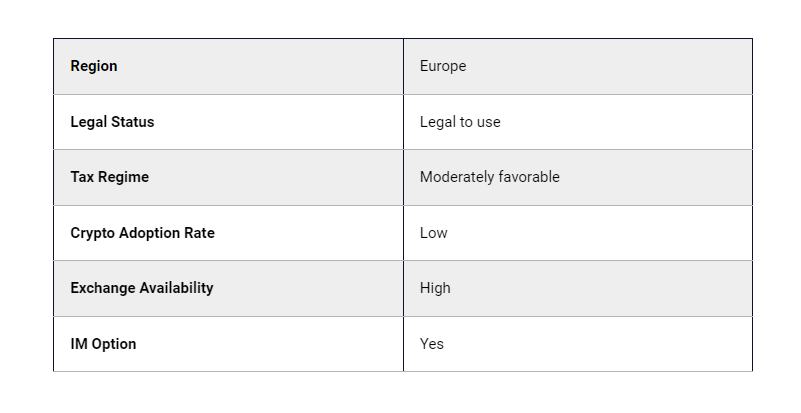

Czech Republic Crypto Regulation Summary. Source: Global Intelligence Unit

Czech Republic Crypto Regulation Summary. Source: Global Intelligence Unit

Russia, on the other hand, recently classified cryptocurrency as taxable property. Mining income will now be taxed based on market value, allowing miners to deduct expenses while capping personal income tax on crypto-related earnings at 15%. The government has also clarified that these transactions will be exempt from value-added tax (VAT).

Overall, cryptocurrency taxation continues to generate debate and regulatory scrutiny worldwide. Binance recently faced allegations of owing $85 million in unpaid taxes to India.

Meanwhile, in the US, Roger Ver—dubbed “Bitcoin Jesus”—is fighting tax evasion charges involving $48 million. Ver’s legal team claims the charges are politically motivated, criticizing the current administration’s regulatory approach to the crypto sector.

These developments reflect how the crypto tax scenario is constantly changing as governments seek to balance innovation with compliance.