Over $400 Million in Sandbox (SAND) Turns Profitable as the Price Skyrockets

The Sandbox (SAND) has seen a significant price surge in recent weeks, with the altcoin rallying by 239% throughout November. This surge brought SAND to a 22-month high, leading many to question whether this price increase signals a resurgence of the Metaverse.

As SAND continues to gain momentum, market observers are closely watching for further signs of the Metaverse’s revival in the crypto space.

The Sandbox Investors Note Gains

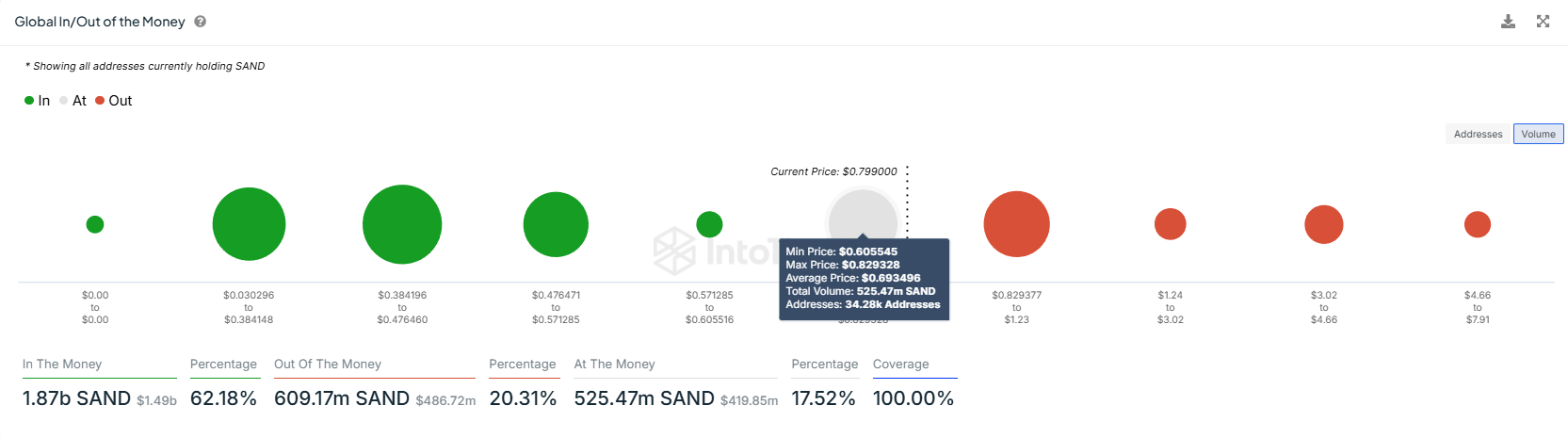

Recent data from the GIOM (Global In/Out of the Money) indicator shows that approximately 525 million SAND, valued at over $417 million, are approaching profitability. This supply was purchased between the price range of $0.60 and $0.82.

As of today, SAND reached an intra-day high of $0.89, pushing this previously dormant supply into profit. If these holders continue to hold their positions, the potential for further price increases is high. This could drive SAND even higher, potentially fueling more bullish momentum in the near future.

SAND GIOM. Source: IntoTheBlock

SAND GIOM. Source: IntoTheBlock

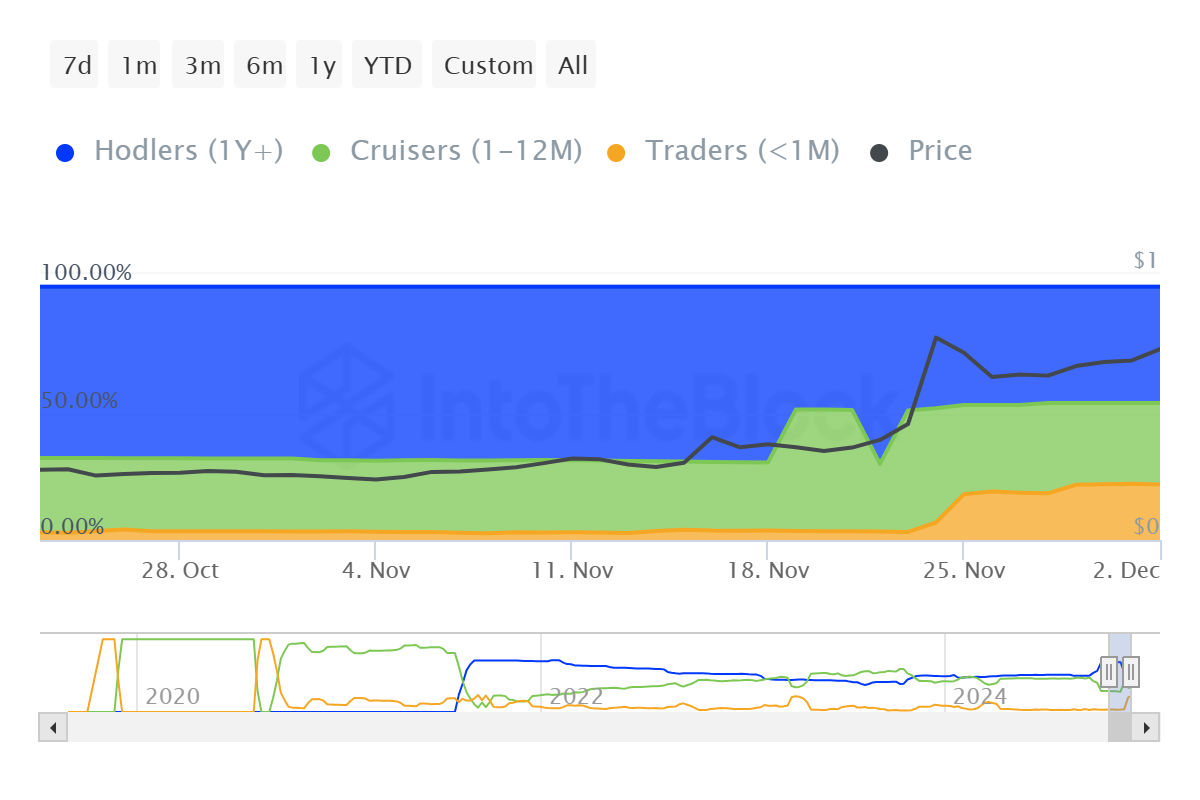

The macro momentum of The Sandbox is influenced by the distribution of SAND tokens. Currently, short-term holders, those holding for less than a month, make up approximately 22% of all SAND in circulation.

This high concentration of short-term holders means that any significant sell-off by this group could lead to a correction in price. Short-term holders tend to react quickly to market movements, and if they choose to lock in profits, it could introduce downward pressure on the price.

SAND Supply Distribution. Source: IntoTheBlock

SAND Supply Distribution. Source: IntoTheBlock

SAND Price Prediction: Growth Ahead

SAND hit a 22-month high of $0.89 over the last 24 hours, rising by approximately 45%. This surge marks an impressive milestone for the altcoin, but the sustainability of this rally depends on broader market conditions. If the Metaverse narrative continues to gain traction and positive sentiment persists, SAND could maintain its upward trajectory.

The next key resistance level for SAND is $1.00, a psychological barrier that could trigger further gains if surpassed. However, if the broader crypto market faces a downturn or if short-term holders decide to sell, SAND could face a correction. In that case, the altcoin might test support levels around $0.70 or lower.

SAND Price Analysis. Source: TradingView

SAND Price Analysis. Source: TradingView

Ultimately, SAND’s price will be influenced by market sentiment and the broader adoption of Metaverse platforms. If The Sandbox can maintain its appeal and attract long-term investors, it could see further gains, potentially revisiting its previous all-time highs. However, investors should remain cautious of the volatility driven by short-term market participants.