Nike’s NFT and Web3 Company RTFKT to Shut Down Amid Declining Market Interest

RTFKT, the NFT-based virtual sneaker company acquired by Nike in 2021, has announced plans to shut down its operations. This decision is likely driven by the continued decline in NFTs over the past two years.

The company will end its web3 activities by January 2025. However, to preserve its legacy, RTFKT plans to launch a new website showcasing its past projects.

The NFT Decline Claims Another Victim

According to its latest announcement, RTFKT will reveal a final product drop scheduled for this month—MNLTH X featuring the Blade Drop—which it described as a symbol of its creative approach to combining digital and physical experiences.

Founded in 2020, RTFKT developed products integrating game engines, NFTs, blockchain, and augmented reality. Nike acquired the company during John Donahoe’s tenure as CEO, marking a notable move into digital assets and the metaverse.

The acquisition aligned with broader trends in the footwear industry at the time, as brands increased their investments in digital sales and NFTs.

However, the market for NFTs has significantly cooled since 2022. This shift, along with Nike’s renewed focus on physical product innovation and strengthening relationships with wholesale partners under its new CEO, Elliott Hill, appears to have influenced the decision.

“This will probably be one of the saddest stories from the NFT space. The project had so much potential to get into the hands of normies. The fact that their team never showed up to any events, to hang with the community, I guess to a degree, this was coming. It’s just sad,” web3 investor and collector Rahim Mahtam wrote on X (formerly Twitter).

In September 2024, Nike excluded the RTFKT logo from its brand lineup in a press release about Donahoe’s retirement, further signaling a strategic shift.

More Firms are Exiting the Industry

Meanwhile, Nike isn’t alone in pulling back on NFTs. Last week, Kraken announced the closure of its NFT marketplace to focus on other projects. The platform halted listing, bidding, and selling features for users.

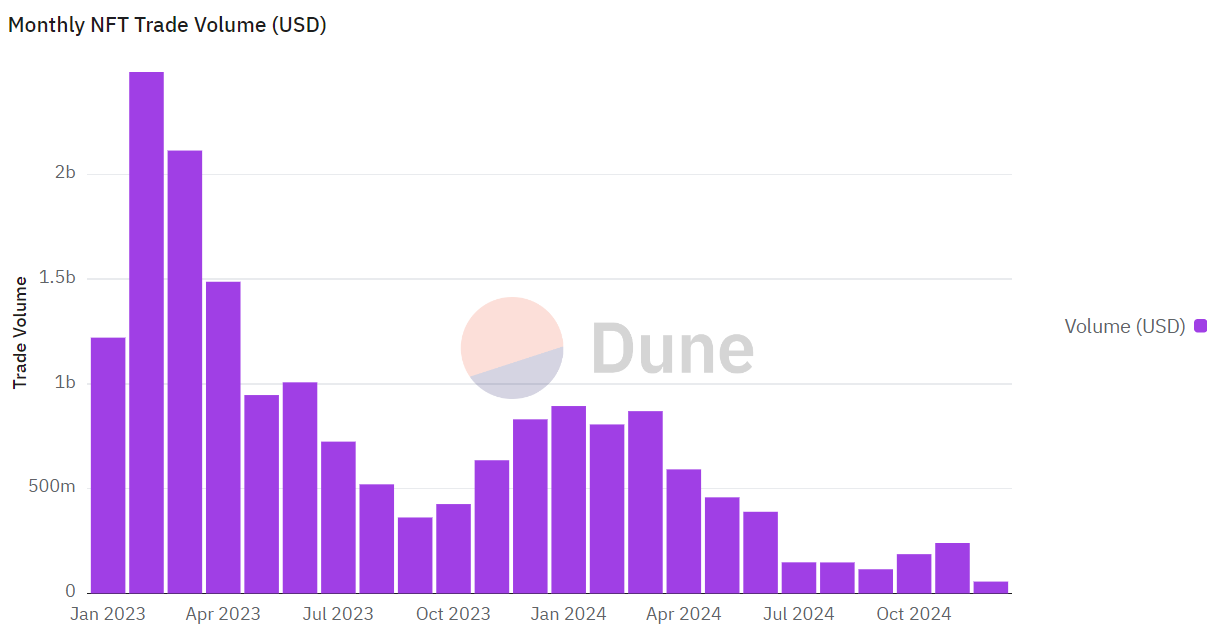

The NFT decline has continued sharply throughout 2024. Data shows that 98% of collections generated little or no trading activity, with most losing over 50% of value within days of release.

In 2024, only 0.2% of NFT projects were profitable, which reflects an oversaturated and speculative market with limited investor gains.

NFT Monthly Trading Volume from 2023 to 2024. Source: Dune

NFT Monthly Trading Volume from 2023 to 2024. Source: Dune

However, there have been certain developments recently that sparked optimism. FIFA recently announced its partnership with Mythical Games to launch a new mobile NFT football game. Meanwhile, a wallet linked to Ethereum co-founder Vitalik Buterin reportedly minted 400 Patron NFTs last month.

Overall, the NFT market remains in decline. More companies might have to follow in the footsteps of RTFKT if the industry doesn’t see reviving engagement.