Polymarket Teases Token Launch as Platform Looks Beyond Election Hype

Polymarket, the decentralized prediction market platform, is signaling potential plans for a token launch following its remarkable performance during the US elections.

This development is expected to usher the platform into the next phase of its evolution.

How Token Launch Could Help Polymarket

On social media platform X, the crypto community noted that the platform recently shared a cryptic message suggesting future token airdrops for active traders.

“We predict future drops. Users who reinvest their winnings into other markets may be eligible for boosted future rewards and drops,” the platform reportedly stated.

Built on the Ethereum Layer-2 network Polygon, Polymarket has established itself as a breakthrough crypto product this year. Its election markets gained significant attention from mainstream media outlets, including Bloomberg. This helped to establish the platform as a reliable source for election insights and sentiments surrounding the candidates.

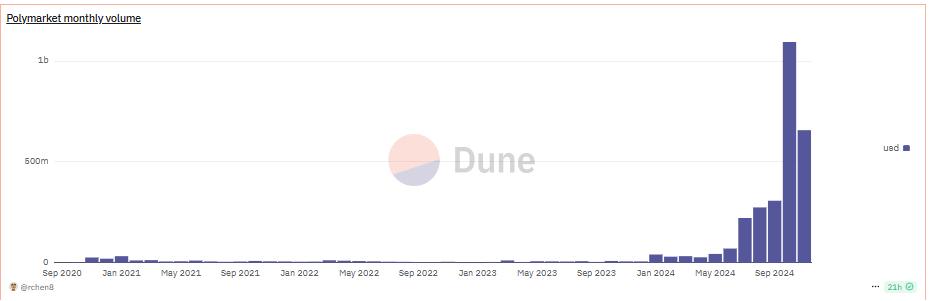

Polymarket’s success is evident in its trading volumes. According to Dune Analytics data, October saw a record-breaking volume of more than $1 billion in trades, while the first ten days of November added another $657 million. Daily active users also reached unprecedented levels during the election period.

Polymarket’s Monthly Volume. Source: Dune Analytics

Polymarket’s Monthly Volume. Source: Dune Analytics

Market analysts suggest that launching a token now could help Polymarket maintain momentum beyond the election cycle. This strategy could encourage continued trading activity through the promise of future rewards. Earlier reports had indicated that Polymarket had considered a $50 million fundraising round alongside a token launch in September.

However, this success has attracted regulatory attention. US Commodity Futures Trading Commission (CFTC) Chair Rostin Behnam has indicated that the commission is monitoring offshore election-betting platforms that serve US customers. Additionally, France’s National Gaming Authority (ANJ) is investigating Polymarket’s compliance with French gambling laws and considering blocking access to the platform.

Despite these regulatory challenges, Polymarket’s potential token launch could represent a strategic move to ensure long-term sustainability. While specific details about the token remain speculative, its implementation could enhance platform functionality and user engagement. This development marks a critical juncture in Polymarket’s evolution from a prediction market platform to a more comprehensive crypto ecosystem.

The timing of this potential token launch coincides with Polymarket’s peak popularity, suggesting a calculated effort to transform election-driven momentum into a lasting market presence. So, the platform must now balance this expansion with increasing regulatory scrutiny in key markets.