Risk-On ETFs Surge After Donald Trump’s Victory, Crypto Products Reap Benefit

Bloomberg ETF analyst Eric Balchunas pointed out a “Trump-inspired gusher of cash” hitting risk-on ETFs in the US market. Bitcoin and crypto ETFs aren’t leading this rally, but they are nonetheless seeing huge gains.

Federal interest rate cuts might cause bearish sentiment for risk-on assets, but crypto ETFs hold a special advantage.

Risk-On ETFs Triumphant

According to Bloomberg ETF analyst Eric Balchunas, risk-on ETF assets exceed all expectations on Thursday. Since Donald Trump won the recent US Presidential Election, the crypto market has been booming. However, recent trading data suggests that risk-on ETFs are also seeing record flows, even in areas unrelated to the industry:

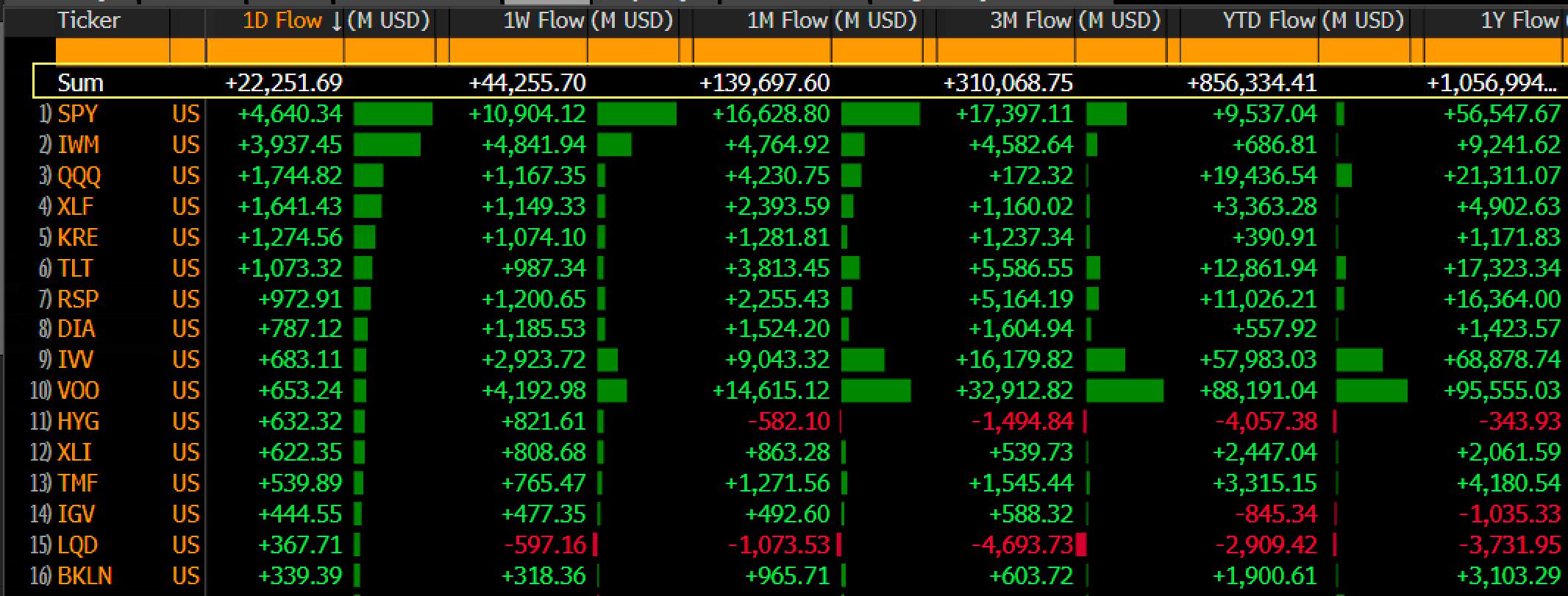

“FLOWMAGEDDON: A Trump-inspired gusher of cash is flowing into risk-on ETFs. +$22 billion in one day is absurd, that is normally a good WEEK. YTD net flows now +$856 billion, ($55 billion away from annual record) and the rolling 1 year has passed $1 trillion,” Balchunas stated via social media post.

Read More: What Is a Bitcoin ETF?

Risk-on ETFs’ Surging Inflows. Source: Eric Balchunas

Risk-on ETFs’ Surging Inflows. Source: Eric Balchunas

Balchunas quoted fellow ETF analyst Todd Sohn as calling this a “post-election release valve.” In a surprising twist, Bitcoin ETFs are nowhere to be seen in this list of biggest winners. However, they still fall into the category of risk-on assets and are independently showing very bullish signs.

For example, take BlackRock’s IBIT, the best-performing Bitcoin ETF. Before the election, the ETFs were already surging in value, and on Thursday, IBIT saw $1.12 billion in inflows in one day. In total, spot Bitcoin ETFs recorded $1.38 billion in inflows on Thursday.

Bitcoin ETFs Performance. Source: SoSoValue

Bitcoin ETFs Performance. Source: SoSoValue

Other crypto-adjacent risk-on ETFs have seen similar victories, even if they didn’t qualify as the best-performing ETFs. For example, CONL, the 2x Coinbase ETF, rose by 62% in one day.

Read More: How To Master Risks and Emotions in Crypto Trading

Balchunas claimed this was close to an all-time record for ETF one-day percentage gains. Smaller wins like this point to a greater bullish trend for the entire asset category.