Solana-related meme coins face massive price correction as initial euphoria wanes

- Solana meme coins tokens like MYRO, SAMO, PONKE, and ANALOS suffered nearly double-digit declines in the past day.

- Experts compare Solana’s meme coin market to street gambling stalls, with low transaction friction and short hold times.

- SOL price resists a decline and notes a nearly 3% daily gain on Friday.

Solana ecosystem’s meme coins are hit by a correction on Friday after posting massive weekly gains. Solana-based meme coins garnered interest from large wallet addresses in January, with big wallets booking millions of dollars in profits trading tokens like Dogwifhat (WIF).

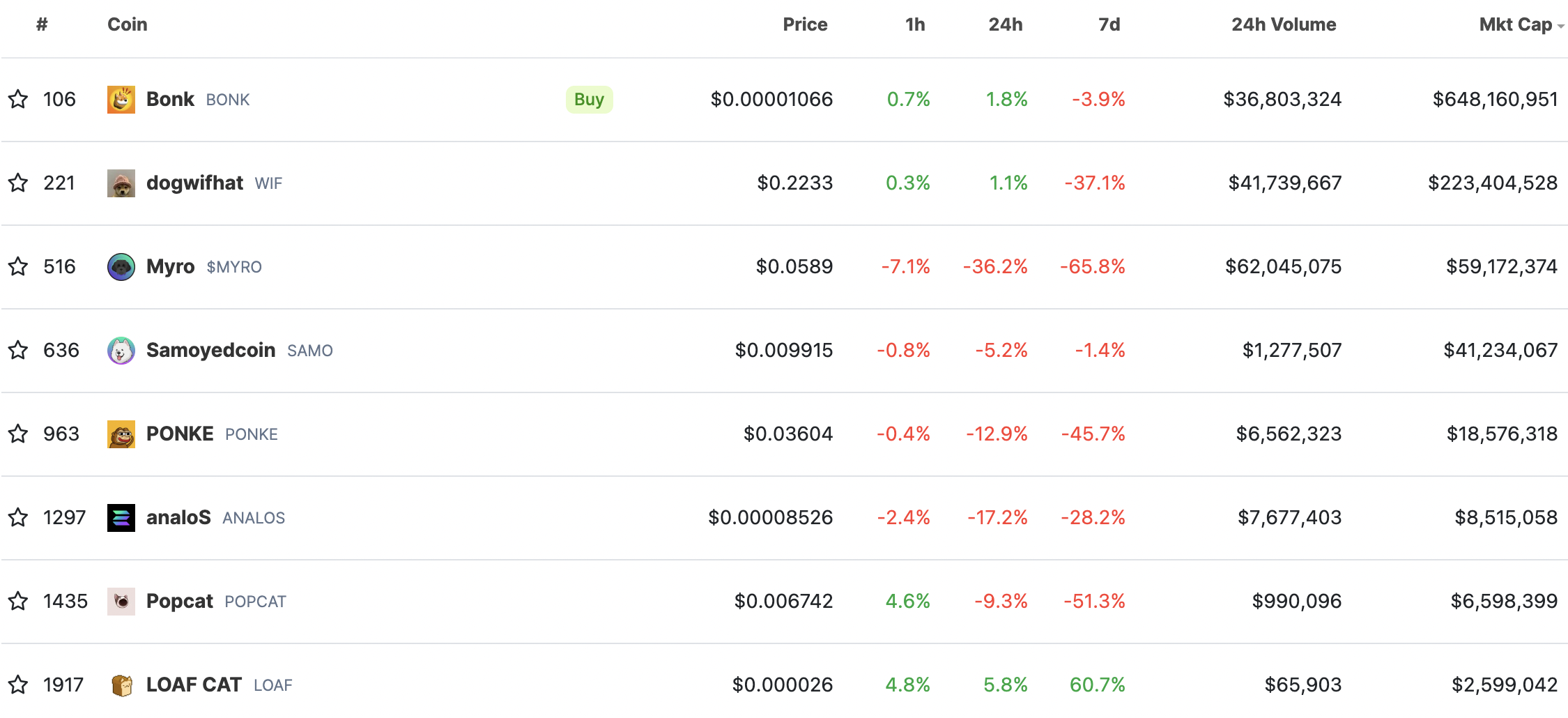

However, recent price action suggests that the meme coin frenzy is likely behind us. There has been a heavy correction in the top Solana ecosystem assets such as Bonk (BONK), WIF, Myro (MYRO), Samoyedcoin (SAMO), Ponke (PONKE), and Analos (ANALOS), among others.

Also read: Bitcoin bull run likely as on-chain metrics spark anticipation for price rally

Solana-based meme coin hype fades

The demand for Solana ecosystem’s meme coins has likely died down as assets were hit by a price correction. Solana’s meme coins have failed to offer a community to holders, and their prices continue to decline as the initial hype surrounding the airdrops fades.

Inspired by iconic dog-themed tokens Shiba Inu and Dogecoin, BONK was launched on Solana on December 2022. BONK rallied over 1,000% in under 90 days in 2023, but the token is now close to 70% below its all-time high of $0.00004000, according to data from Binance. BONK’s listing on Binance was one of the key catalysts that pushed the asset to its peak, but a a steep correction followed.

BONK/USDT 4-hour chart

Solana-based meme coins (except WIF and BONK) have noted a drawdown between 5.2% and 36.2% in the past 24 hours. Nearly all meme coins have suffered a correction on a weekly timeframe.

Solana meme coins. Source: CoinGecko

The current state of Solana’s meme coins is such that the barrier to entry is low. Projects can be developed at a low cost, and there is a heightened risk of rug pulls, short operation cycles, and a lack of adequate information on the team and the project.

The situation can be compared to gambling at a streetside stall, as there is low friction in transacting in SOL-based meme coins. New projects arrive at a fast pace, and traders switch from one to another within a short period of time, resulting in a “pump and dump” like scenario where whales shed holdings in one project when they take profits and move on to the next one.

Retail trader frenzy follows whale movements, only to see overall returns diminish over a long time frame. Most meme coins are suffering double-digit losses on Friday after offering returns in December and January.

Crypto analyst behind the X handle @crypto_bitlord7 notes that most traders that rush into SOL ecosystem’s meme coins are getting “rugged,” meaning that they are losing their investment. As liquidity shrinks and communities take over, the luster of previously attractive meme coins is lost, with holders shedding their holdings in large volumes as price declines.

Solana (SOL) price has resisted a correction despite these developments in its ecosystem. SOL price climbed 16% in a weekly timeframe and the altcoin is trading at $100.96 on Friday.