What to Expect from Solana (SOL) in November 2024: Analysts Weigh In

Solana (SOL) recorded an impressive double-digit gain in October, marking its first strong performance in several months. This rally has fueled bullish sentiment among analysts, many of whom predict that Solana’s price in November could bring further upward momentum for the altcoin.

But what should investors expect from Solana this month? In this analysis, BeInCrypto reveals some analysts’ targets and signs from crucial indicators.

Analyst Expectations Differ for Solana

At press time, Solana’s price stands at $166, marking a 22% surge over the past 30 days. Pseudonymous trader Crypto General notes that SOL’s outperformance of Bitcoin (BTC) hints at further gains for the altcoin this month.

“SOL is showing great strength from the past few weeks, defying the BTC dumps but pumping along with BTC pumping. No doubt it is one of my favourite coin for this season and I am targeting a minimum of $290 in the coming weeks,” Crypto General posted on X (formerly Twitter).

Additionally, the Sharpe ratio has surged into positive territory after remaining in the red from July to September. The Sharpe ratio measures returns by adjusting for risk, making it a popular tool for comparing asset performance.

A negative Sharpe ratio indicates that the potential return may not justify the risk. However, now that it’s positive, Solana’s price shows potential for further gains in November, supporting a bullish outlook.

Read more: 7 Best Platforms To Buy Solana (SOL) in 2024

Solana Sharpe Ratio. Source: Messari

Solana Sharpe Ratio. Source: Messari

Contrary to Crypto General’s prediction, analyst Benjamin Cowen says SOL might not replicate its performance in October. In fact, the analyst says that the SOL/BTC pair, which was in favor of the altcoin, might drop this month.

“I think sol/btc will drop in Nov/dec and bounce early 2025,” Cowen opined.

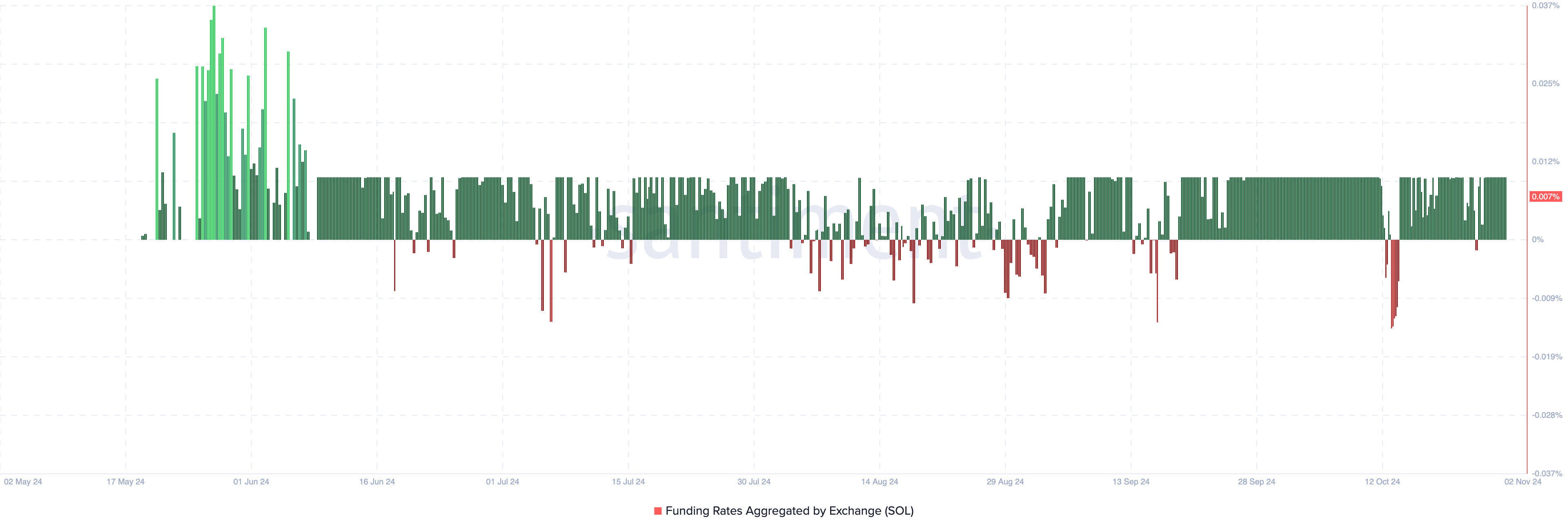

Meanwhile, Santiment shows a positive funding rate, indicating that there are more longs (buyers) than shorts. In contrast, a negative funding rate suggests that shorts dominate the market. Thus, the current reading reflects traders’ expectations for an increase in SOL’s price this November.

Solana Funding Rate. Source: Santiment

Solana Funding Rate. Source: Santiment

SOL Price Prediction: $209 Target Is Possible

Since Wednesday, SOL’s price has fallen by 8.88%, now trading around $163.72. Despite this dip, the daily chart indicates that the token remains above key support at $159.67. Given this setup, Solana’s price may find a rebound off these lows, potentially rallying toward $209.30 by month’s end.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

Solana Daily Analysis. Source: TradingView

Solana Daily Analysis. Source: TradingView

However, if bulls fail to hold this support, this outlook for November may be invalidated, and SOL could then slide further to around $136.71.