Sotheby’s VP Michael Bouhanna turns meme coin BAN into a $1M payday with insider trading

Michael Bouhanna, Sotheby’s Vice President, got into the meme coin market looking for quick cash. After trying his hand with many and getting nowhere, he turned to his own creation and walked away with over a million dollars.

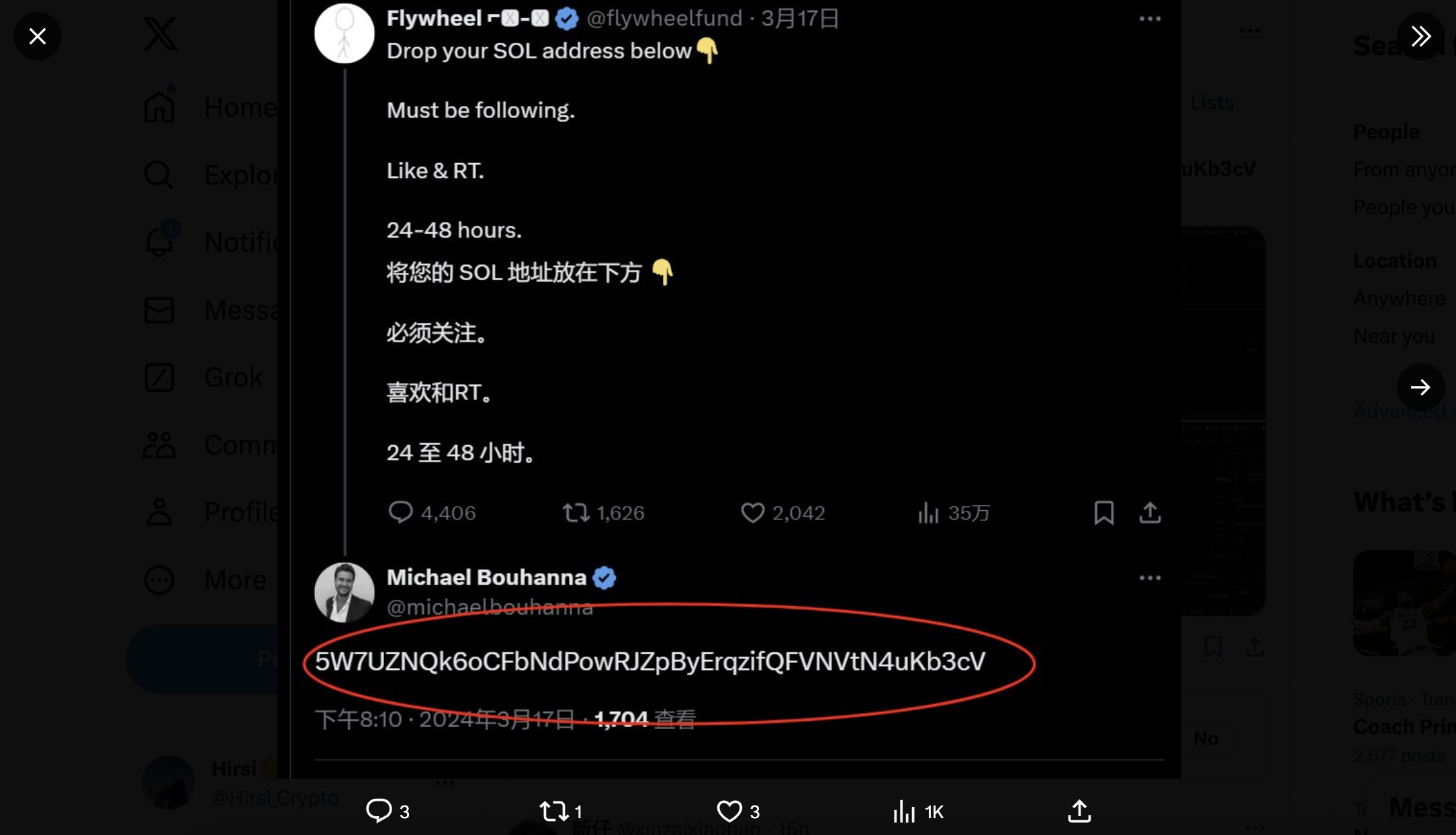

Bouhanna launched a meme token named BAN. He used a wallet identified as “5W7U…b3cV” to do it. Now the wallet wasn’t a secret, he’d publicly confirmed ownership before quietly deleting the tweet.

Insider games and $1M in profit

The funds that fueled the wallet came from another source: “EwVB…mD2.” This wallet, too, had dabbled in meme coins on the trading platform Pump.fun, specifically on October 22, where it churned through more than ten meme tokens in a single day without any gains.

Frustrated with losses, Bouhanna decided to launch BAN with a clear plan to capitalize, despite initially burning all 37.36 million tokens in his wallet to dodge scrutiny.

But he had an insider strategy lined up. He used an additional wallet, “3wj7…yBoG,” which was also funded by the “EwVB…mD2” account. Blockchain analytics platform Lookonchain thinks it’s likely Bouhanna controlled this insider wallet, using it to buy BAN and flip the $1 million profit.

He made calculated trades, including spending 10.2 SOL (about $1,795) to purchase 36.27 million BAN. He cashed out half (18.13 million tokens) for $137,600, leaving the other half valued at $900,000.

Sotheby’s heavy footprint in crypto and NFT auctions

Meanwhile this year, Sotheby’s strengthened its grip on the crypto and NFT market. An auction they had back in June was a standout, featuring NFTs from the Bored Ape Yacht Club (BAYC).

A solid-gold Bored Ape from the now-defunct crypto hedge fund Three Arrows Capital (3AC) was up for grabs. This rare NFT caught intense bidding interest. A similar gold-furred NFT sold for $933,000 just a few months earlier, in March.

That one had two gold-furred Mutant Apes and many Bored Ape Kennel Club NFTs. Sotheby’s has made itself known in NFT circles for high-profile sales, like the $6.2 million it pulled in from “The Goose,” another NFT from the 3AC collection in 2023.

That history of big-ticket sales has positioned Sotheby’s as a prime mover in the NFT space, despite market challenges. In January 2024, the broker hosted its first curated Bitcoin Ordinals sale, integrating Bitcoin-based collectibles into its digital lineup.

Part of their “Natively Digital” series, this auction was a leap into the Ordinals market, a space that got a lot of attention as rare satoshis (individual Bitcoin units with historical or unique attributes) emerge as collectibles.

The auction featured pieces from artists like Shroomtoshi and Jennifer & Kevin McCoy, with estimates from $12,000 to $40,000. Standout pieces included “Brancher,” a dynamic artwork that uses growth algorithms.