Donald Trump’s WLFI Token Launches to $5 Million Sales and Technical Difficulties

World Liberty Financial (WLFI), a new token project endorsed by Donald Trump, was launched to whitelisted investors. WLFI sold $5 million in the first hour, but technical difficulties have disrupted its operations.

These problems highlight crypto community skepticism surrounding the project.

A Mixed Start for WLFI

World Liberty Financial (WLFI), a new DeFi protocol endorsed by Donald Trump, launched on the morning of October 15. World Liberty announced this token launch several days prior but added that the first round would only be accessible to whitelisted users. This token launch had a goal of raising $300 million.

Read more: Tokenomics Explained: The Economics of Cryptocurrency Tokens

World Liberty began the token launch with an X Spaces broadcast, albeit Donald Trump was not present. After WLFI went live, users reported $5 million in sales in the first hour. However, their website went down during this time, and transaction data shows technical difficulties in continuous sales.

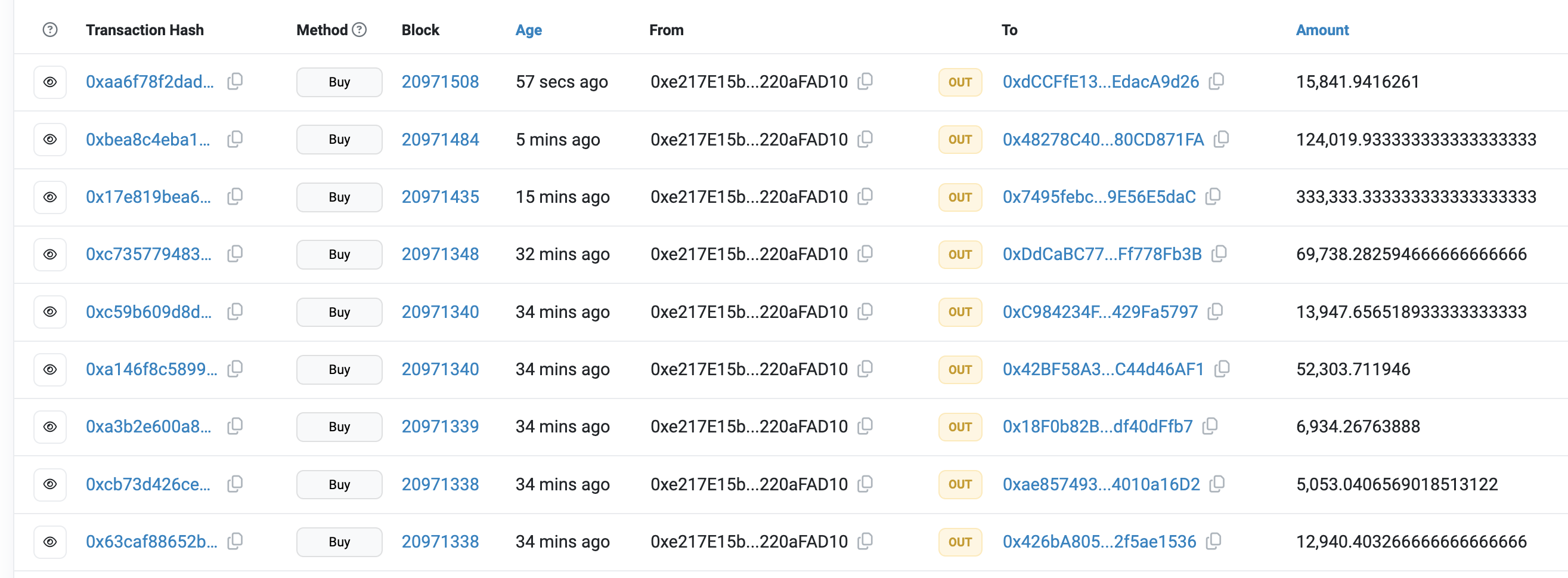

Gaps in WLFI Availability. Source: Etherscan

Gaps in WLFI Availability. Source: Etherscan

Trump’s absence and some of these difficulties have contributed to a sense of unease around the project. Many community leaders have remained skeptical about unclear technical goals and the token launch’s timing near the election.

“The vast majority of people who will buy into Trump’s DeFi project would be better served simply buying Bitcoin and holding,” Manuel Ferrari, Co-Founder of Money On Chain, told BeInCrypto in an exclusive interview.

For example, World Liberty claimed that only accredited investors would be in the first round of sales. The Securities and Exchange Commission (SEC) defines these as investors with over $1 million net worth and $200 thousand annual income. And yet, World Liberty has had difficulties in smoothly processing sales to a group this exclusive.

Read more: Top 11 DeFi Protocols To Keep an Eye on in 2024

As of this writing, World Liberty’s website is still down, but on-chain data seems to show staggered new transactions. It is unclear if these issues will persist throughout the day and interrupt the strong demand for WLFI.