Bitcoin Open Interest Hits Record $19.8 Billion—Is The $100K Rally About to Begin?

The Bitcoin price is rising, reaching as high as $66,173 today; the asset appears to have hit a milestone behind the scenes.

According to a CryptoQuant analyst, EgyHash, Bitcoin’s open interest—a measure of the total number of outstanding derivative contracts—has reached a new all-time high.

This development signals heightened activity in the Bitcoin market and suggests strong sentiment among traders.

Detailing The Open Interest ATH

In a post on the CryptoQuant QuickTake platform, EgyHash detailed the significance of this new peak in Bitcoin’s open interest.

The analyst noted, “Bitcoin’s open interest has reached a new all-time high of $19.8 billion. Additionally, funding rates have hit their highest positive levels since August, indicating that much of this open interest is skewed toward long positions.”

Notably, the rise in open interest and increasing funding rates point to a bullish outlook among traders, signaling their confidence in Bitcoin’s continued upward movement.

EgyHash further emphasized that this trend in the derivatives market reflects a growing influx of liquidity and increased attention in cryptocurrency.

While Bitcoin’s open interest has been climbing, the asset’s price has also seen significant upward movement. Over the past 24 hours, Bitcoin’s value increased by 5.1%, trading at $65,655, following a brief rally to over $66,000.

This price increase has been accompanied by a notable rise in Bitcoin’s overall market capitalization, which currently stands at $1.297 trillion, up from $1.175 trillion just last week.

Bitcoin’s trading volume has also surged, doubling from below $20 billion over the weekend to over $40 billion today.

Bitcoin Price Outlook

The rising market activity and price gains have led several crypto analysts to weigh in on Bitcoin’s future trajectory. One prominent analyst, Trader Tardigrade, shared his bullish outlook, revealing that there has been a breakout in Bitcoin Stochastic.

According to Tardigrade, this breakout has the same pattern as the previous cycle. The analyst added: “The breakout point indicates the local bottom at the root of a MASSIVE Parabolic RALLY. Send $BTC to $500k.”

$Bitcoin Stochastic BREAKOUT

$BTC has the same pattern as the previous cycle. The breakout point indicates the local bottom at the root of MASSIVE Parabolic RALLY. Send $BTC to $500k

pic.twitter.com/LoJwlg2Fko

— Trader Tardigrade (@TATrader_Alan) October 14, 2024

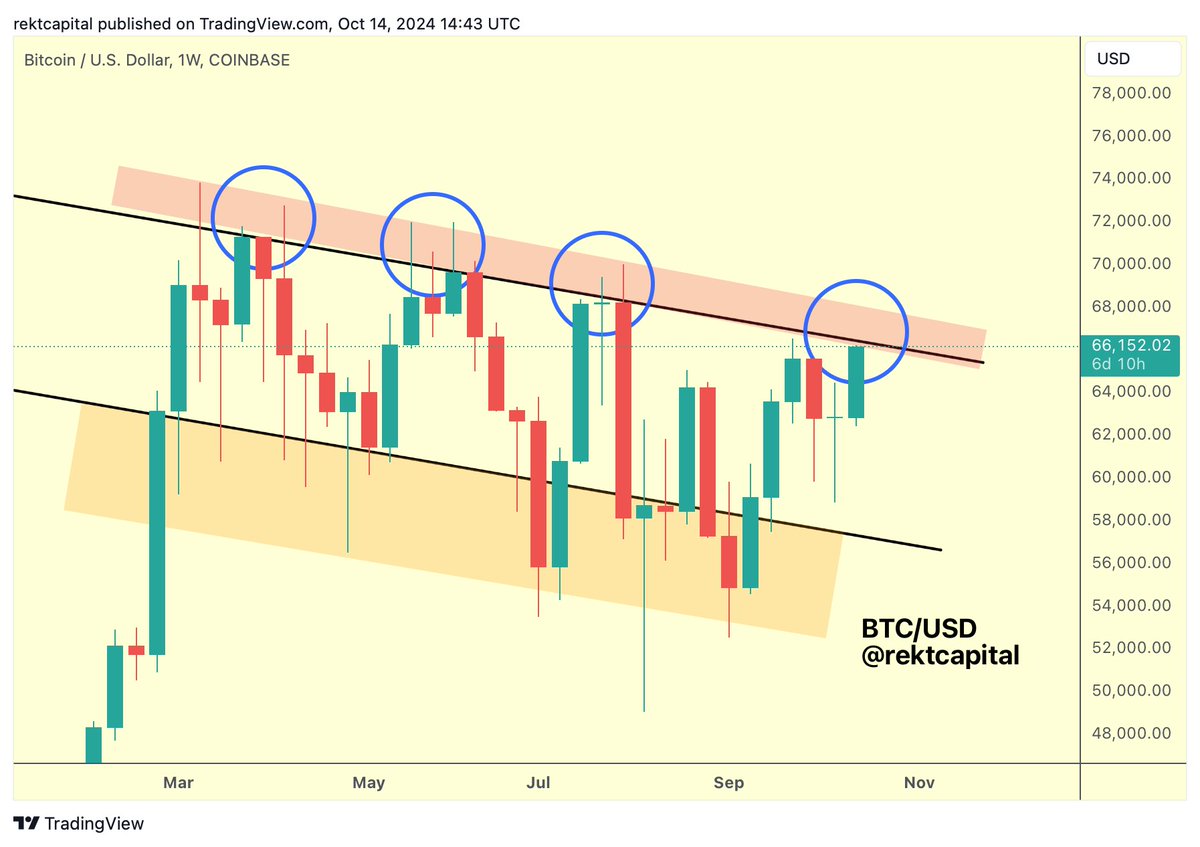

Despite the optimistic outlook from several traders, other analysts are urging caution. RektCaptal, another well-known figure in the crypto space, suggested that Bitcoin needs to secure a weekly close above its current downtrend channel to confirm a sustained breakout.

He noted, “Bitcoin needs to Weekly Close above the black Downtrending Channel Top to finally break out from this Channel.”

Featured image created with DALL-E, Chart from TradingView