Bitcoin Whales Are Going Through A ‘Generational’ Shift, CryptoQuant CEO Reveals

The CEO of the on-chain analytics firm CryptoQuant has explained how the Bitcoin whales have been showing a shift in their Realized Cap recently.

New Bitcoin Whales Are About To Overtake Old Ones

In a new post on X, CryptoQuant CEO Ki Young Ju has discussed the recent trend in the Realized Caps of the new and old Bitcoin whales. The “Realized Cap” here is a model that calculates the total valuation of Bitcoin by assuming that each coin’s ‘true’ value in circulation is the price at which it was last transferred or sold on the blockchain.

The last transfer of any coin is likely the last point at which it changes hands, so the price at its time could be equated to its current cost basis. As such, the Realized Cap measures the sum of the cost basis of the BTC supply. Or, put another way, this metric keeps track of the total amount of capital the investors have put into BTC.

In the context of the current topic, the version of the Realized Cap that’s of interest is limited to just two segments of the market: the new and old whales.

Whales refer to entities carrying more than 1,000 coins in their wallets. This cohort is divided into two based on age using a 155-day cutoff. All whales bought within the past five months belong to the short-term holder or new whale cohort, while those who have been holding for longer than this duration are called the long-term holder or old whales.

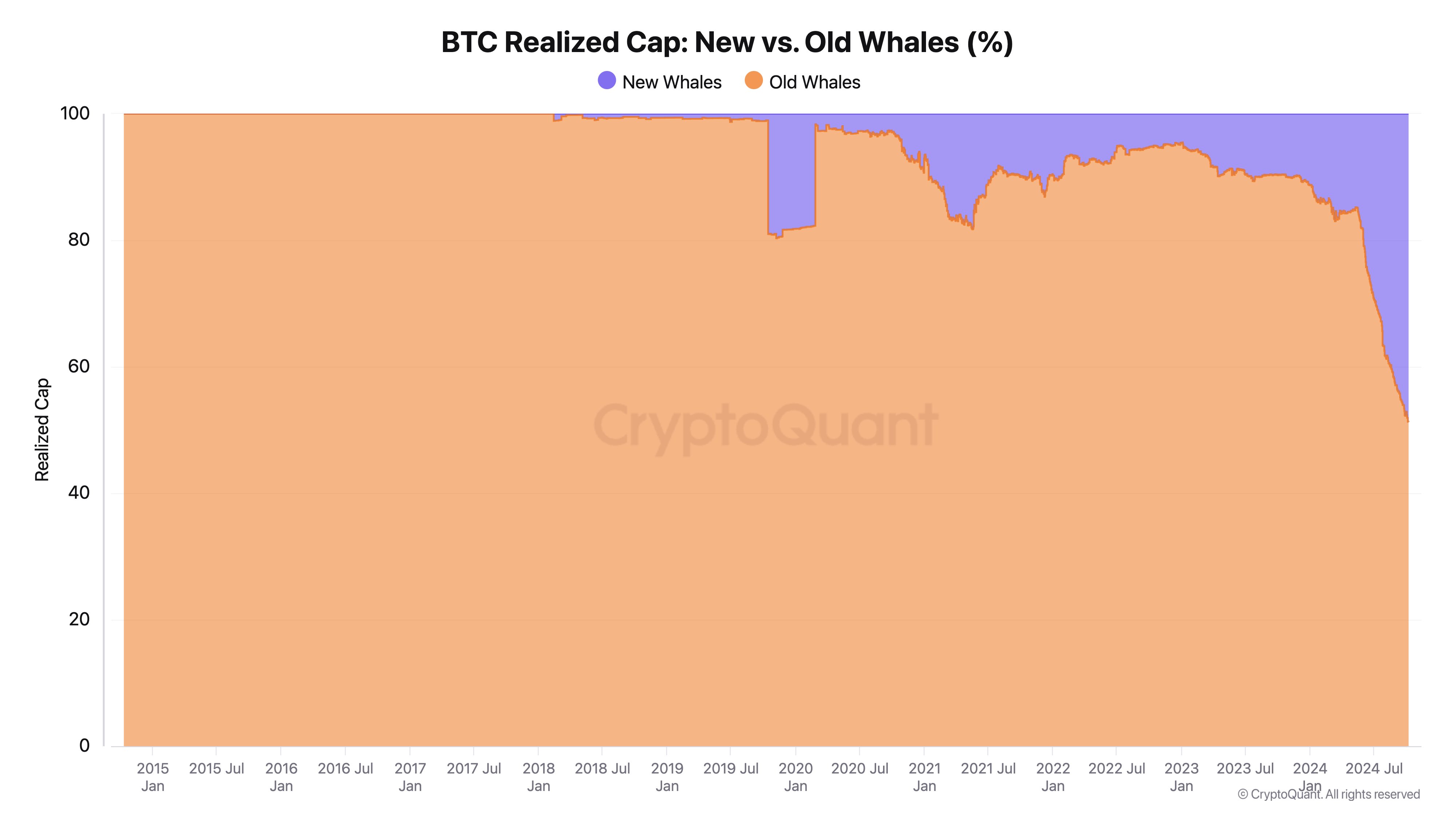

Now, here is a chart that shows the trend in the relative percentages of the Realized Cap contributed by these two Bitcoin groups:

As the above graph shows, the Realized Cap of the new Bitcoin whales wasn’t anything significant before 2018, indicating that veteran capital was king on the network. Following 2018, though, the percentage dominance of this group gradually started to show an improvement.

And this year, the growth in the Realized Cap of this cohort has blown up, with the metric’s value now sitting at $108 billion. For perspective, the indicator is standing at $113 billion for the old whales, which suggests the disparity between the two almost nonexistent.

“Bitcoin whales are experiencing a generational shift,” notes Young Ju, based on this trend. “Realized Cap of new whales is expected to surpass that of older whales soon.”

As for the sudden sharp growth in the Realized Cap of the new whales, it’s likely that the inflows into the spot exchange-traded funds (ETFs) have been falling in this category.

BTC Price

At the time of writing, Bitcoin is trading at around $62,200, down more than 2% over the past week.