Crypto Scammers Desert TON Blockchain for Greener Pastures

Crypto scammers, known for using wallet drainers, are abandoning TON blockchain in search of new opportunities, as the network is no longer conducive to their schemes.

Wallet drainers are malicious tools that enable exploiters to steal cryptocurrency. Scammers typically lure investors into these traps through phishing links, tricking them into giving up access to their assets.

Crypto Scammers Scamp TON Blockchain Over Whale Shortage

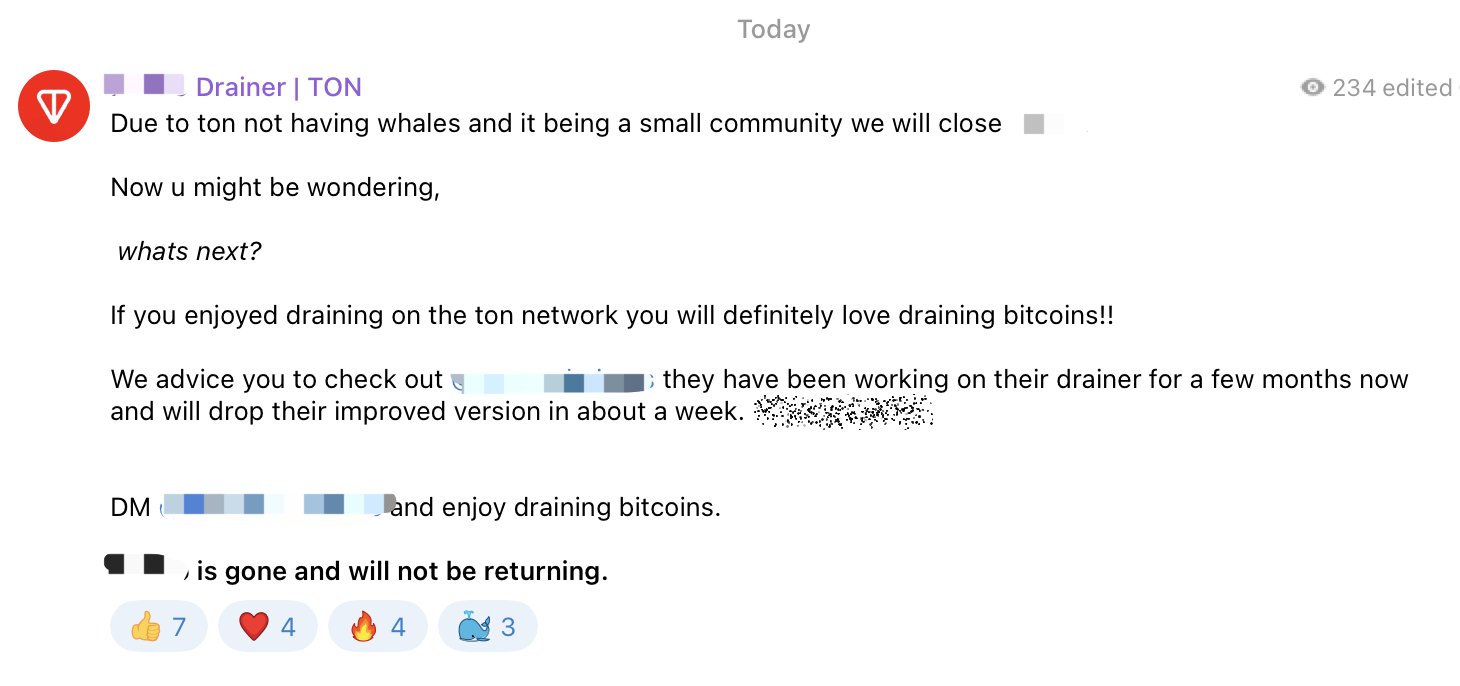

Scam Sniffer, which helps users and developers avoid phishing sites and wallet drainers, highlighted a TON wallet drainer shutting down its services. The exit notice, communicated on Reddit, cited a shortage of whales on TON as the reason for winding down services.

As the TON wallet drainer exits the TON ecosystem, it targets the Bitcoin blockchain, which is expected to offer a more significant avenue for looting.

Read more: What Are Telegram Mini Apps? A Guide for Crypto Beginners

TON Wallet Drainer to Shut Down. Source: Scam Sniffer

TON Wallet Drainer to Shut Down. Source: Scam Sniffer

In hindsight, wallet drainers’ interest in the TON blockchain came amid increased value on the network. At the height of the frenzy, clicker or tap-to-earn games with airdrops helped drive the value surge. Among them were Notcoin and Hamster Kombat, which steered daily active addresses.

Then, bad actors would leverage TON’s comment feature to bait their prospective victims. Clicking the button would execute the transaction. Specifically, transfers would contain a custom message for the recipient at the signing stage in their wallets. Scam Sniffer reported how this tactic caused losses reaching 22,000 TON (or $152,000 at the time) in May.

“As TON gains popularity, phishing scams are on the rise. Scam Sniffer has detected a surge in TON-related phishing sites past month. Don’t just trust; verify! Using our extension or API? We’re actively guarding you against these threats,” Scam Sniffer warned.

Interest in TON grew as Ethereum phishing became more challenging due to advanced security tools that effectively detected malicious links and requests. Now, with fewer opportunities on TON, scammers are moving on, seeking more vulnerable targets as the network dries up for fraudulent activity.

Understanding Why TON Blockchain is Running Stale For Crypto Scammers

The shortage of whales on TON blockchain stems from two key factors. First, TON’s tokenomics have been highly controversial, discouraging large-scale investments.

The lack of transparency in how tokens were allocated and distributed raised concerns about the fairness and legitimacy of the project, especially after the ICO. This controversy intensified following the concentration of wealth among early investors, ultimately leading to Telegram’s shutdown of the project after a prolonged legal battle with the US SEC.

Secondly, the abundance of crypto airdrops on the TON blockchain makes it difficult for scammers to score significant gains. With the majority of users being airdrop farmers, phishing scams on TON provide limited rewards, reducing the appeal for fraudsters.

Read more: What Are Telegram Bot Coins?

As BeInCrypto reported, TON blockchain led Layer-1 transactions in September, driven by viral Telegram-based games and projects. Out of these, the major hits were Hamster Kombat, Catizen, and DOGS. Their gameplay, rewards, and token generation events (TGE), including airdrops, accelerated TON’s growth to millions of active users.

A recent Bitget report corroborates this postulation. It said traffic from popular TON projects like Notcoin, DOGS, and Hamster Kombat were instrumental, with regions like Russia and India leading the adoption.