Cardano’s Charles Hoskinson Applauds Sui’s Growth and Innovative Approach

Cardano founder Charles Hoskinson has commended the team behind Sui, a fast-rising blockchain network that has recently gained significant traction.

Sui is a Layer-1 blockchain and smart contract platform that launched in 2023. Its goal is to simplify and enhance application development in the Web3 ecosystem. The platform operates on the Move programming language, allowing for parallel transaction processing.

Hoskinson Commends Sui Network’s Progress

On October 4, Charles Hoskinson, the founder of Cardano, praised the SUI network team for their recent performance. He specifically acknowledged the work of George Danezis, Mysten Labs Co-Founder and Chief Scientist, and noted that the network deserves recognition within the crypto space.

“Reading about Sui. It’s good to see George’s work come to life. They deserve great success in the space,” Hoskinson stated.

Hoskinson’s recognition comes as Sui’s growth has captured significant attention in recent weeks. Its native token surged by 118% over the past month, pushing its market cap to $5 billion. The platform also reported a 140% increase in active addresses and a 48% revenue jump compared to August.

Read more: A Guide to the 10 Best Sui (SUI) Wallets in 2024

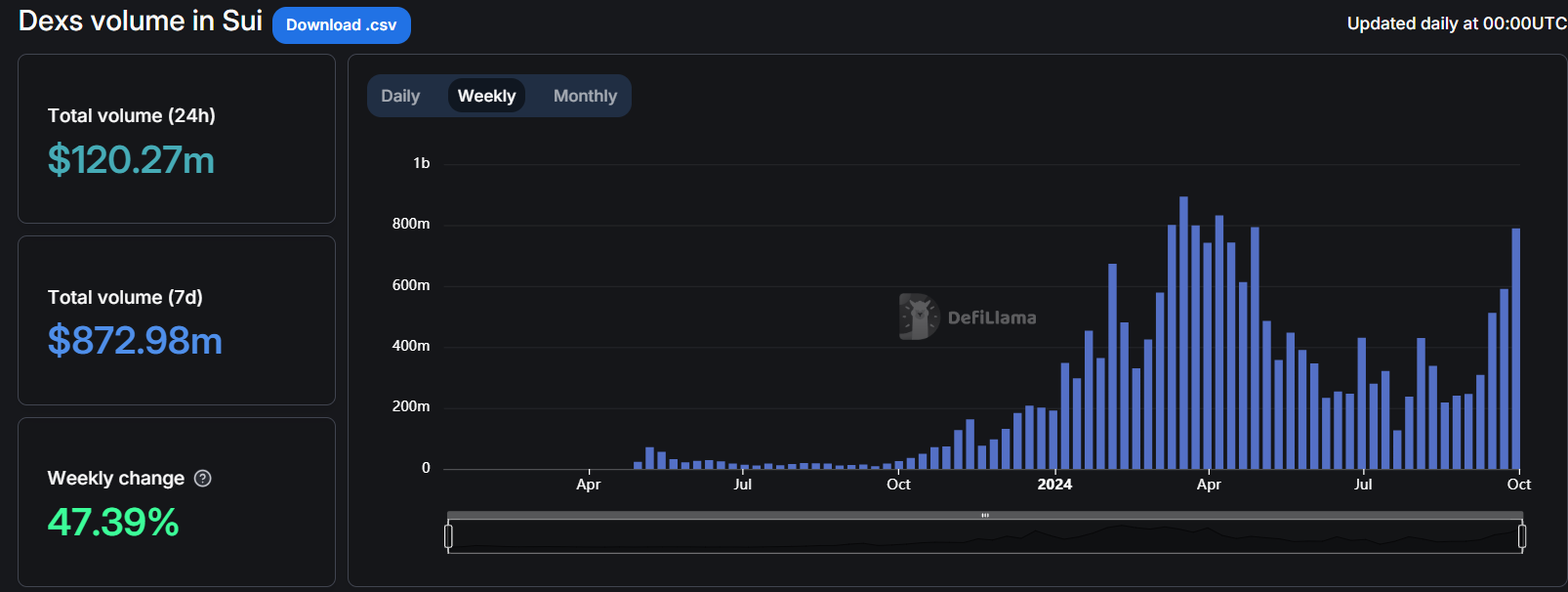

Sui’s DeFi ecosystem is also expanding, with increasing transaction volumes and a growing number of decentralized applications (dApps). Data from DefiLlama reveals a 40% rise in Sui’s decentralized exchange transaction volume, reaching $872 million in weekly transactions.

Additionally, the total value locked (TVL) on the platform now stands at approximately $1.25 billion, ranking it among the top 10 blockchain networks by TVL.

Sui DEX Volume. Source: DeFillama

Sui DEX Volume. Source: DeFillama

Market analysts point to memecoin speculation and the introduction of native stablecoins like Circle’s USD Coin as major drivers of this activity. Additionally, the network has attracted institutional interest, with Grayscale recently launching a dedicated crypto investment trust for the project.

Read more: Which Are the Best Altcoins To Invest in October 2024?

These developments have led some observers to suggest that SUI could become a serious competitor to other smart contract-enabled blockchains, such as Solana and Cardano. Asset management firm VanEck highlighted the blockchain network’s unique object-based architecture, which supports higher transaction throughput and lower latency compared to rivals like Solana and Ethereum.

“If we are to segment our investment theses on Layer-1 blockchains, we put Sui in the camp with Solana and Aptos as chains that are leveraging their high-performance characteristics to appeal to Web2 developers,” VanEck stated.