Immutable X launches zkEVM mainnet in early access phase, could propel IMX price gains

- Immutable X, the Layer 2 scaling solution launches zkEVM mainnet, powered by Polygon’s technology.

- IMX, the native token of the NFT marketplace, could rally as Immutable attracts game developers and gamers.

- IMX price offered nearly 13% gains to holders on the weekly timeframe.

Immutable (IMX) is the native token of an NFT marketplace, a Layer 2 scaling solution for ETH. The protocol unveiled its zkEVM mainnet with early access for game studios and partners.

Using zkEVM mainnet, developers will be able to scale games, offer gas-free interaction for gamers, helping them keep costs down and enjoy the features on Ethereum’s secure infrastructure.

Also read: Bitcoin supply on exchanges declines, in a sign of potential BTC price gains

Immutable X launches IMX mainnet with limited access

In an official tweet on X, Immutable X offered zkEVM’s mainnet access to gaming studios and partners.

The NFT marketplace’s zkEVM launch is significant since the protocol that is designed for trading and creation of NFTs, and games, will now offer several additional features that make its ecosystem attractive: gas free experience to gamers (keeping gamer spend low and attracting more gamers to games developed on IMX) and enhanced gameplay mechanics, among others.

Zero-knowledge proof technology used in zkEVM will offer low fees and high speed for processing transactions, without slowing down the experience for users. The Layer 2 protocol is therefore gearing up to attract more gamers, developers, and studios to partner with Immutable X and build on the zkEVM mainnet.

The protocol has powered the new functionalities on its mainnet using Ethereum’s largest scaling solution, Polygon.

IMX price eyes 14% gains

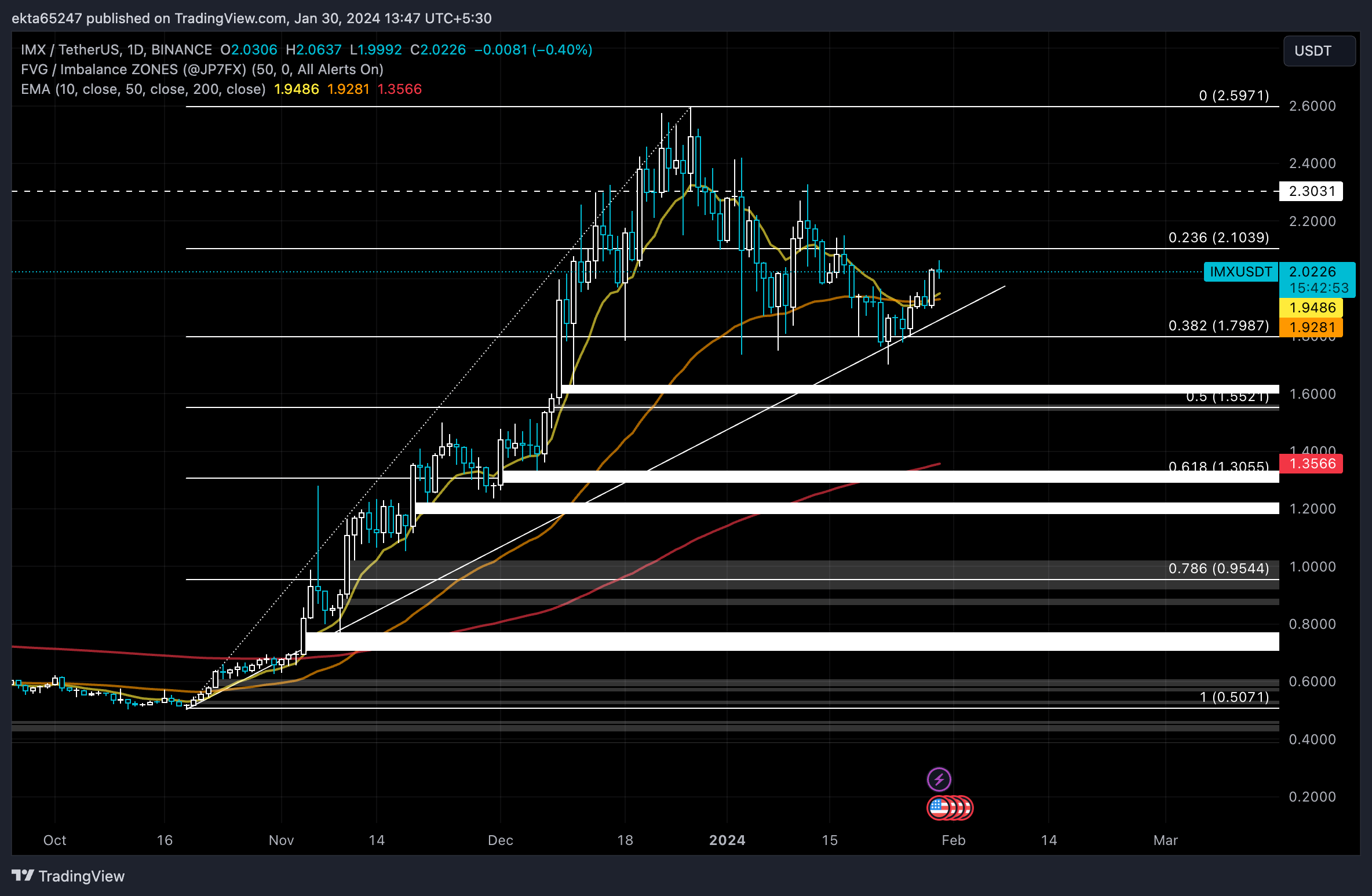

IMX price is currently in an upward trend that started on October 19, 2023. IMX rallied to a peak of $2.5971 on December 27, 2023. The NFT token recently recovered from its January 23 low of $1.7016. At the time of writing, IMX price is $2.0213.

The NFT token is likely to face resistance at the 23.6% Fibonacci Retracement (of the climb from October to December 2023) at $2.1039.

IMX/USDT 1-day chart

IMX price could find support at the 10 and 50-day Exponential Moving Averages EMAs at $1.9486 and $1.9281 respectively.