Cardano price could rise 15% as shark and whale wallets resurface

- Cardano price is on a recovery mission alongside most altcoins in the crypto scene.

- ADA could climb 15% to the $0.6000 psychological level amid rising momentum and large holders resurfacing.

- The bullish thesis will be invalidated upon a break and close below the 100-day SMA at $0.4648.

Cardano (ADA) price is confronting a formidable barrier as it attempts a recovery rally. It joins the broader crypto market which is trying to recover from a steep crash. According to analysts from behavior aggregator Santiment, large holders may have something to do with the ADA move north with on-chain metrics to show for it.

Also Read: Cardano Price Forecast: ADA whales’ resilience might catalyze a 30% recovery rally

Cardano shark and whale wallets resurface

Cardano (ADA) price is up nearly 13% since finding support at the 100-day Simple Moving Average (SMA) at $0.4648. According to Santiment analysts, shark (addresses holding between 500 and 1000 ADA tokens) and whale (addresses holding over 1000 ADA) wallets are the ones driving the surge.

Based on the report, an additional 639 million more addresses holding between 100,000 and 100 million ADA tokens have resurfaced over the last eight months.

With these wallets coming back to life, Cardano price could extend north to shatter the resistance due to the descending trendline at $0.5410. This could bring ADA into contact with the 50-day SMA at $0.5597. A break and close above this level would clear the path for an extended move north towards the $0.6000 psychological level, 15% above current levels.

In a highly bullish case, the Cardano price could extend the gains to the $0.6412 blockade or higher, clearing the $0.6800 psychological level before reclaiming the $0.6831 range high.

ADA/USDT –day chart

On-chain metrics to support bullish outlook for Cardano

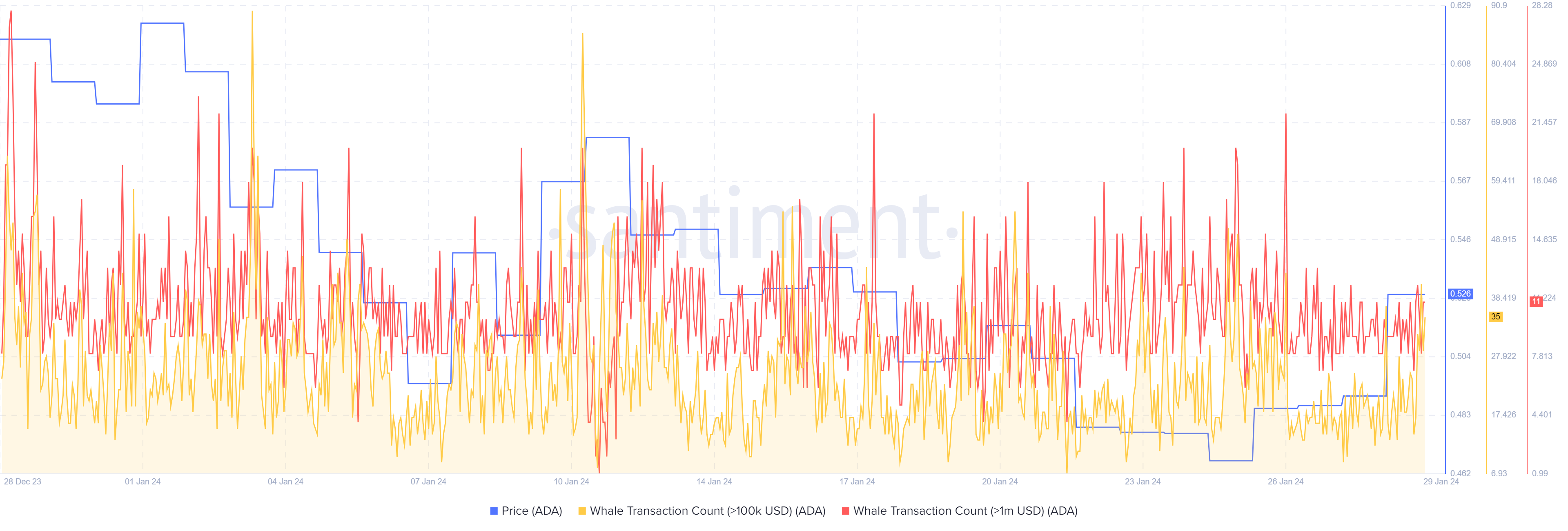

Santiment data shows a notable spike in whale transaction count for large holders moving over $100,000 to $1 million worth of ADA, corroborating the Santiment analysis.

ADA Santiment: Whale transaction count

On the other hand, if selling pressure increases, Cardano price could drop, likely going as low as to lose the 100-day SMA at $0.4648. In the dire case, the gains could extend to the $0.3790 low, levels last tested on December 1, 2023. Such a move would constitute a nearly 30% fall below current levels.